Fintech Fridays podcast with Brian Vieaux

Brian Vieaux, FinLocker President and COO, interviews cool new people with cool new products at cool fintech companies who are reshaping the mortgage, housing and real estate industries.

Brian Vieaux talks with Kristin Messerli, Executive Director of FirstHome IQ, about the recently released 2025 NextGen Homebuyer Report — one of the most important annual reports in our industry – that she authors each year.

Kristin and Brian discuss:

- The trust gap and how LOs can close it

- What Gen Z and Millennials are really thinking

- How loan officers can be the financial literacy leader in their community

- How FirstHome IQ and tools like FinLocker help build trust and long-term business

Brian Vieaux speaks with Michael Vandi, the visionary Founder & CEO of Addy AI, on his journey from Sierra Leone to becoming a problem-solving innovator in the U.S. mortgage industry.

Michael shares how Addy AI started as an email assistant and evolved into a fully automated AI loan processor, addressing originating costs and key bottlenecks in the mortgage process.

The conversation explores the role of AI in enhancing borrower communication, the efficiency of loan processing, and the importance of pre-and post-loan communication in retaining clients. Michael emphasizes the need for innovation in the mortgage industry and the promising advancements AI can provide.

Brian Vieaux speaks with Abdel Khawatmi, a Producing Branch Manager with Got Mortgages at Paramount Residential Mortgage Group Inc. (PRMG Inc.), about the intersection of technology and mortgage lending.

They discuss the importance of client engagement, navigating market fluctuations, and the role of technology in enhancing the client experience throughout the mortgage process. Abdel shares his approach to communication with his clients and internal team, the tools he uses to automate, streamline and evolve processes, and the importance of being accessible and responsive to building long-term client and agent relationships.

Brian Vieaux talks with Chris Mirakian, National Account Director for TrustEngine, which evolved from Mortgage Coach into a powerful platform that can predict refinances and purchases by perpetually analyzing customer data and coach loan originators to have meaningful client conversations to win those deals.

Chris explains how loan officers can use data-driven insights to identify opportunities for clients and leverage technology to personalize marketing with contextual messaging, simplify loan processes and improve customer experiences.

Brian Vieaux speaks with Lynn Goss with the Divorce Lending Association about the emotional complexities of working with clients going through divorce, the importance of loan originators becoming a Certified Divorce Lending Professional (CDLP)to empathetically serve clients and work with family law attorneys, and the need for compliance and professionalism in divorce mortgage planning.

Lyn details how the DLA provides CDLPs with ongoing coaching and business development resources to help them seek, build and nurture relationships with professionals in the divorce legal space.

Brian Vieaux talks with Larry Silver, founding partner of Mortgage Career Exchange, for an insightful conversation on the future of recruitment and staffing in the mortgage industry.

Larry shares these insights:

- How the mortgage industry is rethinking recruitment and the steps employers can take to attract top talent.

- Why investing in education and training for your employees is critical for career growth and retaining top performers.

- The value of building your personal brand on platforms like LinkedIn to network and foster authentic connections that lead to hiring the right talent for your organization.

Brian Vieaux speaks with Matt Jones, Associate Vice President of Government Housing Finance | Residential Policy with the Mortgage Bankers Association about the current state of housing finance, the impact of recent legislative changes, and the future of GSE reform.

They discuss the challenges of housing affordability, the impact of the Biden administration legislation and policies on housing construction, the importance of servicing liquidity for independent mortgage banks, and reviving the trigger leads legislation with the new congress.

Matt also shares MBA’s predictions of what the mortgage and housing industry can anticipate with the incoming Trump administration, including the GSEs.

Larry Bailey, Founder and CEO of Mortgage Workflow Partners, explains to Brian Vieaux how he grew his YouTube audience to 164k subscribers by providing expert tips, tutorials, and insider insights by focusing on a niche mortgage topic with his channel @MasteringEncompass.

Brian and Larry discuss the importance of understanding and documenting your workflows before implementing technology, especially when selecting an LOS, for better efficiency.

All those keen on exploring the Encompass platform’s capabilities, exchanging tips, and learning how to optimize their workflow and technology are invited to join The Mortgage Community for free.

