As refi mortgage applications fluctuate weekly and many homebuyers decide to wait for home prices to become more reasonable, mortgage leads are getting more competitive and expensive. Demand for paid mortgage leads, which are predominantly refinancing leads, has increased exponentially while overall conversion has dropped as leads are sold to multiple originators. When the refinance market was booming last year, refinance leads were often only sold to one or two lenders or originators.

Now that the refinance market is drying up, leads purchased from the major comparison sites are often sold to multiple lenders unless you have the budget to buy exclusively. It’s usually the originator who has their finger on their phone, responding within seconds with a low-interest rate offer, that has a better chance to capture the consumer’s business. The lead still costs the same, whether you are first or last to respond, get the application, or not.

This game of lead roulette is expensive. If one high-quality lead sold to a single originator costs $50, it drops to $25 if sold to two originators and $12.50 if sold to four. If you are only converting 10% of those paid leads, the marketing cost is $500 per converted lead, but you work harder, and the conversion rate exponentially decreases if you’re not the sole recipient.

On a tight budget? A low-cost strategy is to attract free purchase mortgage leads of less qualified first-time homebuyers whose current credit score is in the 560-620 range via social media campaigns. Buying consumer leads with lower credit scores also costs considerably less than high-quality purchasing leads. Rather than sell these homebuyers on a sub-prime mortgage, savvy loan originators are nurturing these potential homebuyers to mortgage readiness while they improve their credit, reduce their DTI, and save for their closing costs.

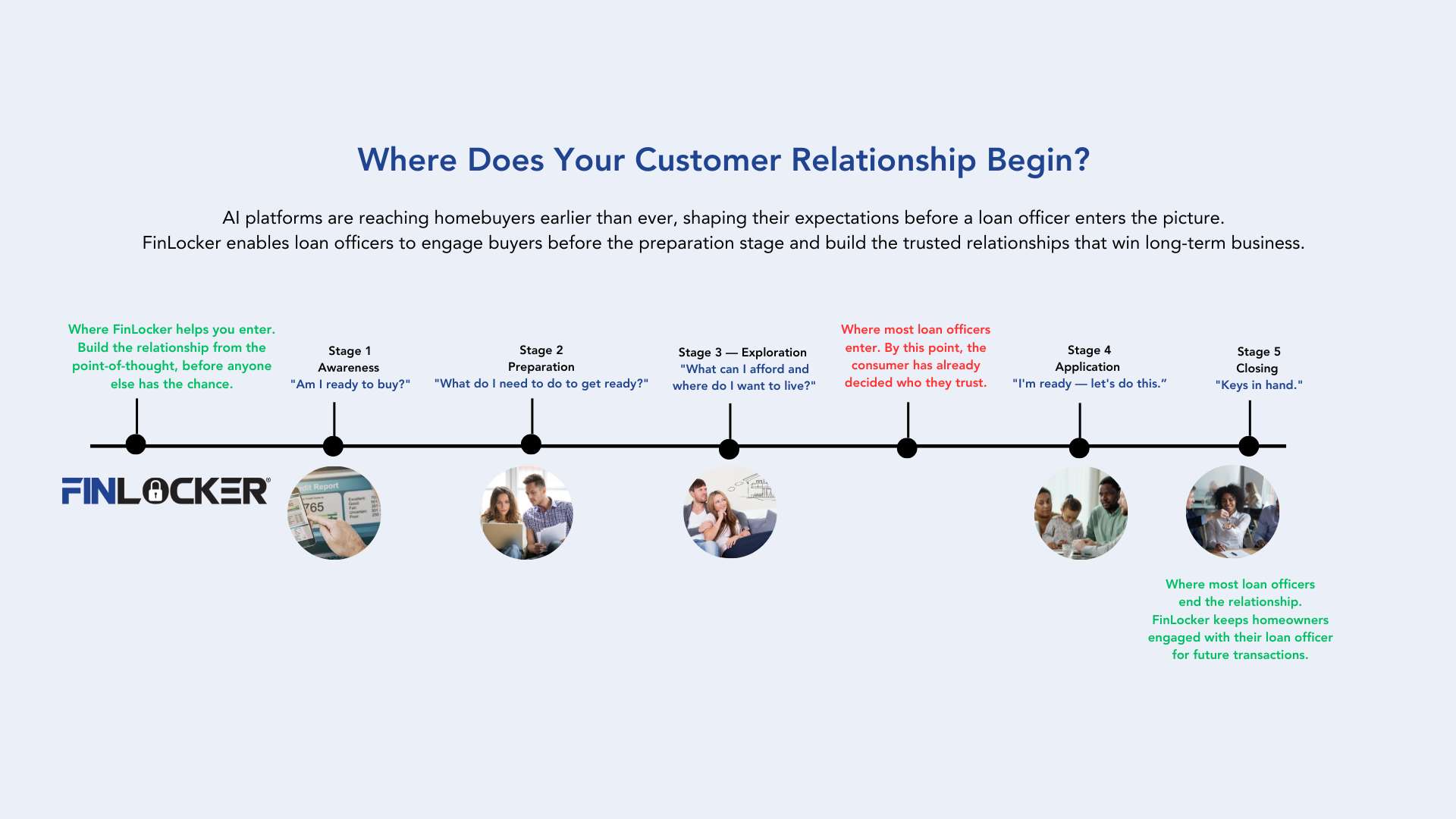

However, there’s an even smarter way to improve your odds of converting leads to closed loans and at a reduced cost. Originators who have the patience to convert purchase mortgage leads can benefit from a new partnership between FinLocker and TransUnion. Using their credit and consumer analytics, TransUnion can identify potential homebuyers in an originator’s preferred geographical area who are in the earliest phases of the decision cycle, long before they start shopping before a mortgage.

To improve their lead to closed loan conversion rate, at less than half the cost of a purchased lead, originators provide these homebuyers with their white-label FinLocker app to improve their mortgage loan eligibility. It doesn’t happen overnight, but by taking the time to nurture underserved homebuyers towards mortgage readiness in your own eco-system, you’ll be building a relationship and customer loyalty as the future homebuyer will not need to use another financial readiness app the entire time they are getting mortgage ready. An additional benefit is that FinLocker can connect to the originator’s LOS, streamlining the loan application and underwriting process. The financial data and documents shared directly from their app essentially prefill their mortgage application, reducing time and risk for all parties.

Schedule a 1:1 Consultation to see how the FinLocker and TransUnion partnership can improve your lead to closed loan conversion.