Many of the mortgage lenders and originators who successfully transformed their business almost overnight in March 2020 had a record year in 2020.

2021 is expected to be another year of change. Now is the time to identify what strategies elevated your business in 2020 and prepare to pivot to 2021.

Will Skype and Zoom meetings replace more of your face-to-face meetings long term?

Did electronic document signing prove popular with your buyers?

Permanently offering both electronic or in-person meetings and document signing to clients will demonstrate that you value their time and understand their preferred communication method.

How will you pivot to grow and nurture your pipeline in 2021?

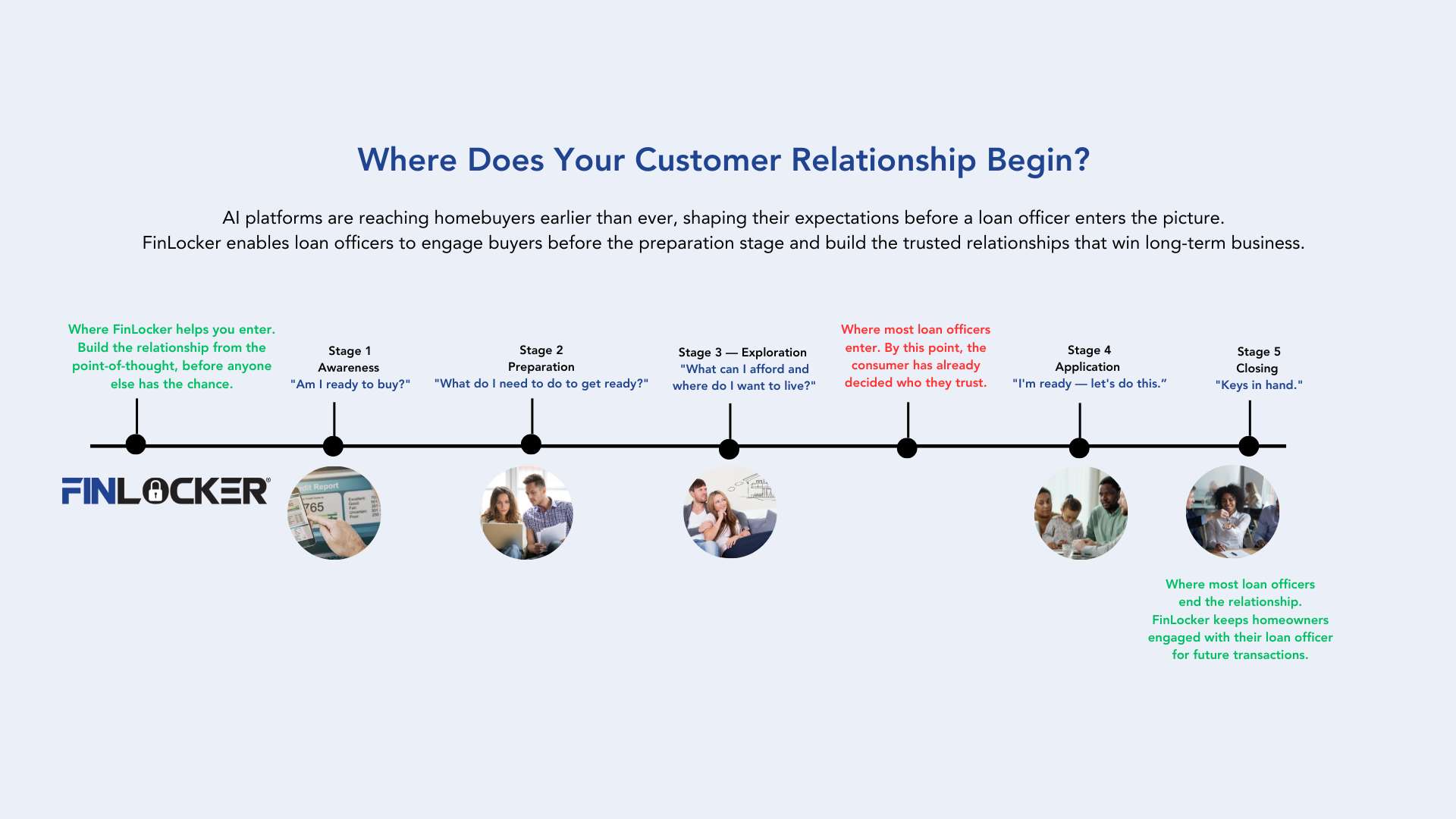

Research indicates that many first-time homebuyers still prefer to work with a local lender. But now that younger borrowers are spending even more time online and don’t need to walk into a branch, how will you pivot to generate new leads?

Whether from real estate agents or past clients, referrals have always provided a significant source of an originator’s leads. Social media is an easy way to stay connected with past clients and offers a low-cost solution to attract new leads. How will you pivot your marketing strategy to stay top of mind and nurture the prospective homebuyers while they get mortgage-ready?

Adopt a high tech and high touch approach to pivot your business in 2021.

FinLocker helps originators reduce the friction of mortgage preparation and the mortgage application process for originators by giving borrowers the tools to control their mortgage preparation.

The borrower uses the FinLocker tools to save their down payment and closing costs, reduces debt, and improve their credit. When a borrower is confident they are mortgage-ready, they can take a short readiness assessment inside the app and decide, based on the results, if they meet the qualifications to proceed with their mortgage application and notify their originator of this decision from the app.

FinLocker reduces the friction often associated with document collection because the borrower can securely upload and save their personal and financial documents to the app, then share those documents directly with their lender directly from the app. The information is delivered to the lender as a MISMO file, which can be transferred directly to the originator’s LOS for processing.

Successful mortgage originators are personable, resilient, and creatively adapt to market fluctuations.

To be successful in 2021 and beyond, originators need to provide the younger generations of homebuyers with high tech tools and solutions they need for mortgage prep and complements your personalized communication.