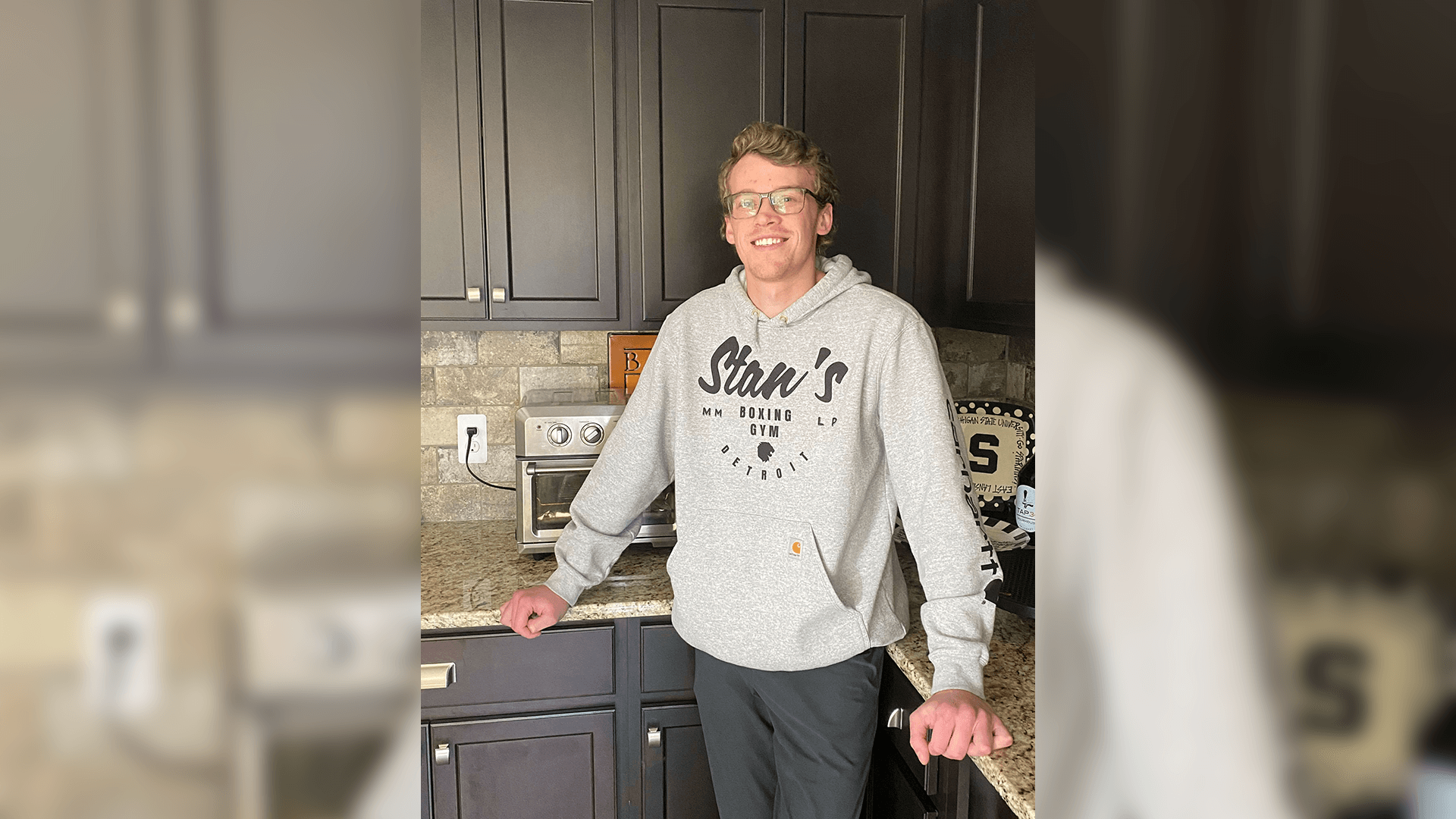

Ethan was typical of many young first-time homebuyers. He had a short credit history, an average credit score and thought the only way to qualify for a mortgage was to have a 20% down payment. What was different about Ethan is that he worked at FinLocker and had the opportunity to create a FinLocker account and use the app’s data and educational resources to carve his own journey to get mortgage-ready.

