Differentiating yourself from other mortgage originators to attract homebuyers can be challenging. Still, you can undoubtedly rise to the top with a successful mortgage lead strategy. There are many ways to generate mortgage leads, but you need to meet homebuyers where they are online to connect.

Many homebuyers lack knowledge of the mortgage process and loan programs, so they often turn to the internet for guidance along their home buying journey. You can incorporate their desire for information into your digital marketing strategies to generate leads, nurture them, and develop long-lasting relationships.

1 – Start generating leads by creating great content

First-time homebuyers need to be educated on the entire mortgage and homebuying process. Many still believe that you need to save 20% for a home down payment. Use your knowledge and experience to create great content that will position you as a trusted mortgage advisor to attract new leads.

The way first-time homebuyers are learning about homeownership is evolving. Today, YouTube is the go-to source for 74% of Gen Z and 64% of Millennials. Instagram, TikTok and Facebook are still used by 46%, but now 34% of Millennials and 43% of Gen Z leverage ChatGPT and other AI tools. (2025 NextGen Homebuyer Report)

While using these platforms and others to generate leads, be sure that all of your content engages, educates, and resonates with your target audience. Your content should include the following to receive the best results.

- Create content based on answering the questions you are frequently asked.

- Show that you’re a local originator with content that highlights why your city is a great place to live.

- Title your content to entice more clicks when posting to your website or social media pages.

- Ask ChatGPT to optimize your content for LLM SEO (Large Language Model Search Engine Optimization)

- End every piece of content with a call-to-action.

2 – Publish content to your business website

Your mortgage website not only has to be visually appealing to the consumer’s eye, but it also must provide a valuable experience for the consumer. Your website is essentially the first place a buyer will visit if interested in using your services, so it is essential to send the right message. A powerful mortgage business website will need a strong focus on user experience (UX) design, a process committed to providing a meaningful and relevant experience for the consumer. Include these elements on your website to strongly impact visitors and generate leads.

Your home page is the first thing buyers will see when visiting your website and should contain a clear message of the services you offer. This message can describe the benefits of working with you, your process, loan programs, and what makes you different from your competitors. Your phone number and email address should be clearly displayed on the home page to make it easy for the consumer to connect with you. The home page should relay your willingness to educate, support, and guide every homebuyer and homeowner through their home financing journey.

A Testimonials page is a must-have on your website, given that most homebuyers consider reviews and recommendations critical when choosing their loan officer. Gather testimonials from previous homebuyers and the real estate agents you work with – and offer to give them a reference in return. Showcasing testimonials on your website will build trust with prospective borrowers.

Your website should have an Education page to show that you want to share your knowledge and experience to help borrowers purchase their homes. Organize your educational content and videos to provide your consumers with a seamless homebuying journey. End each content page with a call to action that encourages the homebuyer to call, text, or email you. A link to get pre-qualified is good, but most people prefer to make a personal connection first.

Mortgage calculators are one of the most searched terms on Google. Provide interactive tools that enable first-time homebuyers to compare their current rent payment to a monthly mortgage payment. Homeowners want to see if they can save money or pay off their home earlier with a refinance calculator.

3 – Connect with prospective homebuyers on social media

The most affordable way to generate leads is to incorporate social media into your business marketing strategy. The diverse selection of mediums opens many opportunities to connect with your target audience. It’s better to select one or two social media channels, depending on your time and resources, and do them well than spread yourself thin across all platforms. Depending on which social media platforms you use, consider implementing these social media strategies to engage with your audience.

- Publish longer education videos on YouTube and short videos on TikTok and Instagram. Make your content searchable by adding relevant hashtags to every post. Search “hashtag generator” for free tools.

- Take a photo with your homebuyers and their real estate agent at closing and ask them if you can post it to your social media page. If they are on Facebook or Instagram, for example, ask if you can tag them in the post, so it also shows on their feed. This strategy will help to get you noticed by the homebuyers’ social media friends and the real estate agent’s followers.

- Host a weekly podcast and invite your real estate agents, loan processors, underwriters, etc., to explain what happens during their step in the home buying or mortgage process.

- Follow other mortgage professionals to see what they are doing on their social media.

4 – Utilize Google My Business so local homebuyers can find you

Fewer homebuyers might be coming to your office, but that doesn’t mean that they don’t prefer working with a local lender.

One way to generate mortgage leads in your area is using a local search engine optimization strategy with Google My Business. This platform allows your mortgage business to appear in local searches.

After registering your business with Google for free, you will have a searchable page where you can list your contact information, operating hours, services, engaging content, and other relevant details. Your page will be displayed when prospective buyers search “mortgage lenders” in your area and it will appear on Google Maps, too.

Many homebuyers want to see positive reviews from past clients. When you ask previous clients to provide a testimonial for your website, ask them if they will also leave you a Google review on your business listing. The more positive reviews you have, the higher you will rank in Google searches.

5 – Generate leads with pay-per-click advertising

The prominence of pay-per-click (PPC) ads on Google search results is diminishing. If you have the budget for paid ads, social media is now where to spend it.

Meta offers pay-per-click ads on Facebook and Instagram. Many leads generated from these ads are from impulse clicks rather than individuals intentionally searching for information. Start by paying to promote your social posts so they will appear in the feed of more people in your region.

