Attract, Build & Nurture Your Customer Relationships

FinLocker offers the next generation technology engagement solution that empowers mortgage lenders, originators, servicers, credit unions, banks, credit and housing counselors to provide their customers with personalized financial solutions and a path to homeownership.

This is literally the best tech I’ve seen in 22+ years!!!

I am so excited and so thankful for you and your team!!!

Sean McGaughey, mortgage loan originator, Edge Home Finance

FinLocker Success Stories

How Abdel Khawatmi, Producing Branch Manager with PRMG, uses PathHome to build trust and convert more borrowers

How Shane Kidwell, founder of Dwell Mortgage, is redefining lifetime client engagement with KeySteps

How Darren Kaplan with Total Mortgage, turned his FinLocker into a high-closing mortgage marketing lead machine

How Dennis Wells, a Producing Branch Manager, built high-intent homebuyer pipelines in 4 months using “Manifest With Us”

How LeaderOne Financial’s Roller Team converted “not yet ready” leads into 20 closed loans with “Manifest With Us” app

How a Mortgage Lender returned 90% ROI using their FinLocker-powered app to attract, engage and nurture homebuyers

How What’s A Mortgage used social media to launch the FinLocker powered WAM Wallet to attract first-time homebuyers

Improve the Financial Health of Those Who Matter Most to Your Business

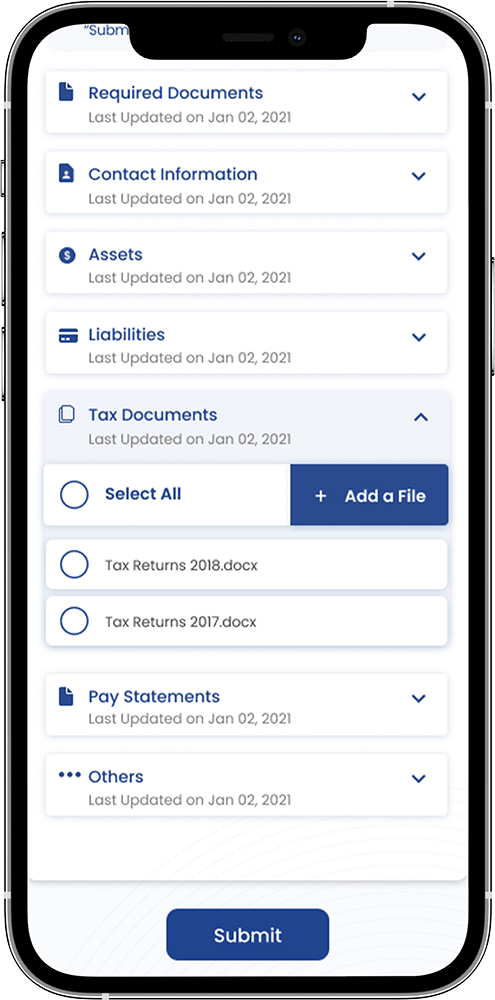

Compliment your CRM and POS tech stack with a homeownership focused financial fitness platform reflecting your brand and value proposition for customer acquisition, nurturing, and retention.

