Vetted VA is an online community where Veterans can ask real estate and mortgage questions and receive answers from a network of Vetted Financial Professionals without being solicited. Vetted VA founder, Christopher Griffith was seeking additional financial tools to assist Veterans in achieving their financial goals.

FinLocker was identified as a partner to deliver Veterans with new financial health and wellness tools with its custom-branded financial super-app that focuses on all aspects of the homeownership journey. In March 2020, Vetted VA partnered with FinLocker to deploy the Vetted VA Go Bag, the financial planning and monitoring tool for Veterans.

The Challenge

Veterans have lacked a comprehensive financial preparedness solution, especially one focused on real estate finance. This is made painfully clear once many leave active service and are no longer supported, instead they are seen as a specialized market that are easy to target and solicit. This solicitation tends to prey on their status as a Veteran by offering specialized services and programs which do not actually provide anything of lasting financial value to the Veteran. The common issue is a lack of understanding and transparency throughout.

“Prior proper planning prevents piss-poor performance,” says Christopher Griffith, Marine Veteran and Founder of Vetted VA. “Both active duty and discharged Veterans understand this saying. With debt specifically, those who cannot plan for the debt they will accrue end up only saving a little money and relying on hope. This isn’t the military way – yet it has been the standard until now.”

The Solution

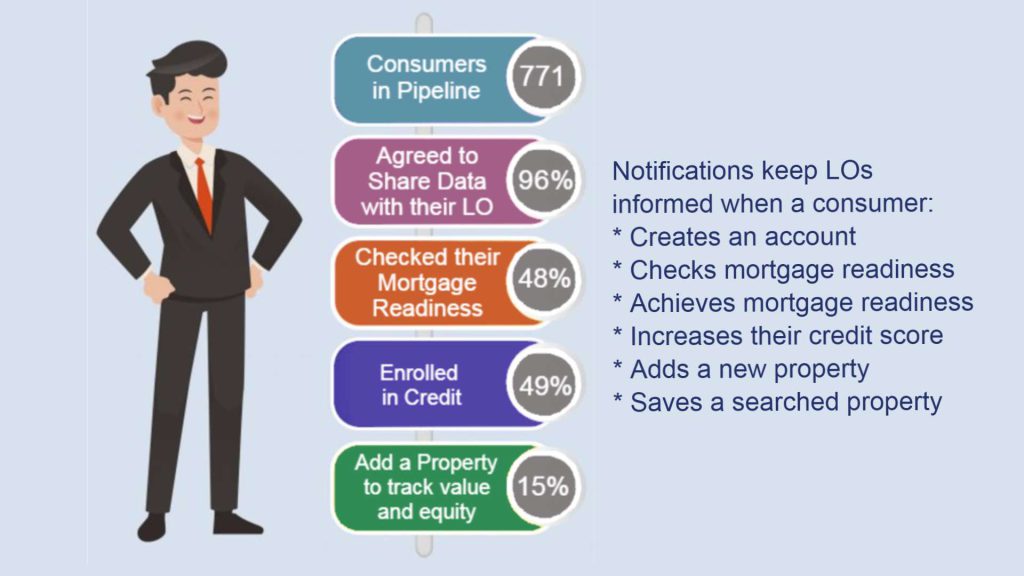

The Vetted VA Go Bag powered by FinLocker is a secure app where Veterans can safely store their financial data from other financial institutions. The app is built around the concept of consumer-permissioned data, so no financial institution will ever see a Veteran’s financial records until they give permission and share with a specific Vetted Professional. The Veteran has full control of what they store in the Vetted VA Go Bag, who they share the information with, and for what purpose. The Vetted VA Go Bag puts Veterans in control of their financial information.

Go Bag is the custom branded financial super-app that provides Veterans with tools that include:

- Credit report, credit score, credit monitoring, and alerts

- Financial tools that enable spending analysis, budgeting, goal setting, and tracking

- Access to an extensive library of homeownership and finance education

- Ability to track value and equity of currently owned real estate

- Search for properties for sale across the U.S.

- Uploading financial documents they will need when they are ready to proceed with their real estate transaction

- Direct connection to the Vetted VA Professionals network for financial advice

Partnering this tool with professional oversight and counseling from Vetted VA Professionals means the Veteran is not only prepared before the conversation, but they have a safe and secure place to take action based on the consultation and, when ready, can take action to share their documents to the Vetted Professional to move the process forward.

Vetted VA focuses on keeping the Veteran in control of their financial future by providing freedom from solicitation, liberty of knowledge from trusted sources, and accountability to deliver what is promised through vetting. FinLocker has fulfilled its part of that vision by supporting the liberty and accountability of information.