Like all employees, when Ethan started working at FinLocker, he created his personal FinLocker account to manage his finances. Watching the videos and reading the articles in the educational resources, Ethan soon realized he could achieve his homeownership goal quicker.

Credit score and report monitoring in FinLocker

Understanding the factors that influence a credit score was important to increase his credit score. As a young home buyer, Ethan had not built a credit history. Opening a new credit account has a low impact on how a credit score is calculated, but having almost no credit history is far more negative. A longer credit history demonstrates to a mortgage lender that a borrower can responsibly manage a smaller amount of credit, so they’ll be more inclined to finance a home purchase.

Ethan started to build a credit history by opening his first credit card account. After six months of making regular purchases and paying off the balance in full each month, he opened a second credit card account.

Over the next six months, Ethan paid his existing auto loan and both credit cards on time and kept his credit utilization rate below 30%. These two factors have the highest impact on credit score calculations. Monitoring his credit score in the FinLocker app, Ethan was able to see that his diligence was paying off and his credit score rose by 50+ points.

“When it comes to using credit cards to build credit, try not to buy anything with a credit card that you can’t afford to pay off at the end of each statement period.”

FinLocker has tools to save for down payment

Like many first-time homebuyers, saving for a down payment and closing costs is a significant barrier to home buying. While improving his credit score, Ethan knew he needed the discipline to begin saving, so he created a savings goal for a 5% down payment plus 4% of the expected purchase price for closing costs. After adding his bank accounts, the FinLocker Spending Analyzer categorized his transactions so he could understand his spending habits. He then created detailed budgets to identify areas where he could save from each paycheck.

Opening a separate savings account and automatically depositing a set amount into the account from each paycheck encouraged Ethan to pay all monthly bills on his set budget while still meeting his saving goal. Eight months later, he’d reached his savings goal but had not found a home to buy, so he created a new goal to save for the first six months of mortgage payments.

“The flexibility of the FinLocker app enabled me to create multiple financial goals. Creating the next goal as soon as I had achieved the first helped me to remain focused on always saving a portion of my income with every paycheck.”

FinLocker can help determine home affordability

Ethan learned that getting pre-qualified or pre-approved for a mortgage is important before starting a home search, so he contacted a mortgage lender who was a FinLocker client. After getting pre-approved, Ethan entered the number into the FinLocker Affordability Calculator. However, the payments were higher than his Detailed Budget recommended. He adjusted the purchase price in the calculator until he was comfortable with the monthly payments.

“Don’t be tempted to buy a home up to the full amount you’ve been pre-approved. I didn’t want to be house poor and committed to a high mortgage payment each month. I also wanted to have money to travel and begin saving for retirement.”

Searching for a home in FinLocker

Ethan initially started his home search online but found many homes in his budget were already off the market. Once he had FinLocker, he used the Real Estate Search widget built into the app, which enabled him to save his search criteria, including preferred price, home type, and the number of bedrooms. He also elected to receive notifications when a new home hit the market. When a family member referred him to a local real estate agent, he also searched MLS listings.

“Searching for my home inside the FinLocker app gave me access to a wide variety of homes that met my saved search criteria. I was also able to avoid being bombarded with calls and emails from advertisers, which often happened when I was using other real estate search sites.”

Ethan achieves mortgage readiness using FinLocker

Fourteen months after opening his FinLocker account, and monitoring his progress with the Readiness Assessment, Ethan found his first home, a 2-bedroom, 1.5-bathroom condo in a northern suburb of Detroit, Michigan, for $115,000.

Ethan contacted his loan officer directly from the FinLocker app to start the mortgage process. He selected which financial documents he wanted to share for his mortgage application directly from the Share Center inside the app.

“When I got pre-approved, my loan officer gave me a list of financial documents that I would need for my mortgage application, so I had plenty of time to upload them to store in my FinLocker. It was really convenient and much more secure to simply select which documents I wanted to share with my lender to complete my mortgage application, rather than scanning and emailing a bunch of bank statements, W2s, and other documents.”

As the condo needed updating, his loan officer recommended a Fannie HomeStyle loan to finance the purchase price and up to $30,000 for renovations.

After the renovation was complete, Ethan’s home was worth approximately $160,000. With 12.5% equity in his new home, Ethan added his new home to the My Property tab to monitor his home’s value and equity. Ethan has continued using his FinLocker app to budget and save for his next financial goal.