Brian Vieaux welcomes back Spencer Dusebout, CEO of Aidium, to discuss the company’s rebrand and its renewed focus on bridging the gap between enterprise needs and producer autonomy.

Spencer explains how Aidium derives data from its CRM to drive loan officer performance and enhance consumer engagement. Brian and Spencer discuss using real-time data insights to positively influence consumer behavior and how automation can empower loan officers to work smarter, not harder. With the current market presenting unique challenges and opportunities, understanding consumer behavior is essential for effective engagement and getting ahead.

Brian Vieaux interviews Bruce Gehrke, Senior Director of Financial Service Intelligence at J.D. Power, about the company’s 2024 U.S. Mortgage Origination Satisfaction Survey.

They discuss the survey methodology, shifts in consumer preferences towards personal interaction, the importance of early engagement in the home buying process, the satisfaction level of first-time home buyers and opportunities for loan officers to enhance customer experience.

Sephali Thakkar, Education Ambassador & Solutions Innovator with T-Mobile, explains how T-Mobile is bridging the digital divide and empowering under-resourced schools through STEM and digital literacy programs, technology, and sustainable funding strategies.

Sephali shares how T-Mobile works with local governments, nonprofits, and corporations to create lasting change and works with teachers and schools to prepare students for a digitally connected future by teaching them to use technology and AI, ethically, creatively and responsibly.

Brian Vieaux and Geoff Zimpfer, Chief Truth Teller with the Mortgage Marketing Institute and host of the Mortgage Marketing Radio podcast, discuss mortgage marketing, emphasizing the importance of personal branding, diversifying lead sources, the hybrid loan officer model and becoming “5 mile famous” with referral partners and in your consumer outreach to enhance business opportunities. They explore strategies for loan officers to enhance their business through education, networking, and effective content creation, while also stressing the significance of maintaining quality in their outreach efforts.

Brian Vieaux chats with Brad Blumberg, founder of Aster Key, a mobile app focused on giving consumers permission control of their financial data. They discuss Brad’s background in real estate and technology, the inception of Astor Key, and data security in the mortgage industry.

Brad shares insights on the challenges of data protection and the need for consumers to control their financial personas. The conversation explores the opportunities for Astor Key to expand beyond the mortgage industry and the broader implications of reputation risk in the financial services industry.

Brian Vieaux and Founder, Steven Cooley, discuss how Mortgage Advisor Tools has simplified the process for the housing finance industry, esp. mortgage lenders and loan officers, to identify technological solutions that meet their needs, whether to replace or fill a gap in their tech stack.

Steven explains the 95-5 rule in B2B sales, highlighting how only a small part of the market is actively seeking solutions at any point in time. Learn how this insight helps fintech vendors allocate their marketing budget and fine-tune their marketing strategies, from advertising to attending conferences, to capture a their share of the market in any sales cycle.

Brian Vieaux interviews Pramod Kollamparambil, co-founder of Loanscape, a platform that helps lenders streamline the broker onboarding process with easy-to-use interfaces, document management, and third-party verification.

They also touch on the importance of listening to customer feedback to help shape a fintech product in the early stages of development, and the power of LinkedIn for networking in the mortgage industry.

Rob Chrane, Founder & CEO of Down Payment Resource, explains to Brian Vieaux how down payment assistance (DPA) programs can help first-time homebuyers and be a valuable financial education topic for loan officers to attract new consumers at the top of the funnel.

They discuss resources for loan officers to educate themselves about DPA programs in their region and the opportunity for lenders to stand out in their communities by offering these programs. Rob also notes the significant demand from real estate agents for loan officers who can help homebuyers with DPA programs.

Mike Faraci, the Founder and CEO of Red Button Media, talks with Brian Vieaux about the challenges of building a successful business and how LinkedIn’s new in-feed video carousels make it necessary to create consistent video content to elevate your brand.

Plus, you’ll get inspired hearing how creating video content has helped Mike and Brian build their businesses, fostered relationships and connected them with new audiences.

Laura Witte, owner of the Truth and Lending team at Highland Mortgage, shares with Brian Vieaux her journey to establishing her own transparent and client-focused mortgage business.