6 – Generate and nurture all of your mortgage leads with your branded FinLocker app

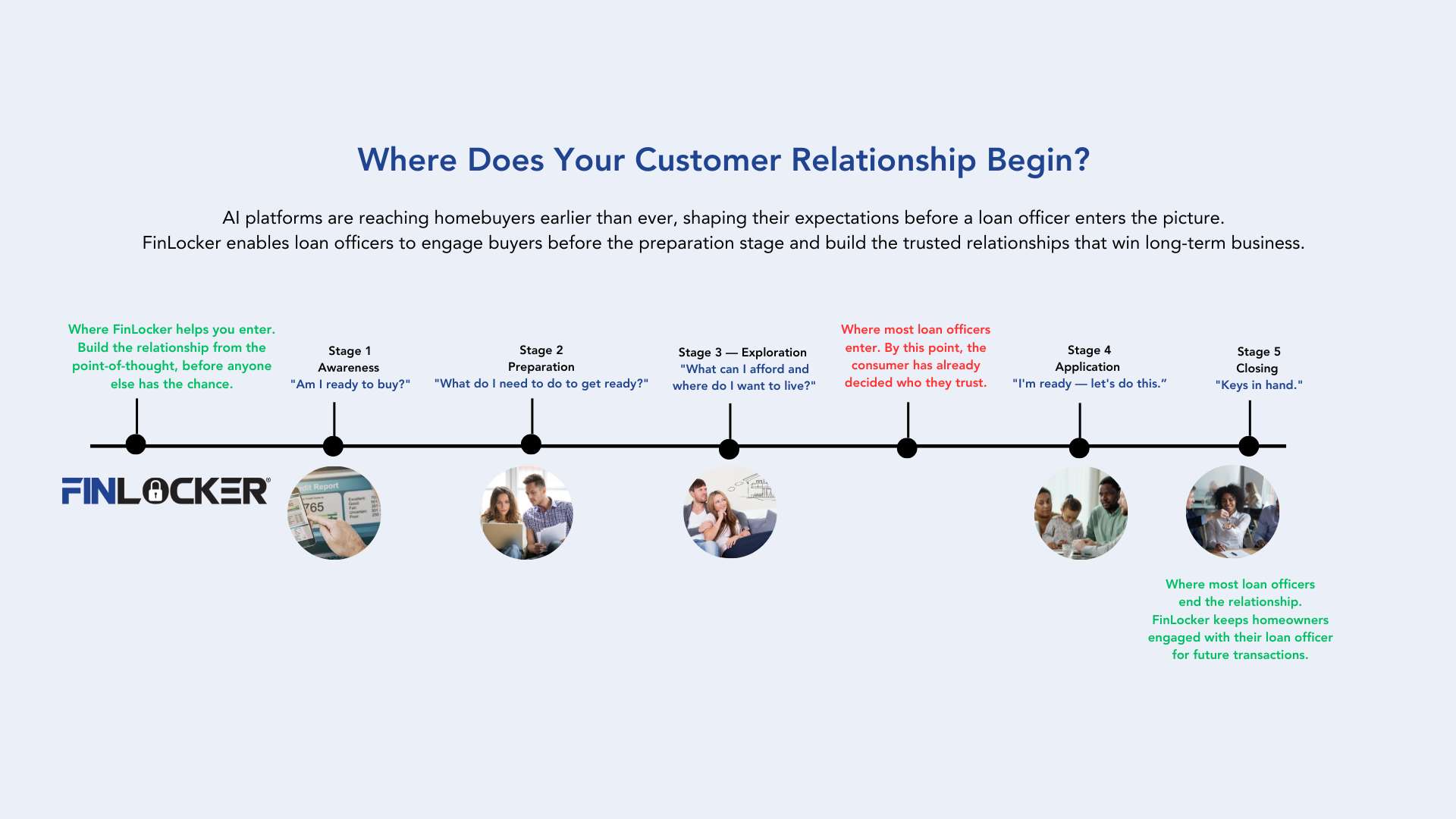

When you obtain potential homebuyers leads at the top of the sales funnel, they come to you at various stages of mortgage readiness. Most first-time homebuyers will likely need guidance through the entire mortgage process. Some may have financial hurdles to overcome before you pull their credit, get pre-qualified and start their home search. Moving up homeowners are more likely to be mortgage eligible when you connect, but the economic instability could’ve affected their savings, credit, and employment history. Nurturing homebuyers takes time away from closing mortgage-ready homebuyers.

To help mortgage originators manage a larger sales pipeline, FinLocker has integrated all of the tools and resources a first-time homebuyer needs to get mortgage-ready into one handy mobile app that you can private-label with your company and a unique brand name. The call-to-action on your social media posts and content can be to download your FinLocker app. Every time a new account is created, you’ll be notified and provided with their contact information to connect.

While the potential homebuyer interacts with the tools to improve and monitor their credit, budget, and savings, they can watch educational videos that explain the mortgage process and loan products. Other built-in widgets such as the interactive home affordability calculator provide a monthly mortgage payment and home budget that fits their income.

The readiness assessment acts as your digital assistant, where they can monitor their real-time progress towards mortgage eligibility. When they are ready to pre-qualified or start their mortgage application, they can quickly share the financial data and documents directly from their app with you to get started.

To see how FinLocker makes it easy to generate and nurture purchase leads, click here to watch our self-service demo, then join a live demo or schedule a 1:1 consultation to have your questions answered. Like that call-to-action?