To meet consumer expections, it is crucial for credit unions to adapt and embrace digital financial tools to attract new members and better serve current members.

In 2023, the average age of credit union members in the United States was 47 and only 7% of all credit union members were Gen Z, according to the McKinsey Consumer Financial Life Survey. While the Gen Z percentage is slightly less than the number of bank customers (12%), the difference becomes more significant when looking at Millennials – 21% for credit unions versus 29% for banks.

To secure their financial future, credit unions must invest in digital financial tools and offer digital banking to attract younger members, improve their financial literacy, increase deposits and be considered for lending transactions as members age. This is where attracting early-journey first-time homebuyers can be particularly valuable and potentially increase their wallet share with these members over the long term.

Additionally, research by Fannie Mae has shown that first-time homebuyers who work with a credit union are more likely to remain loyal to that credit union in the future. The reason? Trust. The Chicago Booth/Kellogg School Financial Trust Index report shows that 58% of Americans trust credit unions, but only 38% trust national banks. Using the public’s trust to attract and loyalty to retain can result in longer and more profitable relationships for credit unions.

Help members lead healthier financial lives with digital financial tools

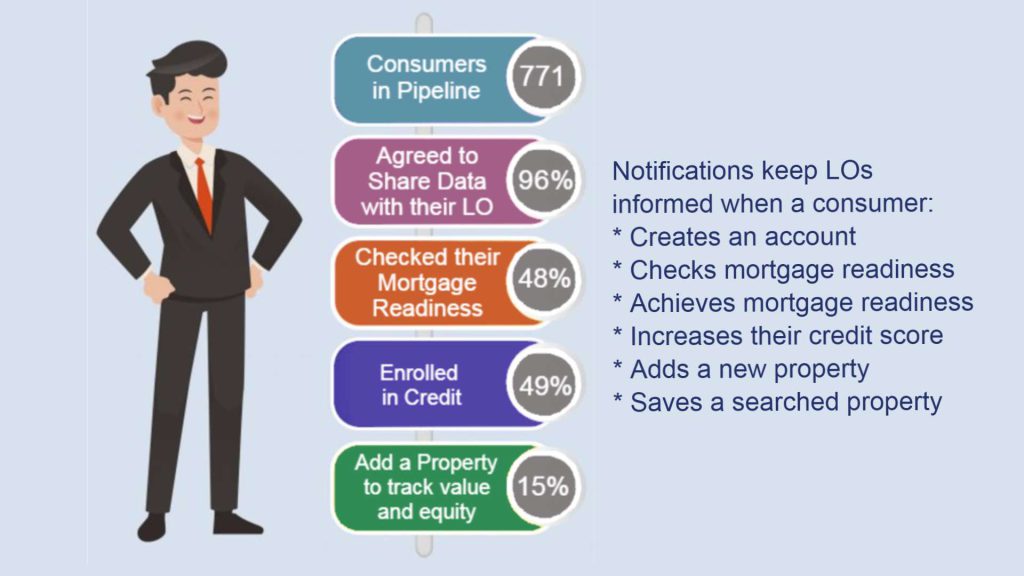

Credit unions can build stronger relationships with their members by providing digital tools that improve financial fitness. Digital tools that assist younger members with financial budgets, savings goals, and credit improvement can help members lead healthy financial lives. When members feel supported and empowered to manage their finances, they are more likely to remain loyal to their credit union and use other products and services offered by the credit union.

Credit unions can help younger members establish positive financial habits with digital financial tools that make it easier to create a personalized budget and track their spending. When members can see all their financial accounts in one place, they can better understand where they are spending their income and identify areas where they can cut back on expenses to save more money towards financial goals like a car loan and mortgage down payment.

Additionally, digital financial tools can help members set short-term and long-term savings goals and track their progress toward achieving each goal. This service can be especially helpful for first-time home buyers who may be saving for a down payment while also paying off other debts, such as student loans or credit card debt.

To compete with the national banks, credit unions should also offer digital tools that help members improve their credit scores and monitor their credit reports. For many first-time loan applicants, a low credit score can be a major obstacle to obtaining good terms for a car loan and mortgage. By providing digital tools to help them understand their credit report and identify areas where they can improve their credit score, credit unions can help members become more creditworthy and better positioned to qualify for a loan.

Empower members to achieve homeownership with digital financial tools

One area where digital financial tools can significantly impact the financial lives of credit union members is by helping them achieve homeownership. Credit unions can engage with their members and build stronger relationships with their community by partnering with fintechs to offer digital financial tools that help first-time homebuyers navigate the entire home buying process. This, in turn, can help credit unions expand their wallet share and attract new members, especially first-time home buyers.

Attracting early-journey first-time home buyers is an excellent strategy for building the member base. Buying a home is one of the biggest financial decisions that most people will make in their lifetime. For many young adults, buying a home represents a significant financial milestone, and it may be the first time they have had to manage a large amount of debt. It can be a stressful and confusing process, especially for first-time home buyers. Credit unions can attract and engage with this demographic by providing digital tools that make the home buying process more manageable. By providing members with digital tools that clearly guide members through the home buying process, credit unions can empower their members to feel more confident and in control of the process.

Many credit unions offer a digital mortgage application allowing members to apply for a mortgage online from the comfort of their home. This can save members time and hassle and help credit unions process mortgage applications more efficiently. Digital tools that help prospective homebuyers calculate their monthly mortgage payments, compare different loan options, get pre-qualified, and track the progress of their mortgage application, can make the home buying process more manageable.

Another excellent strategy for credit unions to engage with their members and build stronger relationships is providing members with a homeownership preparation app with a branded real estate search. A credit union-branded real estate search can keep home buyers away from using national real estate websites like Zillow, Redfin, and Rocket Homes, which promote the loan products of other financial institutions and benefit credit union members in multiple ways.

First, a credit union-branded real estate search can help keep members engaged with their credit union throughout the entire homebuying process, not just when the member submits their mortgage application. When members use a credit union-branded real estate search, they are more likely to remain loyal to their credit union and use other products and services, such as home and life insurance.

Second, a credit union-branded real estate search can help credit unions build a stronger brand presence in their local communities. By offering a branded real estate search, credit unions can position themselves as a trusted resource for prospective homebuyers in their community. This can be promoted to acquire new members, especially first-time home buyers looking for guidance and support throughout the home buying process.

Third, a credit union-branded real estate search can help credit unions differentiate themselves from national financial institutions and real estate sites. By offering a unique and personalized home search experience to attract new members, credit unions can stand out from their competitors with a valuable tool that cannot be found elsewhere.

As credit unions embrace digital solutions offered by reputable fintechs, offering innovative and personalized digital financial tools will position themselves as a trusted resource to attract younger members and build stronger, more profitable relationships over the long term. When members feel supported to improve their financial fitness and empowered to make decisions confidently throughout the homebuying process, they are more likely to trust and remain loyal to their credit union. Attracting early-journey first-time homebuyers with digital financial tools can be a valuable strategy for credit unions looking to lower their average member age and increase wallet share by offering additional borrowing, banking, and investment products.