Laura discusses the strategies she uses to maintain a pipeline of prospective homeowners at various stages of the homebuying process, including the role of automation in providing regular communication and personal touches.

Brian Vieaux is joined by Steven Cooley, Founder of Mortgage Advisor Tools, the first free comprehensive resource for mortgage lenders to discover new technology and services. Mortgage Advisor Tools serves as a 24/7/365 virtual exhibit hall featuring over 1,000 companies across 80 categories, offering a comprehensive range of vendors specializing in software and services for marketing, sales, business operations, IT, mortgage operations, and much more.

Andrew Penner, founder and CEO of Milo, joins Brian Vieaux to discuss their new product, Milo, and how it engages customers up-the-funnel and monitors their activities, helping loan officers identify high opportunity prospects. The platform provides branded home value reports to educate customers on their options and uses conversational AI to qualify customer and automate outreach, helping loan officers prioritize prospecting and maximize their impact.

Tim Rood, CEO and co-founder of Impact Capitol, discusses with Brian Vieaux his new product called Alfred, which uses generative AI to provide real estate and mortgage professionals with valuable insights, such as market analysis, and to streamline the process of sourcing content for newsletters. Tim highlights the potential use cases for loan officers, such as nurturing referral and consumer relationships and helping homebuyers find affordable housing options.

In the spirit of those not-so-fun election debates later this year, Brian Vieaux has added some levity to this week’s Fintech Friday’s #podcast by moderating a light-hearted debate between Matthew VanFossen (The Big POS Guy) and Jerry Melia (The Other POS Guy) based on the characters they created for their Mortgage Automation Technologies LinkedIn marketing campaign.

Brian throws out all the hard-hitting questions to cover almost everything you’d want to know when selecting a POS system, including features, functionality, security, reliability, customer support, scalability, integrations and pricing.

Brian Vieaux’s talk with Matthew Marks, Founder and CEO of eVocalize, a platform that simplifies the creation of local digital marketing assets for loan officers and real estate agents to build brand awareness and generate leads. Matt shares success stories from a couple of his mortgage company clients, using two typical use cases provided by Brian. Matt explains how the system analyzes a mortgage lender’s data and, over time, improves itself through machine learning and AI to become really smart at creating digital marketing assets that generate local leads that drive transactions.

Uday Devalla, Chief Technology Officer with Sagent, discusses with Brian Vieaux the growth of the mortgage servicing industry and the need for mortgage servicing platforms to adapt quickly to regulatory and market changes.

Uday introduces Sagent’s future state platform, Dara, an end-to-end mortgage loan servicing platform that aims to provide a real-time, seamless experience that allows consumers to self-serve while offering mortgage servicers opportunities for cost savings and customer retention. He also highlights the role of AI and machine learning in enabling predictive models, document classification and extraction, and automation to improve efficiency and customer engagement.

Brian Vieaux interviews Al Pitzner, the Managing Director and Co-Founder of Conforma Compliance Group. They discuss the important service compliance consulting offers the fintech industry, particularly in the face of the numerous challenges that the business environment presents. They also provide a comprehensive overview of the top compliance issues in the mortgage industry, including fair lending and state enforcement, offering valuable insights to the audience. The conversation then shifts to the role of compliance in evaluating and implementing technology, with a particular focus on social media monitoring and consumer-facing tools.

Brian Vieaux talks with Will Caldwell, CEO and Co-Founder of Snap. Will shares how Snap is revolutionizing the mortgage manufacturing process through innovative data and workflow solutions by streamlining existing legacy systems, driving costs down, and making workflows faster and more efficient.

With an initial focus on hazard and flood-related reports, Will reveals how Snap is leveraging cutting-edge technology to expand into fraud detection and loan risk analytics. Through its efficient data stack and automation, Snap also offers seamless integration with Encompass® to provide efficiency and reduce costs for mortgage lenders.

Brandon Spriggs, CEO and Founder of Survey Loop, has set out to make it easy to collect customer feedback by making it easy for them to provide feedback. He shares with Brian Vieaux how Survey Loop leverages generative AI to analyze survey responses to obtain actionable insights that help businesses make data-driven decisions.

