Learning Center

A Guide to Understanding Homebuyer Agent Agreements

Navigating the real estate market as a first-time homebuyer can be challenging. Recent changes resulting from the National Association of Realtors® (NAR) settlement have added complexity to the process, even for experienced homebuyers. To help you prepare for the...

- Budgeting

- Credit Scores

- Emergency Fund

- Financial Goals

- Financial Planning

- First-time Homebuyer Tips

- Home Insurance

- Home Renovation

- Homeowner Tips

- Mortgage Loan Options

- Mortgage Process

- Mortgage Relief

- Personal Data Protection

- Refinancing Mortgage

- Retirement Planning

- Save for Down Payment

- Selling a Home

- Student Loan Tips

How to Buy a Home on Any Salary

Are you looking to buy a home but uncertain that your current income will not be enough to afford one? The nationwide shortage of affordable housing and higher interest rates have some people concerned that they may need to hold off buying their first home....

9 Things to Consider When Buying a New Construction Home

Do you dream of building your dream home or just want to be the first person to live in your home? Maybe you're finding it challenging to locate an affordable contemporary home that checks off all your boxes? If you've answered "Yes" to any of these scenarios, you...

Factors That Influence Your Credit Score

Your credit score is determined by several factors, including payment history, the amount of credit you are using, length of your credit history, new credit accounts, and the types of credit you have open. Understanding the factors that affect your credit score...

How Consumer-Permissioned Data Protects Your Personal Identifying Information

When you conduct financial transactions online, you often risk exposing your personal identifying information (PII) to criminals who can use that information for identity theft, fraud, and scams. Types of sensitive personal identifying information that criminals...

Benefits of Saving Money as a Family

Whether your family is just you and your partner, a family with children, or a multigenerational household, all families have short-term and long-term financial goals. A highly effective way to ensure financial stability within your household is by learning how to...

10 Questions Unmarried Couples Should Ask Before Buying a Home Together

Whether you are an unmarried couple committed to living together or engaged to be married, it might be tempting to buy a home together before interest rates increase. But is it wise?State law governs how property is to be divided or distributed if a marriage...

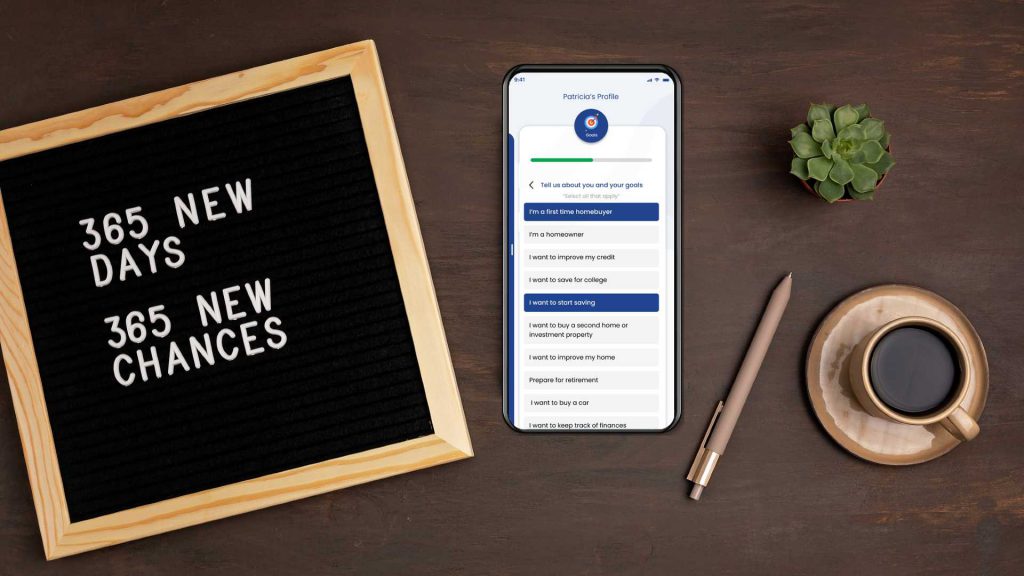

How to Achieve 6 Popular Financial New Year’s Resolutions in 2025

65% of Americans have a financial resolution this year. The top financial resolutions for Americans in 2025 are to build up their emergency savings (79%), save more money (43%), pay down debt (37%) and spend less (31%), according to Fidelity’s 2025 New Year’s...

How to Set Realistic Goals for the New Year

The start of a new year is the ideal time to set the goals you would like to achieve throughout the year. Your goals should be realistic and attainable within a reasonable time. Follow these tips for setting realistic goals to ensure you achieve your goals...

10 Tips to Successfully Sell Your Home Over Winter

In many parts of the country, winter can be a challenging season to sell your home. However, with fewer homes on the market, you can be successful with the right strategies. Let these tips guide you on how to appeal to buyers over winter so you can quickly finalize...

Pros and Cons To Selling Your Home During the Winter Holidays

While spring and summer have proven to be peak seasons for real estate, the winter season also has advantages for homeowners who need to sell. While you should probably tone down your holiday decorations while your home is on the market, if you follow these tips,...

6 Ways to Build Your Credit While Holiday Shopping

With the holiday season quickly approaching, the excitement of gift shopping for our loved ones begins. However, along with the excitement comes the financial pressure of keeping our credit in good financial standing. Fortunately, it is possible to enjoy holiday...

How Many Times Can You Use a VA Home Loan?

In recognition of those who have served our country, the Department of Veteran Affairs (VA) provides lifetime benefits for qualified veterans, active-duty personnel, reserve members, National Guard members, and some surviving spouses. As long as you restore your...