In today’s competitive mortgage market, a borrower’s credit profile is a critical factor in determining loan eligibility. However, credit remains a significant hurdle for many mortgage applicants, leading to application denials and pipeline fallouts, significantly impacting conversion rates.

Research highlights the importance of proactively assisting borrowers in improving their credit scores. According to the CreditXpert Credit Potential Index, 77% of credit scores below 760 could move up at least one 20-point band within 30 days. Furthermore, 46% of borrowers are willing to delay closing by 30 days to secure a better rate.

Mortgage originators who provide borrowers with tools and educational resources to improve their credit scores will not only qualify more applicants, but the borrowers will be better positioned to receive competitive rates and terms, boosting pipeline conversion.

Consumers Seek Credit Education

Consumers rely on various sources, including banks, credit card providers, credit monitoring services, and credit bureaus, to access their credit scores and monitor their credit before applying for a new line of credit, such as a credit card, auto loan or mortgage.

According to a recent TransUnion Credit Education Study, of the U.S. consumers enrolled in credit monitoring tools for the first time with TransUnion, 55% are Credit Seekers who plan to open a new credit account, 30% are Credit Managers who aim to better manage their debt levels, and 15% are Credit Improvers, defined as consumers with subprime credit scores, who seek to improve their credit scores. Impressively, 42% of all Credit Seekers opened a new account the following year, 24% of all Credit Managers said they were able to pay down debt as a result of credit monitoring, while all Credit Improvers improved their score by 28 points on average in one year, and those new to credit saw their score improve by 35 points.

Despite the prevalence of credit monitoring services, many consumers remain unaware of the factors influencing their credit scores. A survey by the Consumer Federation of America revealed significant knowledge gaps, with only 78% of consumers recognizing high credit card balances and 71% knowing that personal bankruptcy was a factor affecting credit scores.