Brian and Brandon discuss various scenarios for loan officers and mortgage lenders to survey their early journey first-time homebuyers throughout their homeownership journey.

Brian Vieaux’s guest is Ryan Sandler, CEO of Truework, which provides mortgage lenders with an efficient, accurate and secure customizable platform for income and employment verification. Ryan discusses with Brian the lack of transparency and consumer’s privacy concerns in sharing personal financial data, particularly for income verification. Sandler explains the waterfall process of income verification and the importance of automation in streamlining the process. He also discusses the company’s near-term roadmap, including expansion into other verticals, and their future plans of bringing other data assets onto the Truework platform.

Katherine Campbell, Founder of Leopard Job, discusses with Brian Vieaux the work revolution and the opportunities for companies needing executive or department leadership to adopt fractional work models. Katherine shares her firsthand experience juggling roles and passions as a fractional CMO for Shape Software. The discussion extends to the mortgage industry, exploring the potential benefits of adopting a fractional approach to fill various staffing roles in cyclical markets. Brian and Katherine discuss the work landscape pre and post-COVID, the impact on younger workers and work-life balance.

Brian Vieaux talks with Dawar Alimi, the visionary Founder and CEO of Lender Price, who shares his company’s fascinating start-up story. Together, they explore the democratization of pricing and how technology holds promise to improve the consumer experience with faster and more efficient loan origination and reduce loan manufacturing costs for mortgage lenders. Beyond making significant waves in the mortgage tech space, Lender Price has achieved another milestone – industry recognition through a prestigious award!

Jeremy Potter, President of titleLOOK, explains how the company has reshaped the landscape by breaking free from traditional PDF-bound title commitments with a universal data standard that empowers lenders to seamlessly integrate title information, fostering transparency and a more informed consumer experience.

Jeremy and Brian discuss the future of title services, emphasizing the need to move title data upfront to create a digital record for each property, akin to a “CARFAX for Houses,” to provide consumer protection and promote informed decision-making.

Brian Vieaux talks with David Fulford, Chief Client Officer with Gateless, which offers Smart Underwrite, a mortgage technology that uses machine learning to transform labor-intensive, error-prone loan processing and underwriting tasks into an efficient, fully automated system. They discuss how mortgage lenders can intelligently automate key processes and reduce time, costs and risk associated with mortgage loans.

Brian Vieaux talks with Rich Gagliano, CEO of Dark Matter Technologies, about the recent acquisition of their flagship loan origination system, Empower. They discuss the role of artificial intelligence (AI) in the mortgage industry and how it can improve loan processing and underwriting efficiency. They also address the fear of technology replacing mortgage jobs and emphasize the importance of balancing AI with human interaction before looking towards the future of consumers sharing their direct-sourced data to streamline the process of applying for a mortgage.

Brian Vieaux talks with Jeff Walton, the CEO of InGenius, a data analytics platform for recruiting mortgage loan officers and prospecting for realtors. They discuss the Community Reinvestment Act (CRA) and how it is now relevant to non-depository lenders (IMBs) lending to underserved communities. Jeff explains how InGenius employs multiple data sources to provide granular insights, enabling mortgage lenders to scale and personalize their recruiting efforts and empowering loan officers to identify and market to real estate agents.

Brian Vieaux talks with Michael Neef, Founder and CEO of Pre-Approve Me, a digital customer engagement platform, about the pivotal role of technology in differentiating mortgage professionals and enhancing the customer experience. In an era where online distractions abound, they explore the importance of meeting customers at their digital doorstep and using technology to foster continuous consumer engagement that enriches the customer experience and secures lasting relationships.

Brian Vieaux talks with Amit Ghole, Founder and CEO of Inflooens, which provides mortgage lenders with a streamlined, transparent platform that reduces tech spend by consolidating systems and enables collaboration by seamlessly unifying the tech infrastructure for loan officers and loan processing workflows. They discuss the importance of relationship-based experiences in the mortgage industry and the potential for AI to enhance the advisory capabilities of loan officers and enable mortgage lenders to scale their teams efficiently.

