The composition of American homeownership is evolving. The outdated notion that women are the co-borrowers on a mortgage application is being challenged as more women increasingly take on the responsibilities of homeownership on their own. According to Maxwell, 1 in 3 women with partners bought alone because they’re the breadwinner or have strong credit and savings. Single women comprised 19% of homebuyers, while single men accounted for 10% of homebuyers in 2023, according to the National Association of Realtors®.

While more women are achieving homeownership, their motivation and approach to the homebuying process are differences that the mortgage and real estate industries should be prepared to address. According to NextGen Homebuyer, women approach home buying more carefully and cautiously than men. They often experience more financial challenges to achieve mortgage eligibility, which they approach with a “cost savings mindset.” Men see homeownership as an investment. Whether that is their primary reason to buy or because their purchase is another investment to add to their portfolio alongside stocks, high-yield savings accounts, and retirement accounts.

Women fear being taken advantage of and not having a trusted advisor. However, they are prepared to do the research and spend time preparing to qualify for a mortgage. Mortgage originators can earn their business by being the trusted advisors they seek and empowering them with financial solutions to overcome the obstacles they face to qualify for a mortgage.

The gender wage gap slows down women’s financial progression

While women ended 2023 with 56.5% participation in the workforce (11.4% less than men), there persists a gender wage gap that negatively impacts the ability of single women to become homeowners. According to the Bureau of Labor Statistics Usual Weekly Earnings of Wage and Salary Workers report released on January 18, 2024, women had median weekly earnings of $1,031, or 83.8% of the $1,231 median for men. The wage gap was even more significant among the major race and ethnicity groups. White women earned 84.1% as much as their male counterparts, compared with 93.9% for Black women, 78.3% for Asian women, and 87.8% for Hispanic women.

Although women earn less than men on average, they remain diligent in their savings and financial planning. Women acknowledge the financial responsibilities involved in purchasing a home and set themselves financial goals to achieve before starting their homebuying process. Many women want to improve their credit and financial well-being by paying down outstanding debt and saving for a sizeable down payment. According to Maxwell, 60% of single women said they saved for 2+ years for their down payment, so loan officers need a long-term nurturing strategy to keep them engaged and informed of their progress while motivating and educating homebuyers.