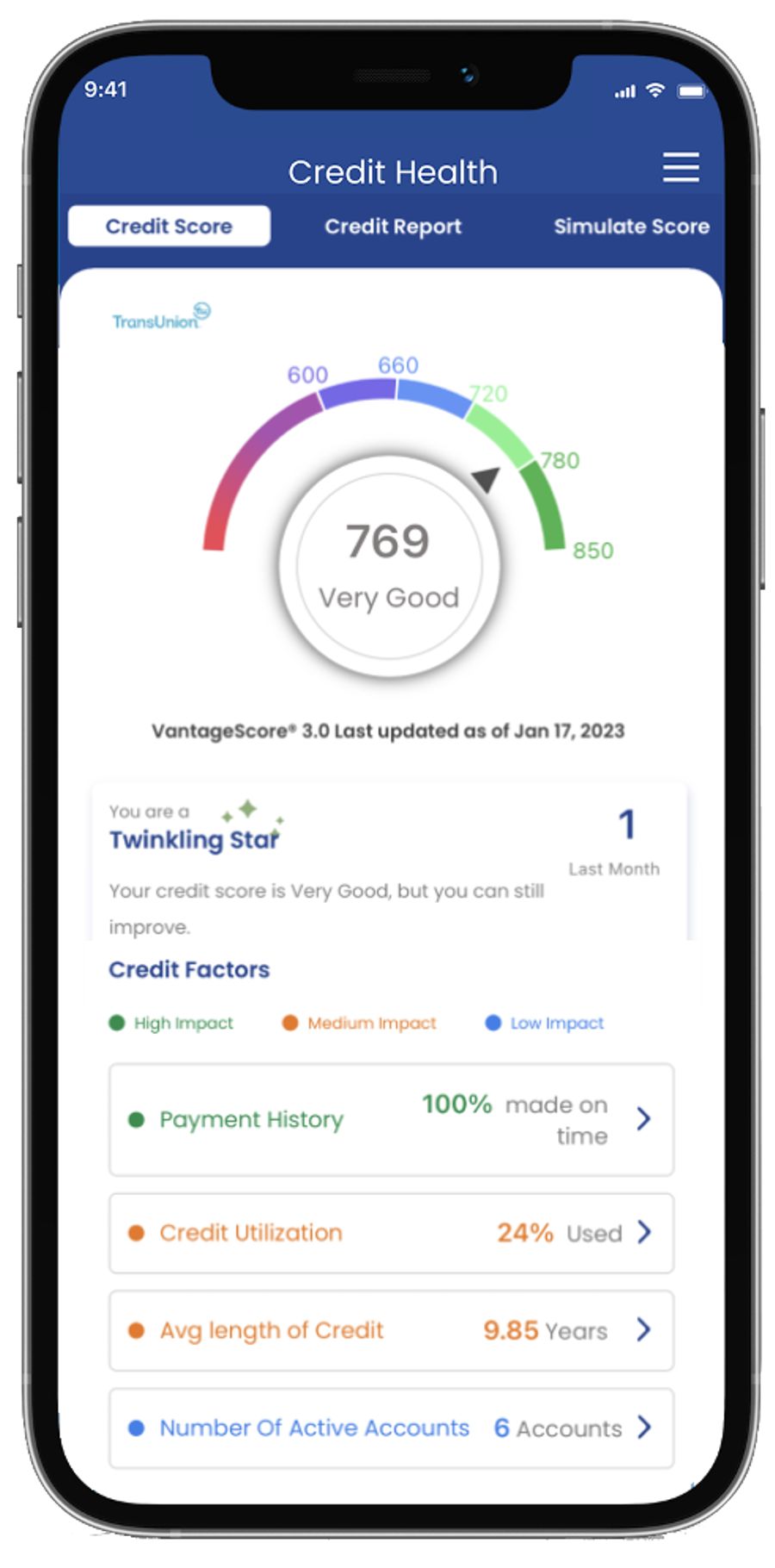

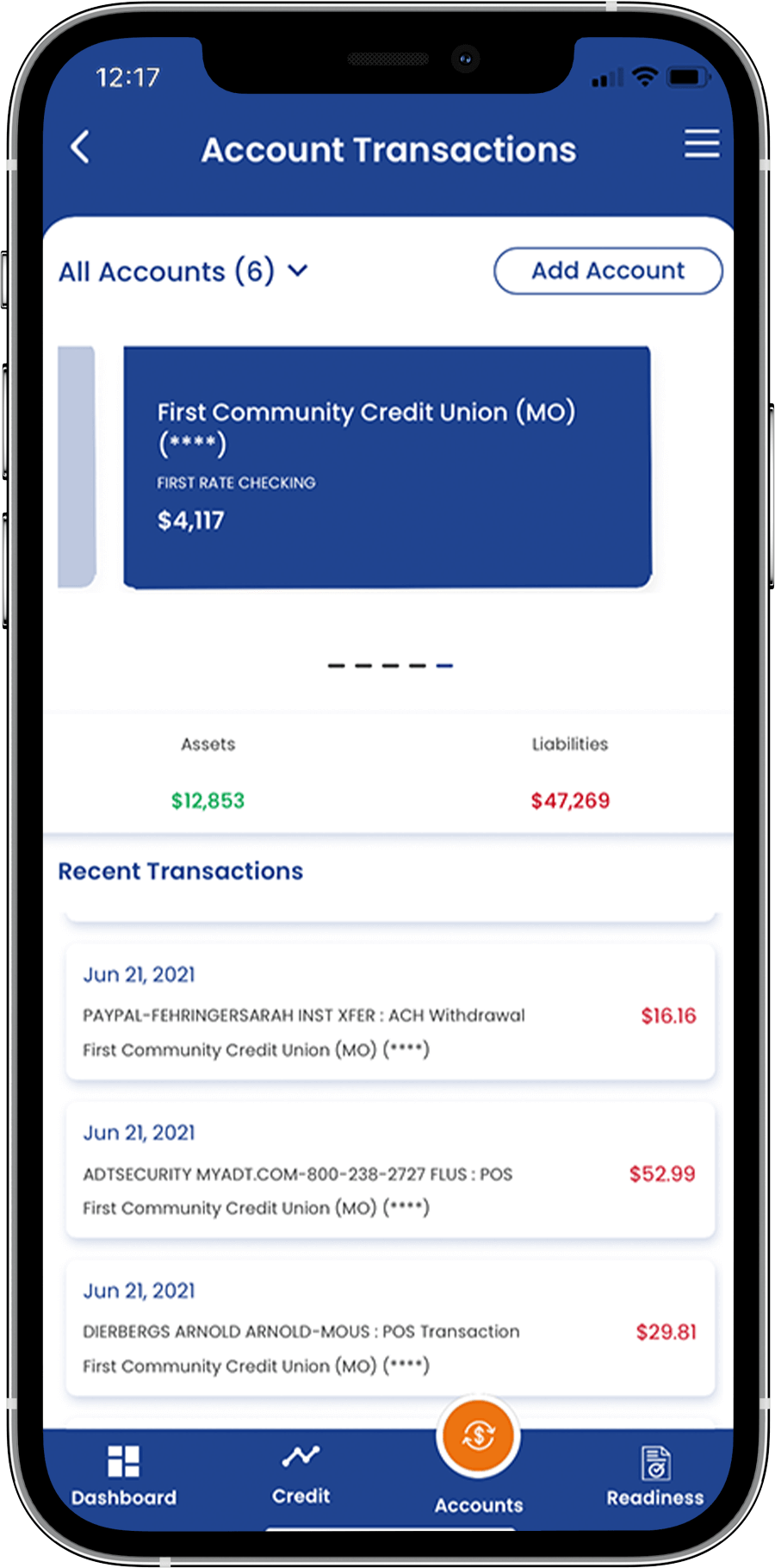

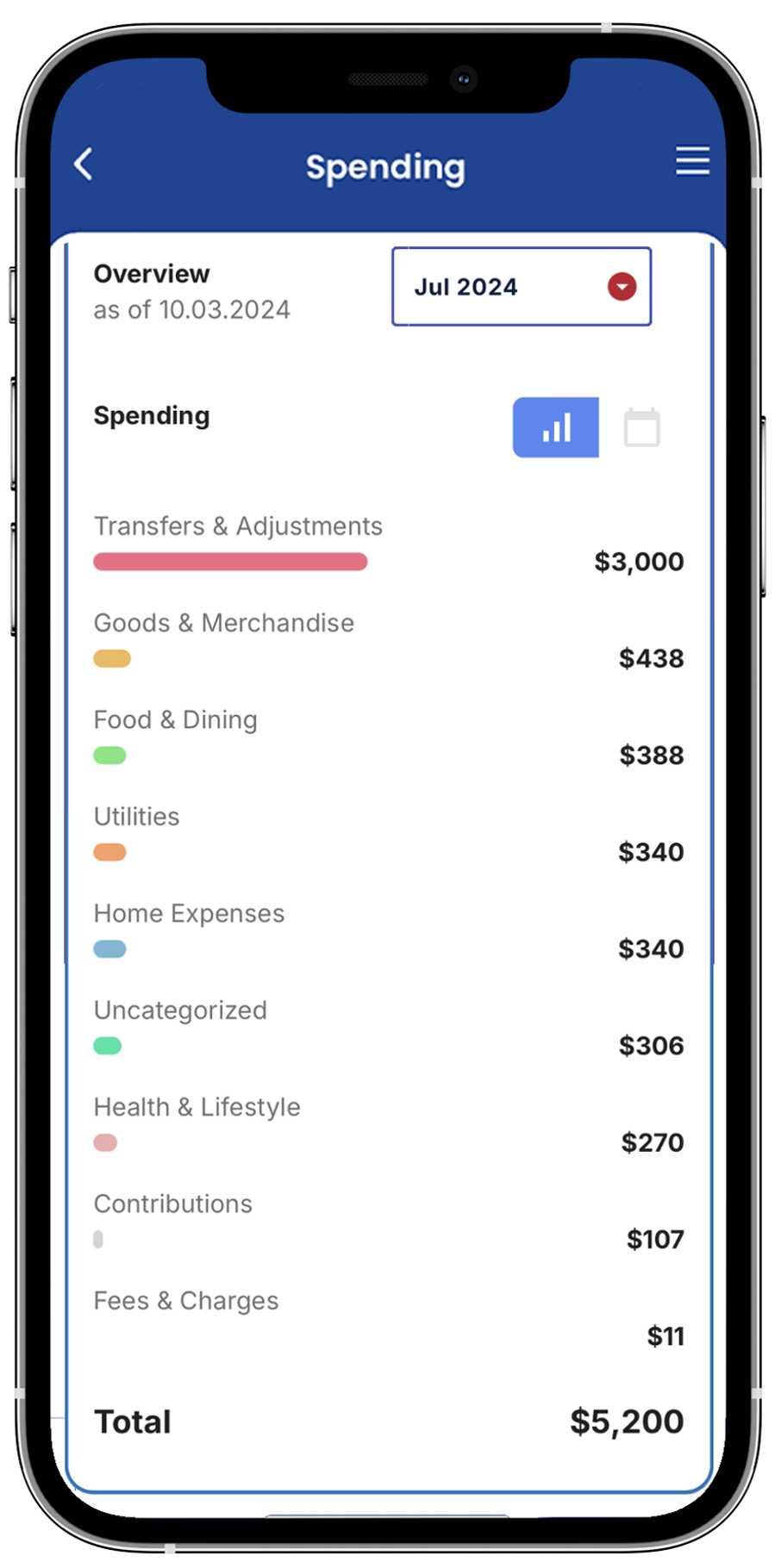

Consumer-permissioned data and proprietary analytics drive FinLocker to deliver personalized financial journeys that help consumers overcome financial challenges to achieve and sustain homeownership, enabling financial institutions to efficiently manage their customer pipeline and provide seamless borrowing experiences that create customers for life.