Brian Vieaux speaks with Spencer Dusebout, Founder and CEO of Aidium Mortgage CRM, which provides mortgage lenders with an end-to-end solution that automates the entire borrower journey. Brian and Spencer discuss how loan officers can scale conversations, better manage their sales funnel, and use data analytics to increase ROI by improving engagement, conversion, retention, and recapture rates.

Brian Vieaux is joined by David Maland, Chief Marketing Officer at Noteflow, Inc., to discuss mortgage servicing. They do a deep dive into the innovative technologies and workflow processes used in managing performing and non-performing non-QM loans for asset managers, investors, mortgage lenders and servicers.

Brian Vieaux is joined by Branden Cobb, a Fractional Chief Marketing Officer with MarketingExec.us. Branden shares how real estate and mortgage companies can leverage the services of a fractional CMO to gain strategic perspectives on rebranding, market expansion, and demand generation without the overhead of a full-time permanent CMO.

Branden delves into actionable tactics for real estate agents and mortgage companies to amplify lead generation, adeptly capture prospects, and seamlessly convert them into clients.

Brian Vieaux is joined by Ginger Bell, the Founder and CEO of Edumarketing for the 100th podcast. Listen to this insightful discussion for practical tips on using #AI and getting started on social media, video marketing and podcasting to build relationships that lead to more customers for your mortgage or real estate business.

Brian Vieaux talks with Katherine Campbell, Founder of Leopard Job, and Kyle Draper, CEO of KyleDraper.com, about Kyle’s game-changing book, “Rethink Everything You Know About Social Media.” You’ll gain valuable insights on why it’s time to shift your focus away from simply amassing followers. Discover innovative strategies that will set you apart from other loan officers by learning how to harness the power of your personal brand and leverage your expertise to serve the followers you currently have by giving them what they need, not what you want.

Brian Vieaux is joined by Rutger van Faassen, Head of Market Strategy with Curinos. Discover the secrets to success as Rutger unveils how mortgage lenders, banks and credit unions can effectively acquire and analyze competitive intelligence. This episode dives deep into benchmarking your company based on critical factors like cycle time, application and locks pull-through rates, mix of applications, and the weighted average market price. Moreover, Rutger will discuss how geographically dissecting this data to create region-specific benchmarks can provide valuable insights for your business.

Brian Vieaux is joined by Ben Treadway, Head of Sales for SocialCoach, which helps mortgage loan officers automate their social media presence. They share tips for using your mortgage experience to create social videos that get attention, attract the next generation of homebuyers, build your network, and strengthen the relationships with your referral partners.

Michael McAllister, Empower LO, shows loan officers how to reinvigorate your marketing and borrower communication and strengthen realtor relationships.

Geoff Zimpfer, Mortgage Marketing Institute, advises how to leverage social media and digital marketing to build a compelling personal brand.

Michael Kelleher, Adopt the Brand, shares his expertise in helping loan officers build a strong personal brand and leverage innovative strategies to achieve sustainable growth

Brian Vieaux is joined by Scott Payne, Chief Product Officer of Shape Software. Drawing on his experience as a mortgage originator, Scott explains the benefits of the lead management platform that he developed for companies, including mortgage lenders, to efficiently manage leads they’ve obtained from multiple sources, whether they’ve been obtained organically, acquired or reactivated past customers, to improve conversion and maximize ROI.

Brian Vieaux is joined by Anthony Balsamo, Co-Founder of Vonk Digital, a website platform specifically for the mortgage industry built on top of WordPress. Anthony shares how individual loan officers, mortgage brokers, small teams, and companies can establish an online presence, generate traffic to their website, optimize conversion, and attract the next generation of tech-savvy homebuyers to your business.

Brian Vieaux is joined by Steve Sigaty, Enterprise Sales Expert with Lender Toolkit. Steve explains how the platform provides training and tools, including 42 different plugins to power up your Encompass® mortgage software to streamline your loan processing and efficiently scale your business by automating repetitive processes so your loan officers and Ops team can focus on what they do best – providing 5 star customer service and close loans faster than the competition.

