The Hispanic homeownership rate is on the rise. As National Hispanic Heritage Month runs September 15 through October 15, it is an opportune time to take a deeper look at this growing market of homebuyers using data primarily from the 2020 State of Hispanic Homeownership Report®️ a publication of the National Association of Hispanic Real Estate Professionals®️.

Since 2014, Hispanic homeownership has increased for six consecutive years, the only demographic in the U.S. to do so. In the next 20 years, the Urban Institute has projected that 70% of new homeowners will be Hispanic, adding an additional 4.8 million net new homeowners. However, you don’t need to wait for this demographic of homebuyers. Currently, there are over 8.3 million “mortgage-ready” Hispanics aged 45 and under with the credit characteristics to potentially qualify for a mortgage.

So what’s preventing more Hispanics from becoming homeowners now? Like many first-time homebuyers, credit and debt-to-income ratios are barriers to mortgage eligibility, yet they face additional obstacles.

Hispanic homebuyers tend to have lower credit scores on average than the general population. According to Freddie Mac, as of January 2021, Hispanics overall had a median VantageScore of 668, compared to 728 for the White population and 706 for the general population. Additionally, borrowers had a median debt-to-income ratio of 41%, had a median household income of $74,000, and purchased homes with a median down payment of 3.5%.

These borrower profiles make Hispanic first-time homebuyers vulnerable to underwriting changes, particularly in 2020, a year that the Mortgage Bankers Association claims was the most restrictive credit access environment in six years.

As a result, Hispanic homebuyers are more than twice as likely to use FHA loans to finance their mortgage compared to their White counterparts. On top of requiring private mortgage insurance, Hispanics paid an average of 90.1% more in closing costs for an FHA loan versus those of conventional loans in 2020. They also paid more closing costs – $599 more on conventional loans and $1,410 more on FHA loans – on average than White borrowers.

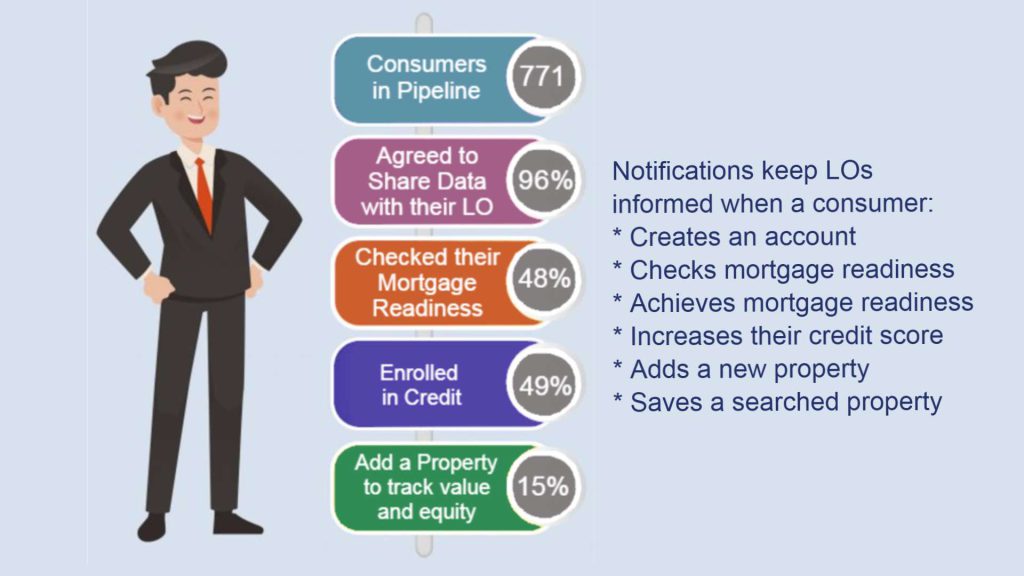

FinLocker is an equitable solution that can prepare the 1 in 3 Hispanics who are in their homebuying years (25-44) for homeownership. The tools in the FinLocker platform can help first-time homebuyers build and monitor their credit, manage their banking accounts, and budget to pay down debt to reduce their debt-to-income ratio. They can create realistic savings goals for Conventional, FHA, and VA loans using the Home Affordability Calculator. The Readiness Assessment perpetually analyzes each user’s enrolled financial data, keeping them on track and motivating by displaying their progress towards being mortgage-ready. Educational resources in English and Spanish teach them about the mortgage process and homeownership.

Watch the online demo or schedule a live demo to see how FinLocker can help you capture the next generation of homeowners and get them mortgage-ready.