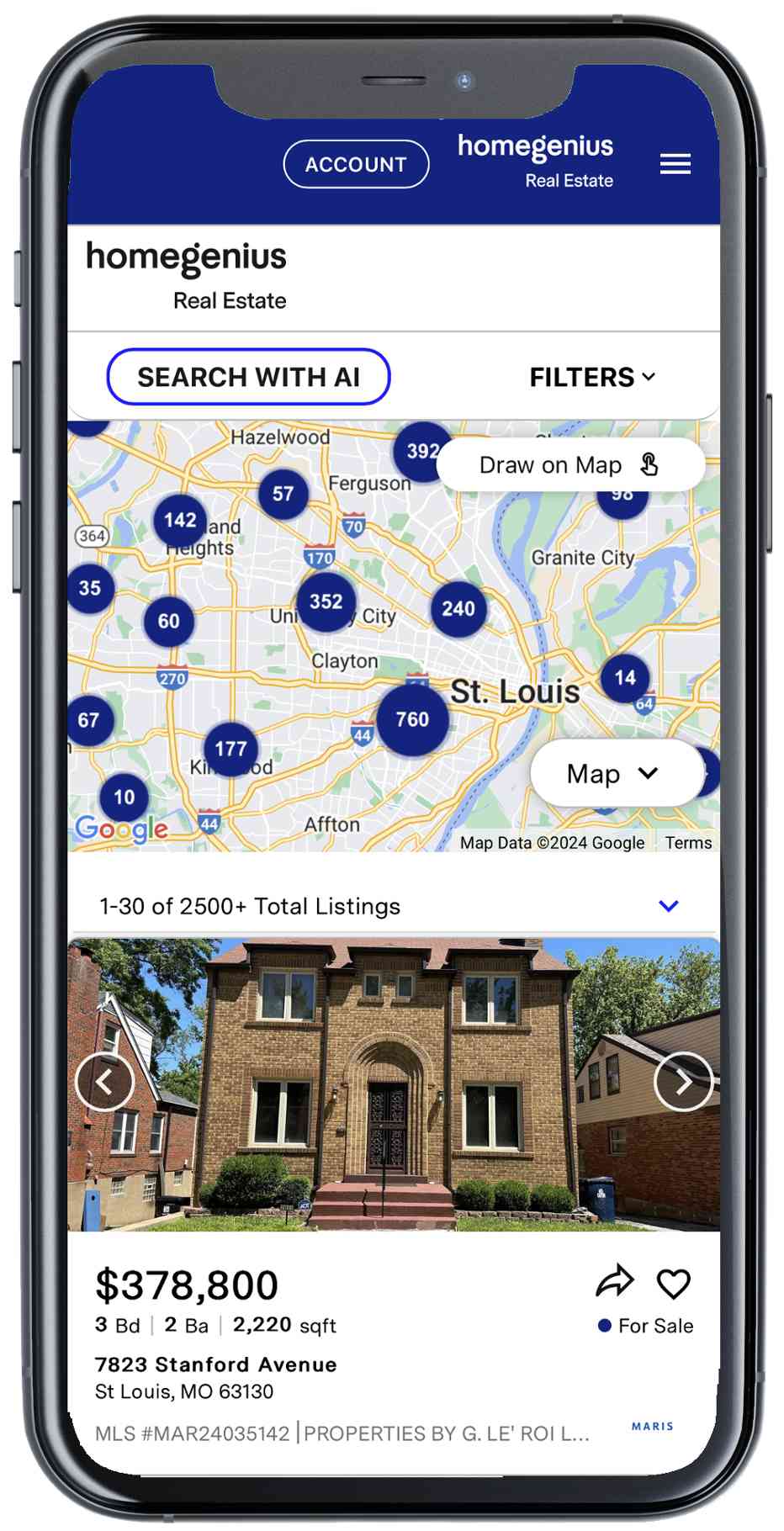

Mortgage lenders and loan originators use FinLocker to attract new customers and nurture homebuyers toward mortgage readiness.