Brian Vieaux is joined by Ryan Cotter, Divisional Leader with The Mortgage Corp, who shares how he is bringing actionable strategies to underserved markets in Chicago who would otherwise not have the opportunities to build wealth through homeownership. Ryan shares the details of his 4-3-2-1 home hack strategy that you can take back to your market to help first-time homebuyers achieve financial freedom.

Brian Vieaux talks with Alex Levi, Managing Director of TrustStar a Tecnotree Corporation.

Brian Vieaux is joined by Wendell Couch, Southeast Regional Manager and Parker Couch, Producing Branch Manager with American Financial Network, to share their old-school lessons and new-generation tactics for attracting, engaging and converting prospective homebuyers.

One of Parker’s tactics is financial education videos that you can check out on YouTube.

Brian Vieaux catches up with Fobby Naghmi, Senrio Vice President with Homecomings Mortgage & Equity, for a preview of Simpl, the new relationship-building CRM tool that he’s been developing to streamline the recruiting process for multi-tasking producing managers.

Brian Vieaux engages in a candid conversation about the state of the mortgage industry with Scott Groves, a successful Producing Branch Manager and in-house sales coach with Synergy One Lending. For the past 8 years, Scott has drawn on his wealth of experience to serve as a personal coach for loan officers and a compelling motivational speaker through his company, Consolidated Coaching. To help elevate your business to new heights, Scott shares the winning tactics that loan officers are employing to generate and nurture leads in the current market.

Brian Vieaux talks with Eric Levin, EVP of Client Development with Model Match, a talent management software and relationship development and management platform for the financial services industry. Mortgage lenders can use the Model Match data platform to identify mortgage originators, operations, and marketing talent they want to build relationships with to scale their business. Loan officers can also use the software’s MLS research to identify real estate agents suitable for a business relationship.

Eric hosts The Walk podcast on YouTube.

Brian Vieaux talks about real estate technology with Steve Gaenzler, SVP, Products, Data & Analytics at Radian homegenius Real Estate, which leverages data science to create opportunities for consumers, agents, lenders, investors, and other participants in the real estate process to search, evaluate and transact residential properties. Steve shares how homegenius Real Estate uses AI vision technology to increase personalization for consumers and investors. Consumers and investors can interact with the technology to search for a home with specific features to to purchase or to renovate and flip.

Brian Vieaux talks about social media marketing with Greg Sher, Managing Director of NFM Lending and co-creator of NFM’s Influencer Division. Greg shares the secrets of his influencer loan officer team’s success in attracting 65,000 people in 24 months and how they drive their realtor relationships. He discusses the importance of having a strategy to turn leads into loans and nurture consumers for 6, 12, 24+ months until they are ready to buy a home.

Brian Vieaux talks with James Duncan, Director of Marketing with Thrive Mortgage, about connecting with Gen Z and Millennial first-time homebuyers on social media. They discuss consumer behavior trends and tactics to start using your authentic brand to consistently create engaging educational content that provides value to future homebuyers.

Brian Vieaux explores practical solutions for assisting first-time homebuyers to reduce their student loan payments, lower their debt-to-income ratio, and increase their home buying budget with:

• Catalina Kaiyoorawongs, CEO and Co-Founder of LoanSense

• Scott Schang, CEO of Find My Way Home

• Rodney L. Debro, Loan Officer with NEXA Mortgage

Brian Vieaux talks with Dana Trajcevski, Co-Founder of Rebel Chics Media, which uses their mortgage banking experience to create custom branded compliant content for loan officers and real estate agents who don’t have a social media presence or the bandwidth to create their own content, to educate and inspire homeownership.

Brian Vieaux talks with Joshua Parish, Founder of VetLife, a non-profit organization that assists veterans in connecting with the benefits they have earned through their military service. They discuss the upcoming VetFest, Michigan’s largest free veteran event being held on August 12, to enable active duty, retired and veteran families to enjoy a fun social day while learning about various veteran-specific resources.

Brian Vieaux talks mortgage marketing with Dan Smokoska, Founder of Loangendary Marketing, a new marketing agency focused 100% on the mortgage industry that developed from the success of Dan’s Be Loangendary weekly newsletter for loan officers. They discuss the importance of putting yourself out there to build your personal and business brand and ways to develop your social media audience.