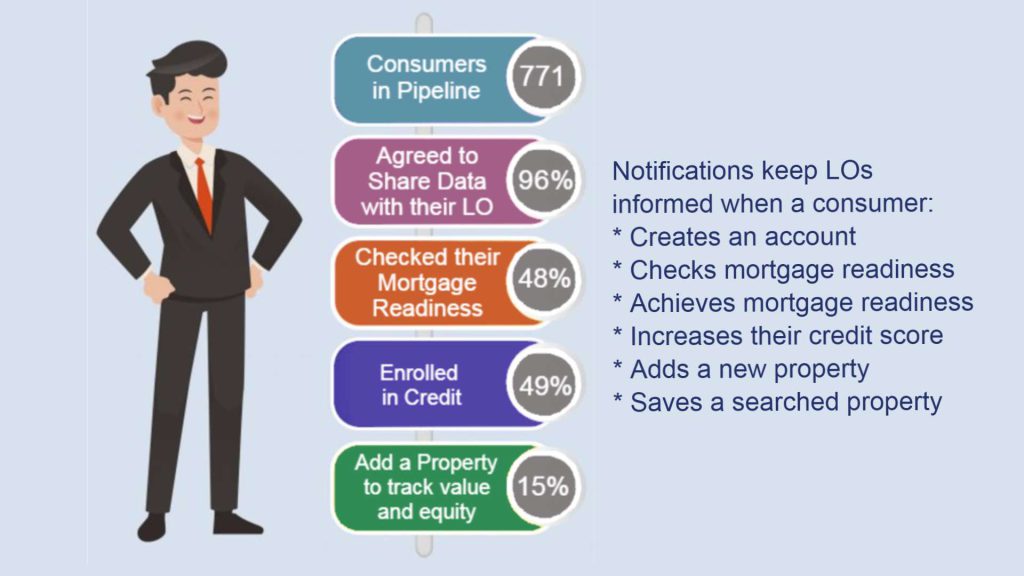

Mortgage lenders and loan officers can provide the FinLocker app to female homebuyers to obtain financial education and improve their financial health before applying for a mortgage. They can build their credit by monitoring their credit report and using tools to improve their credit score. FinLocker categorizes the transactions in their bank and credit card accounts and provides a spending analysis to show where they are spending their income, helping them to identify where they can save towards saving for their down payment and closing costs. They can also create a personalized budget to pay down their debts to reduce their debt-to-income ratio. Homebuyers can monitor their progress towards mortgage eligibility with the homeownership snapshot, which perpetually analyzes their enrolled financial data, and receive an action plan to help them overcome any financial challenges before they get pre-qualified for a mortgage and start their property search.

Women tend to have increased caretaker experiences

Many single women homebuyers have caretaking responsibilities, such as caring for children or becoming the sole caregiver to an elderly parent. It can be challenging for single women to balance financially supporting their family and investing in their dream of homeownership.

Women have a higher rate of financing a home purchase with an FHA loan than any other loan product. Single mothers may need the additional financial support that down payment assistance programs provide low-income homebuyers to help them attain homeownership.

While single mothers will benefit from FinLocker’s time-saving financial management tools, the app also offers a seamless way to initiate a mortgage application, saving time for all homebuyers, mortgage originators, and their operation teams.

Helping women find a home that meets their needs

Women prefer to purchase a home near friends, family, and healthcare facilities more than men. Mothers also consider proximity to schools to make balancing their career and child-rearing responsibilities easier.

FinLocker includes a property search to enable women to research sales prices, plan their homebuying budget, and begin their property search when they achieve mortgage eligibility. Providing women with tools to conduct their preliminary home search when it’s convenient for them will help them identify homes that meet their needs.

Women face higher mortgage rates and higher mortgage denials

Due to financial factors such as the gender wage gap, many single women have high debt-to-income ratios and a poor credit profile, resulting in a higher rate of mortgage denials than single men.

Men are significantly more likely to learn about financial planning from a young age. In contrast, women can benefit from their mortgage originator’s financial knowledge. Rather than leaving prospective homebuyers to self-determine when they have met loan requirements to pre-qualify for a mortgage, FinLocker can guide them through a personalized journey that will show them what they need to do and when they are mortgage-eligible.

When women overcome any financial barriers to homeownership, they emerge with higher credit scores and lower debt-to-income ratios than single men. Despite the lower income level, single women also typically put down a larger down payment and default on loans less frequently than single men.

Minority women face additional barriers to achieving homeownership

On top of the financial obstacles that single women must overcome in homebuying, minority women must overcome additional challenges. Many homebuyers of color face redlining, putting financial services and homeownership out of reach for minority individuals.

Black and Hispanic women often set a precedent for homeownership in their families. However, they are less likely to receive financial education or down payment gift money from their family than white female homebuyers. When they leave college, they often have high student loan debt, increasing their debt-to-income ratio and putting their credit at further risk.

These barriers, however, have not deterred Black and Hispanic women from becoming homeowners. In a 2021 report from the Urban Institute, between 1990 and 2019, Black women increased their homeownership rate by 5.6%, Hispanic women by 15.3%, and Asian women by 18.06%. In comparison, the homeownership rate of Black men declined by 8%, Hispanic men only increased by 3.2%, and Asian men increased by 5.0%. Even among married two-income households, it is increasingly common to see women listed as the heads of household, particularly in Black households.

How mortgage lenders improve communication during the mortgage process

While female faces representing all races are seen in the real estate industry, the mortgage industry has responded slower. Increasing the number of women in customer-facing roles at mortgage lenders will help improve communication and reduce gender discrimination.

Women tend to use social media, particularly Facebook and Instagram, more than men. They are more likely to follow brands on social media, so it should be easier for mortgage lenders, loan officers, and real estate agents to connect early with financial education and practical information on the mortgage process, money management, and homebuying.

As women continue to make gains in employment and as heads of households, more women will achieve homeownership. Financial tools and education, a streamlined digital mortgage application, and a transparent loan process will make it easier for more women to achieve and sustain homeownership.

Article was updated on March 6, 2024.