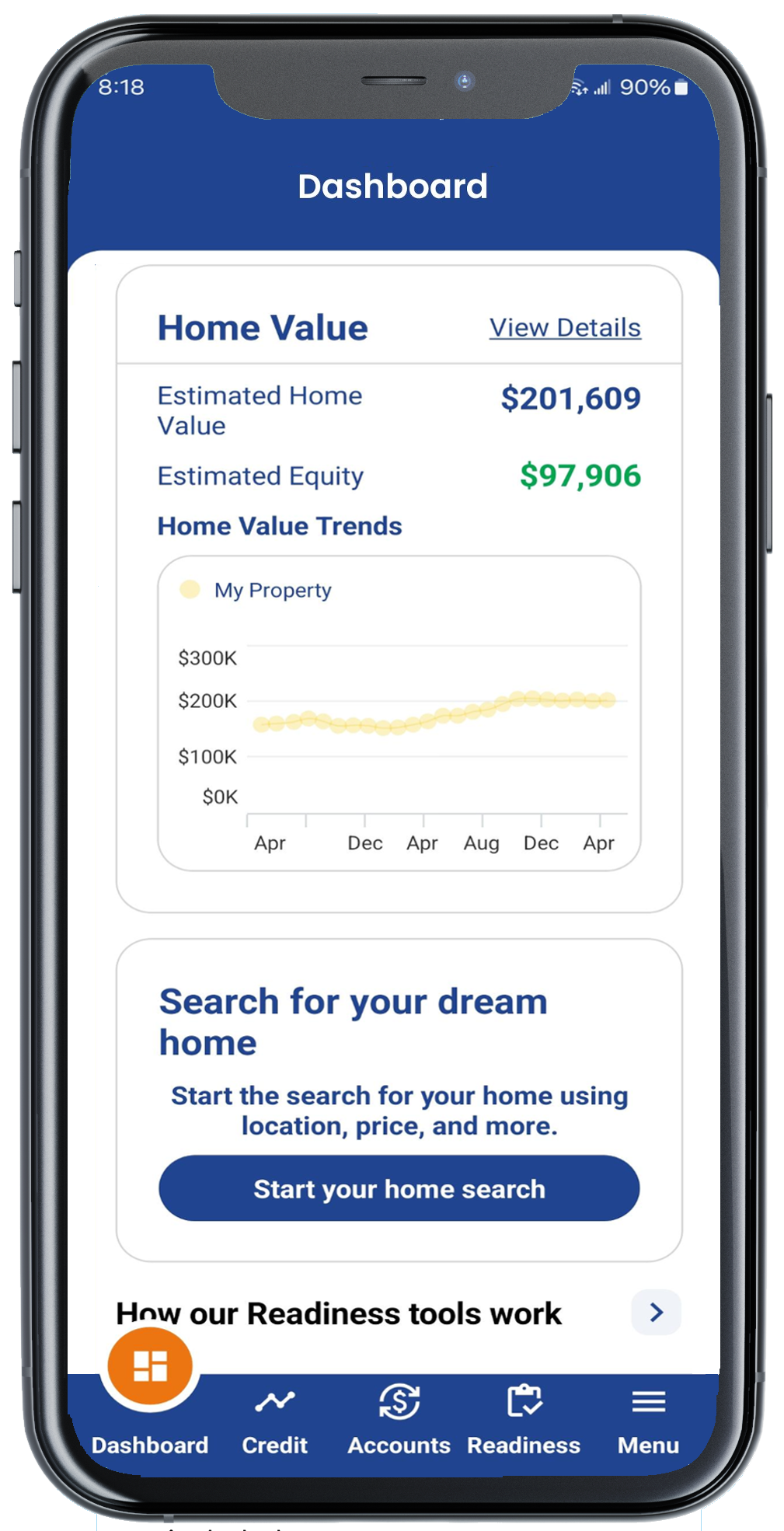

Mortgage lenders and servicers use FinLocker to retain and recapture homeowners, creating customers for life.

Credit unions and banks use FinLocker to attract new members, improve their financial fitness and help them to achieve homeownership.

FinLocker compliments the advice credit and housing counselors provide to clients repairing credit and improving their financial health.