Brian Vieaux is turning the tables on Dustin Owen, Founder and Host of The Loan Officer Podcast. Dustin reveals his remarkable journey, starting from his days as a loan officer, where his passion for improving the financial literacy of his clients ignited. He transformed this dedication into a popular podcast and a new venture, TLOPonline, which offers loan officers coaching, scripts, marketing ideas, and sales training.

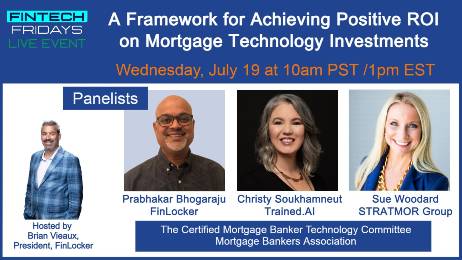

Brian Vieaux hosts a powerhouse panel featuring Sue Woodard, Christy Soukhamneut, and Prabhakar Bhogaraju, for a discussion on using mortgage technology to deliver positive ROI based on the paper the panelists collaborated on for The Certified Mortgage Banker Technology Committee, Mortgage Bankers Association.

Brian Vieaux talks with Dale Larson, Founder & CEO of Modex, a cutting-edge mortgage data analytics marketplace focused on recruiting for mortgage lenders, banks and credit unions. They delve into the challenges mortgage lenders face when recruiting loan officers with established books of business and how leveraging Modex’s data sets helps identify the most suitable loan officers to bolster production.

Brian Vieaux talks mortgage marketing with Katherine Campbell, Chief Marketing Officer with AnnieMac Home Mortgage. They discuss how traditional and online mortgage marketing fueled consumer demand for a seamless experience for their entire homebuying journey. Plus, they unlock the secrets to the winning mortgage strategy that enables loan officers to compete with big-budget lenders by combining their local expertise with a customer-first tech stack.

Brian Vieaux talks with Jimmy King, Co-Founder of BankingBridge, a mortgage solution that enables mortgage lenders, credit unions, banks and mortgage brokers to easily add mortgage calculators and rate tables to their website to increase the opportunities to capture and convert website visitors. Jimmy shares tips for attracting quality prospects that are lower down the sales funnel to your website.

Brian Vieaux talks with Luke Babich, CEO of Clever Real Estate, a game-changing service that benefits loan officers, real estate agents, home buyers and sellers. With Clever Real Estate, home buyers can receive up to 0.5% cash back, while sellers can learn how to interview top real estate agents on the platform who are committed to accepting a modest 1% listing fee.

Watch the recording on LinkedIn

Scott Schang joins Brian Vieaux to show you how to use Google Bard and ChatGPT to identify the hottest first-time homebuyer markets and their pain points and desires. He’ll demonstrate live how to create engaging content to build your pipeline today with tomorrow’s homebuyers.

Brian Vieaux talks with Walter Carter, Chief Digital Officer with HomeStar Financial Corporation, on the remarkable work Walt’s team is doing to supercharge their CRM capabilities, empowering loan officers to maximize their database to drive business and cultivate stronger relationships with real estate agents and builders. Walt also shares insights from his book, “We Can’t Stay Here: Becoming A Change Captain,” which explores the Seven C’s of Effective Change Leadership.

Matt Harrick, Chief Revenue Officer with Voxtur Analytics, a real estate technology company that offers targeted data analytics to simplify tax solutions, property valuation, and settlement services throughout the lending lifecycle, explains how the data hub and workflow platforms enable loan officers to mine life-change data to identify new customers and how they can action on the data to generate revenue.

Brian Vieaux talks with Ryan Cotter, who is Chairman of the Real Estate Rumble and, by day, Divisional Leader of The Mortgage Corp. about their share their passion for fundraising for their respective boxing-related organizations that support disadvantaged youth.

Brian Vieaux talks with Elizabeth Dodson, Co-Founder of HomeZada a cloud-based digital home management solution that helps homeowners better manage their home maintenance, improvement projects, home inventory and finances.

