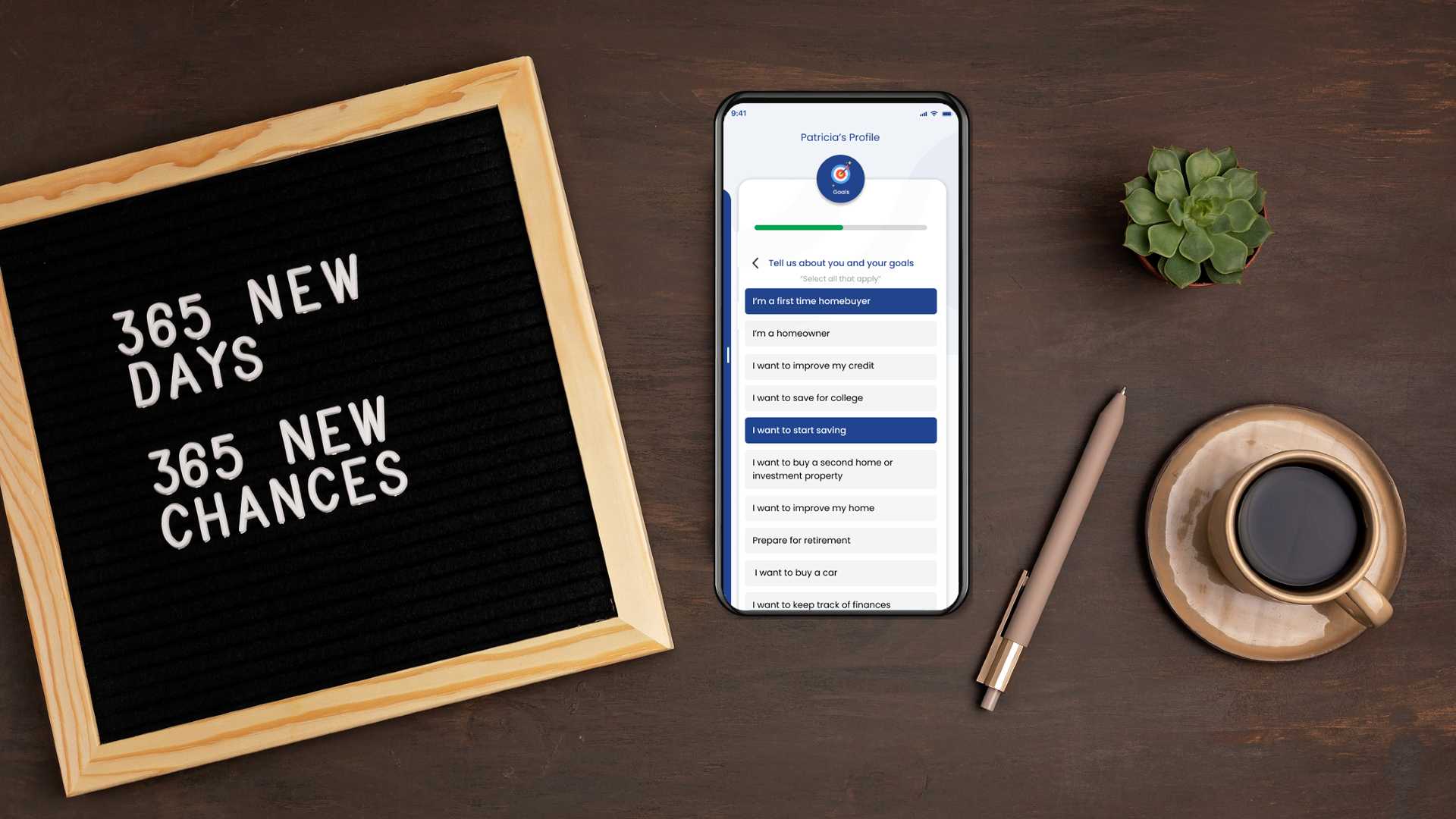

The start of a new year is the ideal time to set the goals you would like to achieve throughout the year. Your goals should be realistic and attainable within a reasonable time. Follow these tips for setting realistic goals to ensure you achieve your goals successfully this year.

Establish your financial goals

Establishing your goals will give you a sense of direction and expectations to follow, as long as you are specific and realistic in your process. Consider where you are now and where you want to go. Define your goals in terms of needs and wants.

For example, you may set a goal to increase your credit score this year. Having a higher credit score can help you qualify for a car or home loan. The higher your score, the more likely you’ll be offered better rates and terms on loans and credit cards. Signing up for credit monitoring in your FinLocker will make it easier to monitor your progress and receive tips to improve your credit. Use the credit simulator inside your FinLocker to evaluate various credit-related scenarios to see how they will impact your credit score, too.

Create a plan to achieve your financial goals

Once you have identified your goals, you need to create a plan to decide how you can best achieve these goals. Doing research can give you an idea of the commitment and time necessary to reach each goal successfully. Gather information such as how long it may take to achieve the goal, any costs associated with meeting the goal, any skills you may need to acquire, and how long the process will take. As you find answers, you need to determine whether you can provide the effort required to reach the goal or if the goal is asking too much from you and is unrealistic.

For example, if you want to pursue a different career or be promoted from your current position, research what skills you need to achieve this goal? Are there courses you need to take? Are the courses free or can you afford the fees? Do you have the time to do the courses while maintaining your current position and family responsibilities?

Assess any limitations or obstacles

Consider any limitations that may make your goals challenging to achieve. Upon research, you may have found that one of your goals may require more money or time than you can afford to commit. As you assess these obstacles, you may need to rethink how you will still achieve a goal.

For example, suppose you have a goal to get fit and decide you need to go to the gym five times a week. In that case, you need to consider any limitations or obstacles that may derail you along the way. You may decide that you have too many other responsibilities that prevent you from getting to the gym five times a week. Instead, you decide to make your fitness goal more realistic by going to the gym 2 or 3 times a week and incorporating a walk or bike ride with your family or friends on the weekend. It might take you a little longer to achieve your goal, but you’ll be less likely to be derailed on your path to success.

Break your goals into subgoals to stay motivated

Achieving goals can be a lengthy process, and it may take a while for you to see any considerable progress. Instead, break down your goals into smaller achievable steps. Write down each step and as you accomplish each step, mark it off to track your progress. These smaller quick wins will motivate you to achieve your larger goal.

For example, if your goal is to save $10,000 this year for a down payment, pay off debt, or create an emergency fund, you first need to look at your budget and work out how to save $115 per week or $16 per day. If you can save that money in a high-interest savings account, you will reach your goal in less than 12 months.

Think SMART to achieve your financial goals

The SMART method is a strategy people use to ensure their goals are Specific, Measurable, Attainable, Relevant, and Timely. Any goal you are setting this year would benefit from having these five elements to achieve them.

Specific: Your goals need to be defined and with a clear plan to follow.

Measurable: Determine what indicators along the way will show you are progressing.

Achievable: Make sure each goal can be achieved within a particular timeframe.

Relevant: Your goals should align with your values and objectives.

Timely: Assign an end date to reach your goal to maximize motivation and prioritize tasks.

The new year offers a fresh start for you to set new goals and plan how you will accomplish each goal effectively. Setting realistic financial goals and using these tips to create a plan to achieve them will increase your chance of success and give you the confidence to achieve your goals this year.