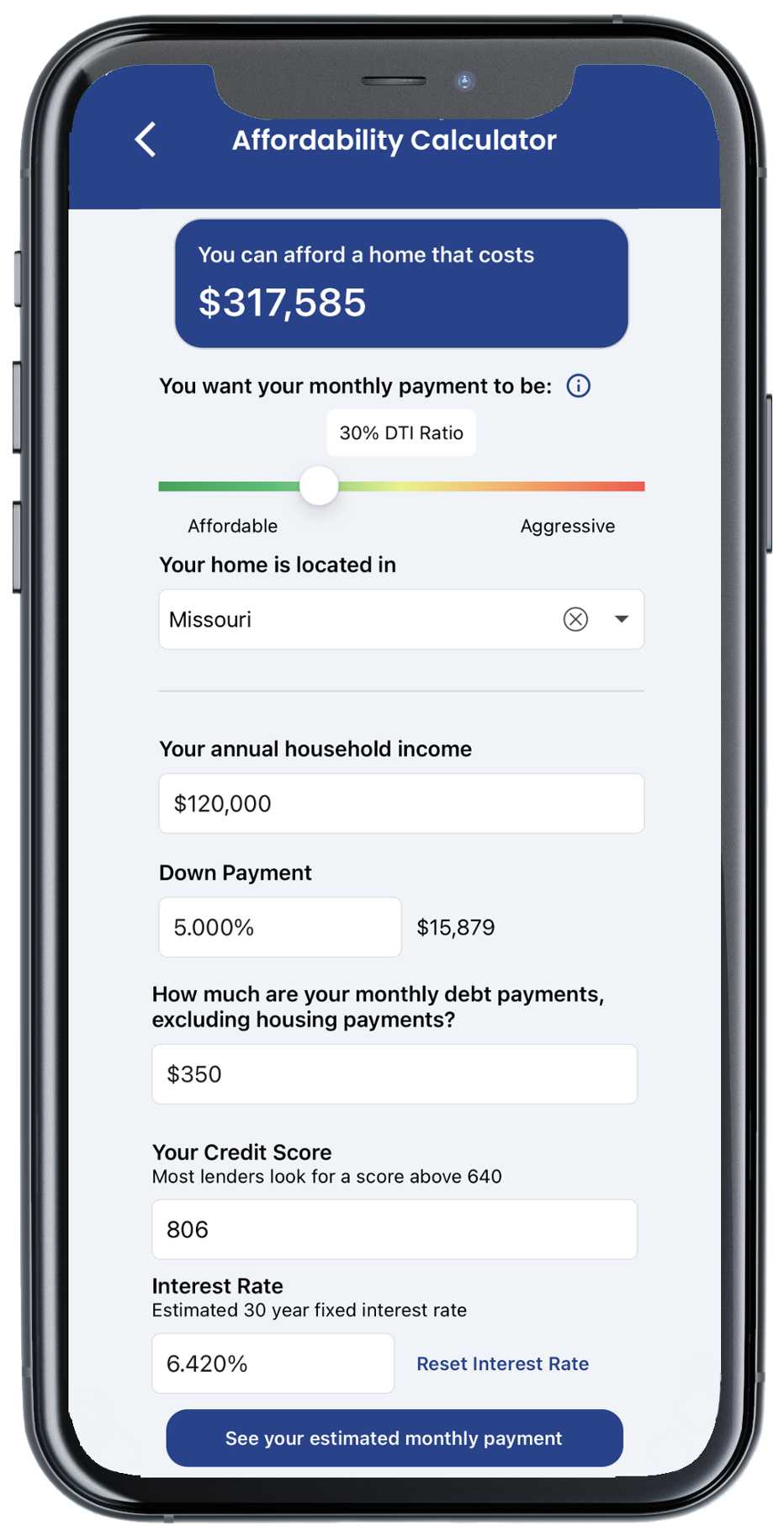

FinLocker is the All-in-One App to Achieve Financial Fitness and Mortgage Readiness