Evan Wade, Founder of EpochOS, shares with Brian Vieaux how he started a national mortgage brokerage, Epoch Lending, and developed the first Enterprise Resource Planning (ERP) specifically for mortgage brokers, which enables loan data and financial data to live in one software system.

Brian Vieaux and Sara Nakae, Senior VP of Strategy & Partnerships with Cypress Ascendant Holdings and Ascendant National Title, discuss the importance of regularly evaluating your processes to uncover opportunities for efficiency and cost reduction.

Brian Vieaux talks with Tim Wagner and Andrew Haberman, Co-Founders of beefy, a digital marketing agency that focuses on social media, online ads and event promotion for mortgage, real estate and technology.

Brian Vieaux talks with Andrew Liput, Founder and CEO of Secure Insight, a pioneer in vendor management and wire fraud risk for mortgage lenders and consumers.

Brian Vieaux has a lively conversation with Steve Richman, Presenter, Trainer & Consultant with SteveRichman.com. They talk about the importance of keeping a positive mindset to ride out the current mortgage and real estate market conditions and how to build relationships with next year’s home buyers.

Brian Vieaux talks with Kelly Yale, Director of Innovation and Divisional Vice President with NEO Home Loans on analyze and assess tech solutions to provide loan officers with a fully integrated and scalable tech stack with data intelligence that provides loan officers with a complete picture of their consumers, drive business and provide personalized customer experiences.

Brian Vieaux talks with Peter Paglia, President and CRO of Cole Information, which provides hyperlocal business intelligence solutions for the real estate, insurance, home services, and mortgage industries.

Brian Vieaux talks with Mo Oursler, Executive Vice President with Mortgage Career Exchange, a digital portal and engagement hub transforming the way mortgage professionals and companies connect by offering members monthly networking and recruiting events, resume and LinkedIn coaching, and MBA courses to learn new skills.

Brian Vieaux talks with Aru Anavekar, Founder and CEO of Botsplash, a SaaS consumer engagement platform that removes friction in multi-channel customer communications by enabling the consumer to respond via their preferred channel, and their loan officer can reply through the same channel via the platform.

Ally Carty with ActiveComply, shares with Brian Vieaux how she’s applying her passion for sales and social media marketing to help IMBs, banks, and credit unions use social media compliantly to connect with next-gen homebuyers. They also discuss Ally’s popular video series @get2knowgenz on TikTok, in which she bridges the gap between the mortgage industry and next-gen homebuyers by asking her gen z peers financial education questions.

Patrick O’Brien, Founder and CEO of LenderLogix, shares with Brian Vieaux how his early career as a mortgage originator provided the impetus to design and create digital mortgage solutions that deliver efficiencies for loan officers and real estate agents and a ⭐ ⭐⭐⭐⭐ experience for their borrowers.

Brian Geary, Chief Commercial Officer with Argyle shares with Brian Vieaux how his background in banking and fintech led him to join Argyle to reduce friction and costs of verification of employment and income for lenders and empower borrowers to control their data while making the verification process easier.

Mike Faraci, Founder & CEO of Red Button Media, shares with Brian Vieaux how his background in mortgage origination inspired him to begin creating engaging educational video content for mortgage originators and real estate agents to connect with first-time homebuyers by promoting their team, branch, or personal brand on social media.

Learn how to stay on top of social media trends and build your database by creating engaging content that resonates with prospective homebuyers while keeping you connected with your homeowners from:

- Joshua Dobson, BluPrint Home Loans

- Rebecca Richardson, UMortgage

- Minh Nguyen, What’s a Mortgage

Jason Cave, Head of Fintech Strategy with the Federal Housing Finance Agency (FHFA) discusses with Brian Vieaux, CMB the opportunities for technology to make a difference in the mortgage process and how the FHFA plans to bring people across the entire mortgage ecosystem together to solve specific tech problems.

Jason Perkins, Co-Founder & President of Bonzo, shares how his background as a mortgage originator and marketer inspired him to create Bonzo to help originators and agents scale their marketing using an omnichannel approach to building relationships. Jason discusses his tech development process to innovate its product to increase response rates and engagement.