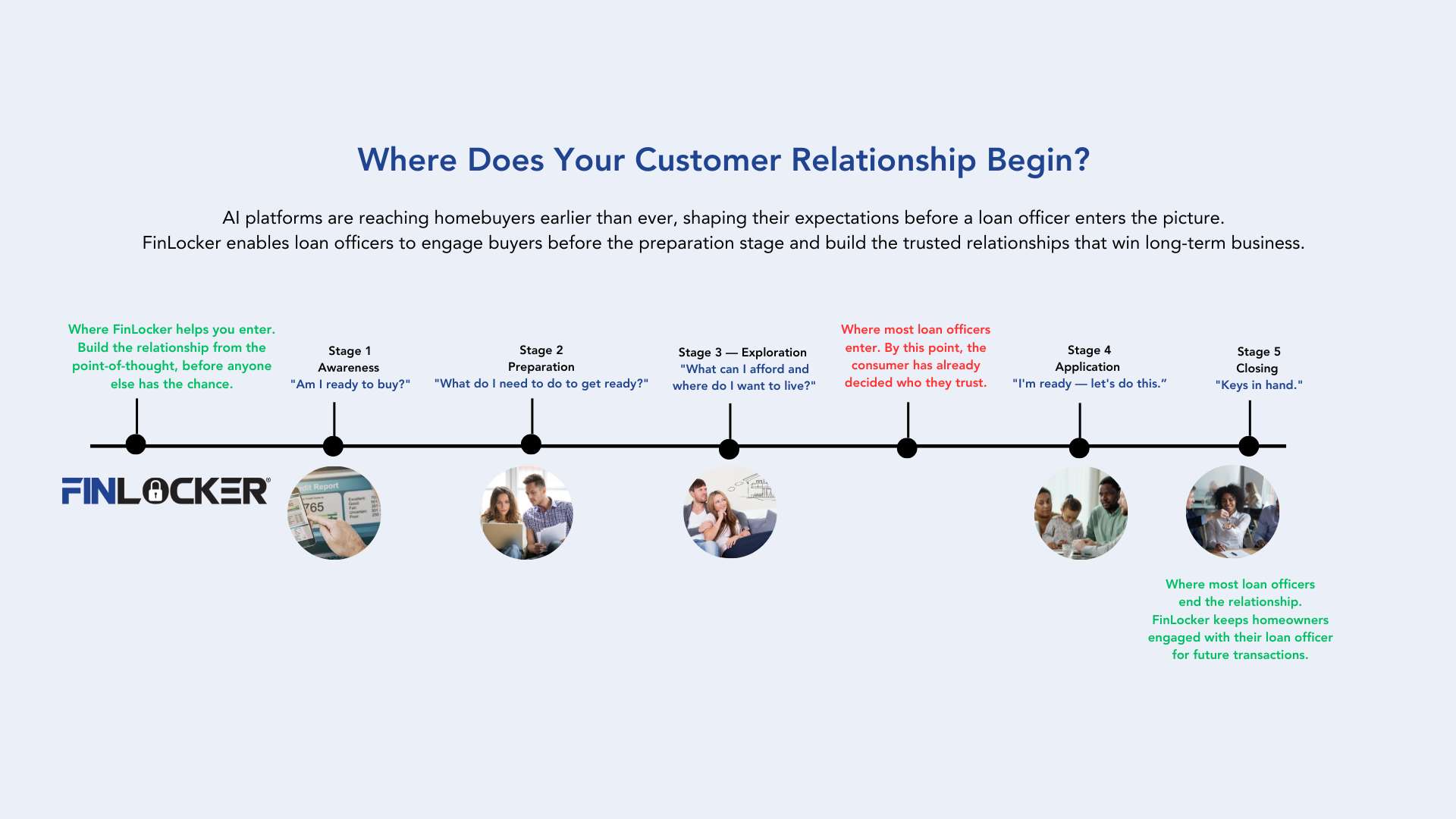

Originators can help improve prospective borrowers’ credit health and mortgage eligibility by educating them early in their homeownership journey about the credit score factors and providing them with free tools to monitor their credit.

Clarifying Credit Score Misconceptions

Many first-time homebuyers are unsure about the minimum credit score required to qualify for a mortgage loan. A Fannie Mae study found that 53% of consumers were unaware of the minimum credit score or were entirely out of range.

Loan officers who leverage social media for financial education can attract prospective homebuyers early in their homeownership journey by discussing credit score requirements for various mortgage programs before pre-qualification applications are submitted.

The Competitive Advantage of Offering Free Credit Monitoring

We’ve seen that lenders who offer credit education and monitoring to their existing and prospective customers help their customers achieve their financial goals. However, lenders who provide credit monitoring and improvement tools also have a competitive business advantage. A third of consumers in the TransUnion survey said they’d prefer a lender that offers them credit monitoring services when choosing where to originate a new loan. Banks and credit unions will benefit from the 39% of consumers who said a lender offering credit monitoring would influence them to continue banking with that lender.

Operationalizing Credit for Increased Conversion

Lenders should operationalize credit early in the mortgage process to increase pipeline conversion for consumers with lower credit scores. By providing consumers with tools and resources to understand their credit improvement potential upfront, originators can build trust, strengthen borrower relationships, and reduce fallouts and denials.

A targeted approach is advisable for loan officers looking to build a long-term sales pipeline. Target marketing to attract:

- Consumers with credit scores in the 500 to 579 range who could qualify for an FHA loan with a 10% down payment, but can be nurtured toward better terms with a higher credit score

- Consumers with credit scores in the 580 to 619 range who can be nurtured to qualify for an FHA loan with a 3.5% down payment

- Consumers with credit scores in the 620 to 679 range who could qualify for FHA but would benefit from a conventional loan

- Consumers with credit scores above 680 would prefer to improve their credit score to qualify for the best loan terms while they save for their costs to close and search for a property

Leveraging FinLocker for Credit Improvement

FinLocker offers consumers a suite of tools to bolster their credit health, including access to their TransUnion credit score and report and a credit simulator to test the impact of various scenarios on their score.

FinLocker can also assist in recovering previously turned-down applicants by providing personalized journeys to improve credit scores and debt-to-income ratios while guiding them toward mortgage readiness.

By deploying engaging technology solutions like FinLocker, originators can empower prospective homebuyers and reengage turned-down applicants, ultimately increasing pipeline conversion.