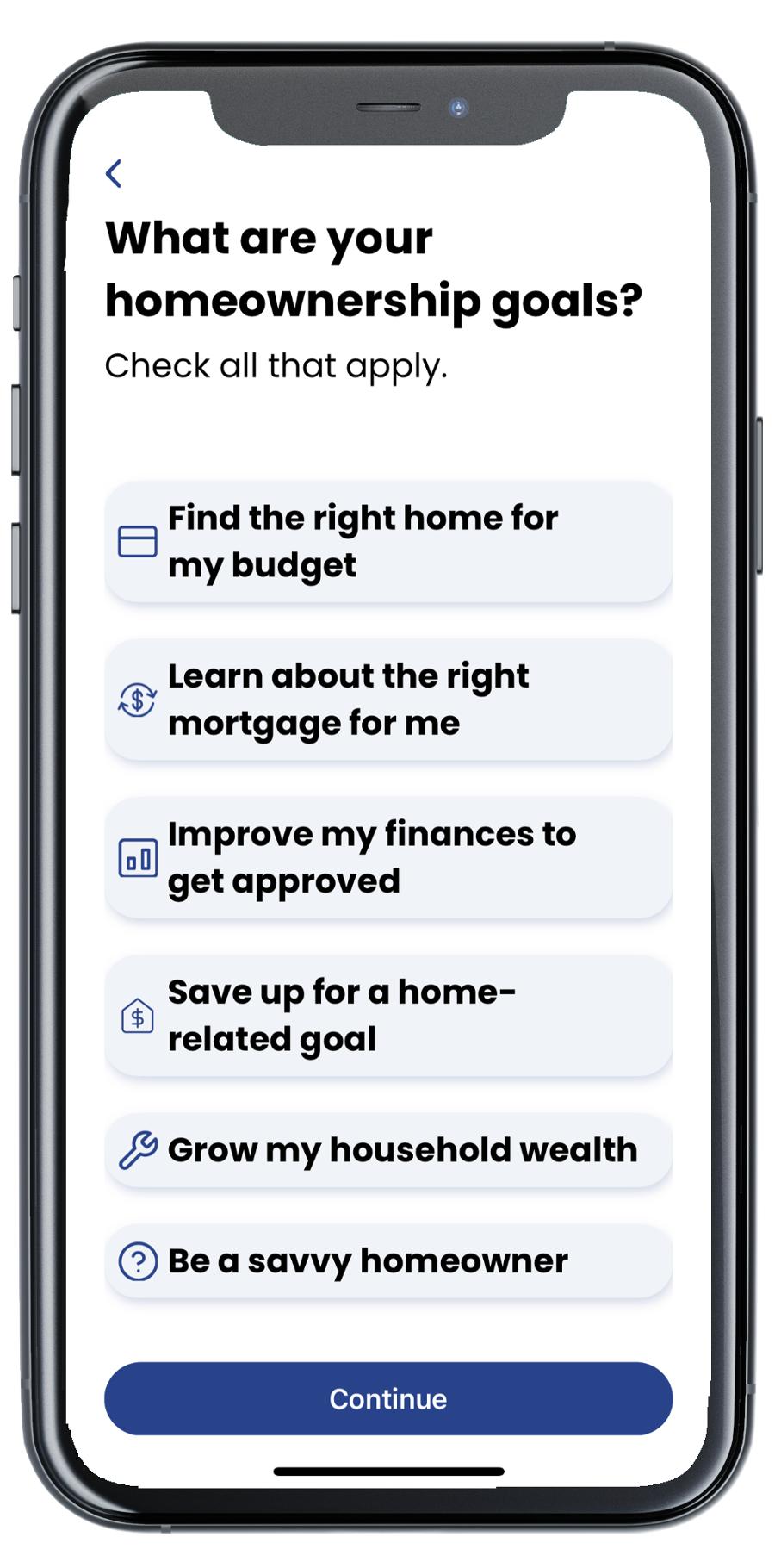

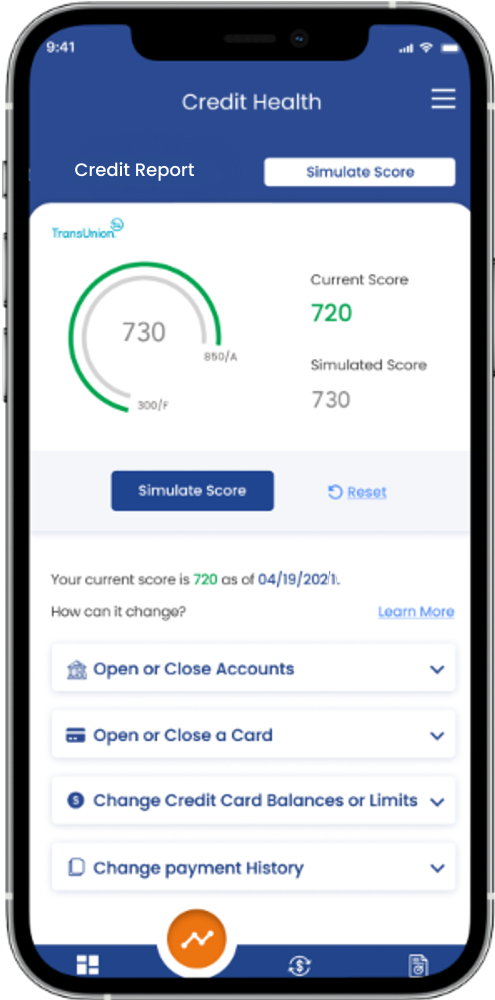

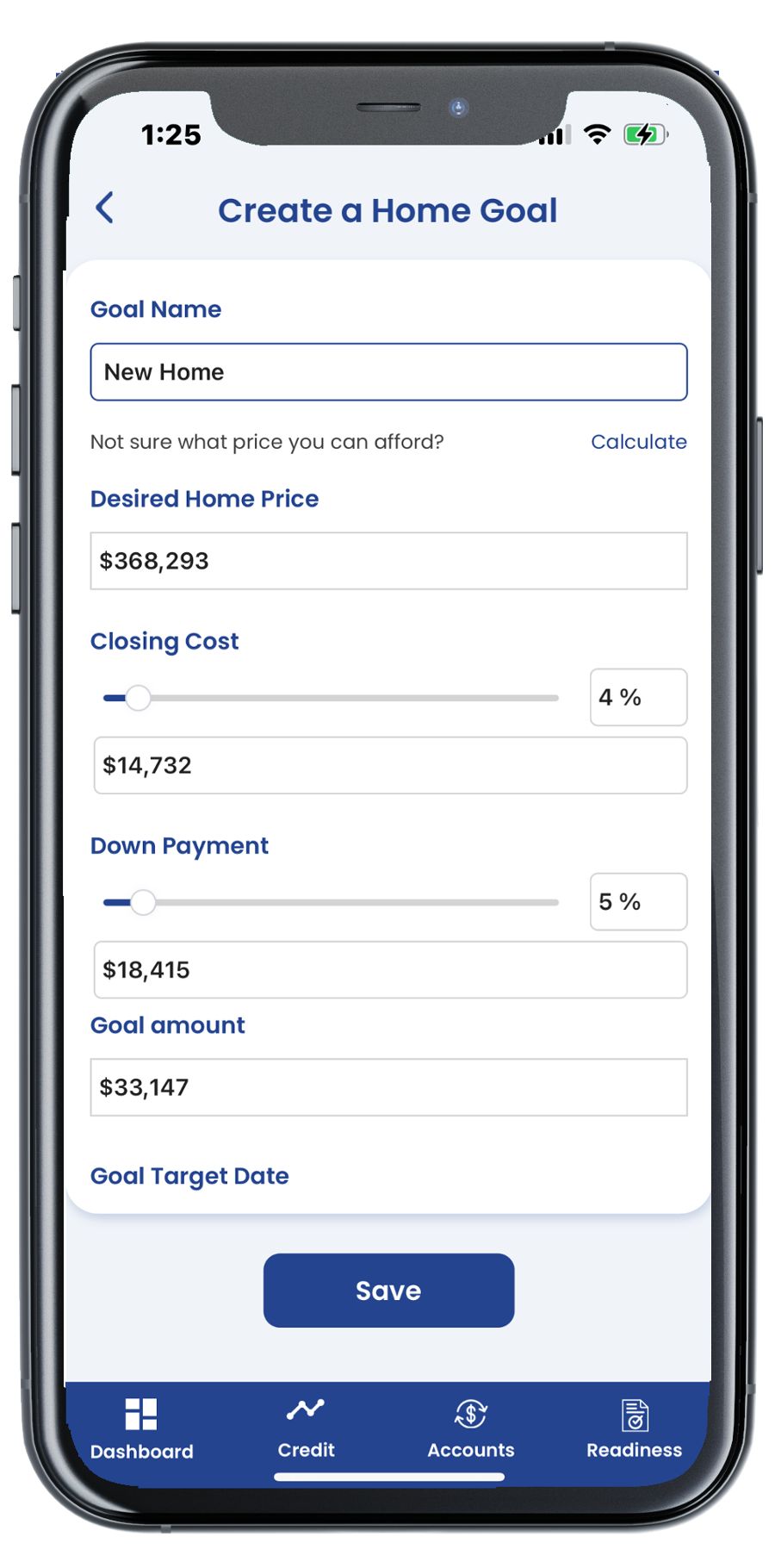

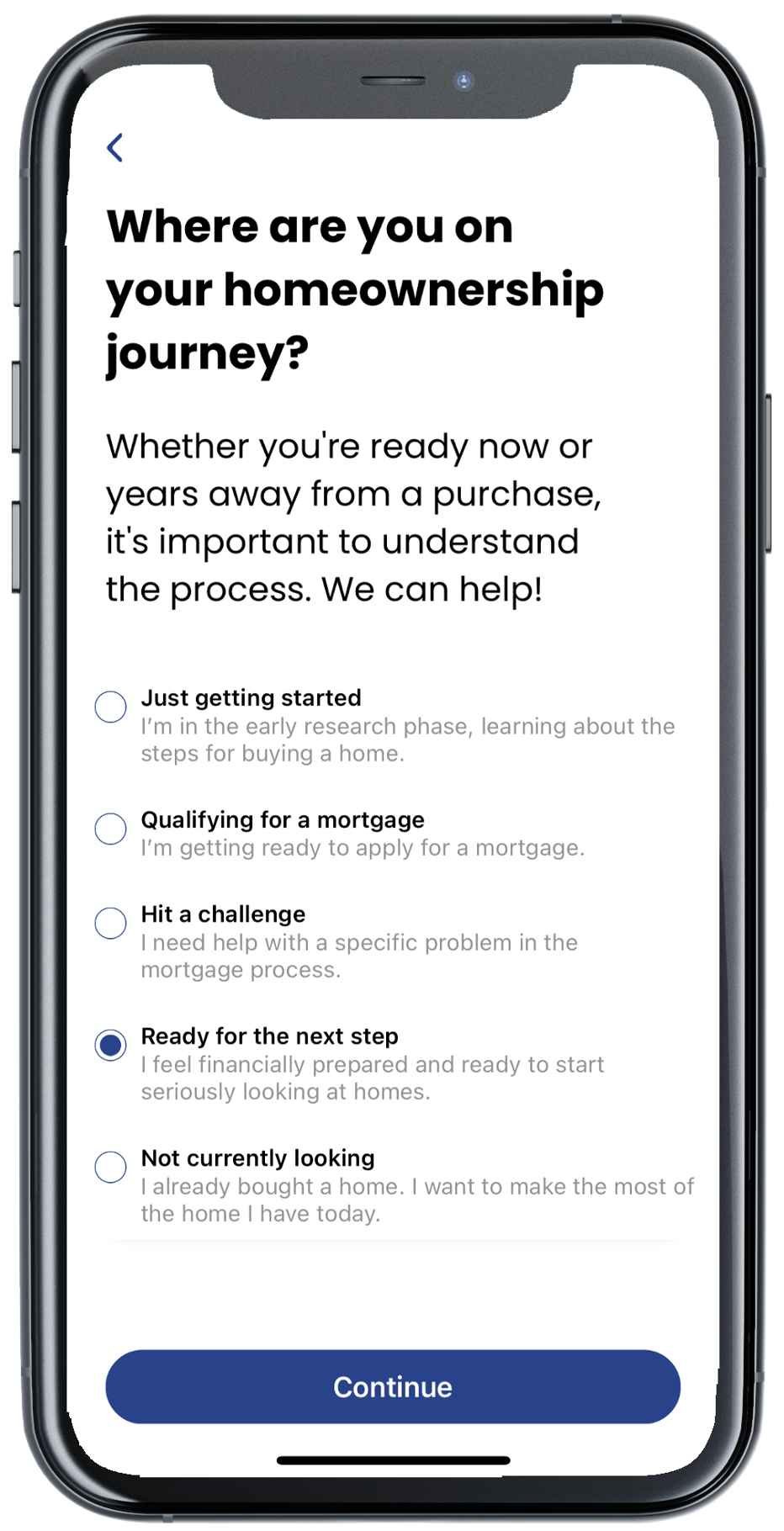

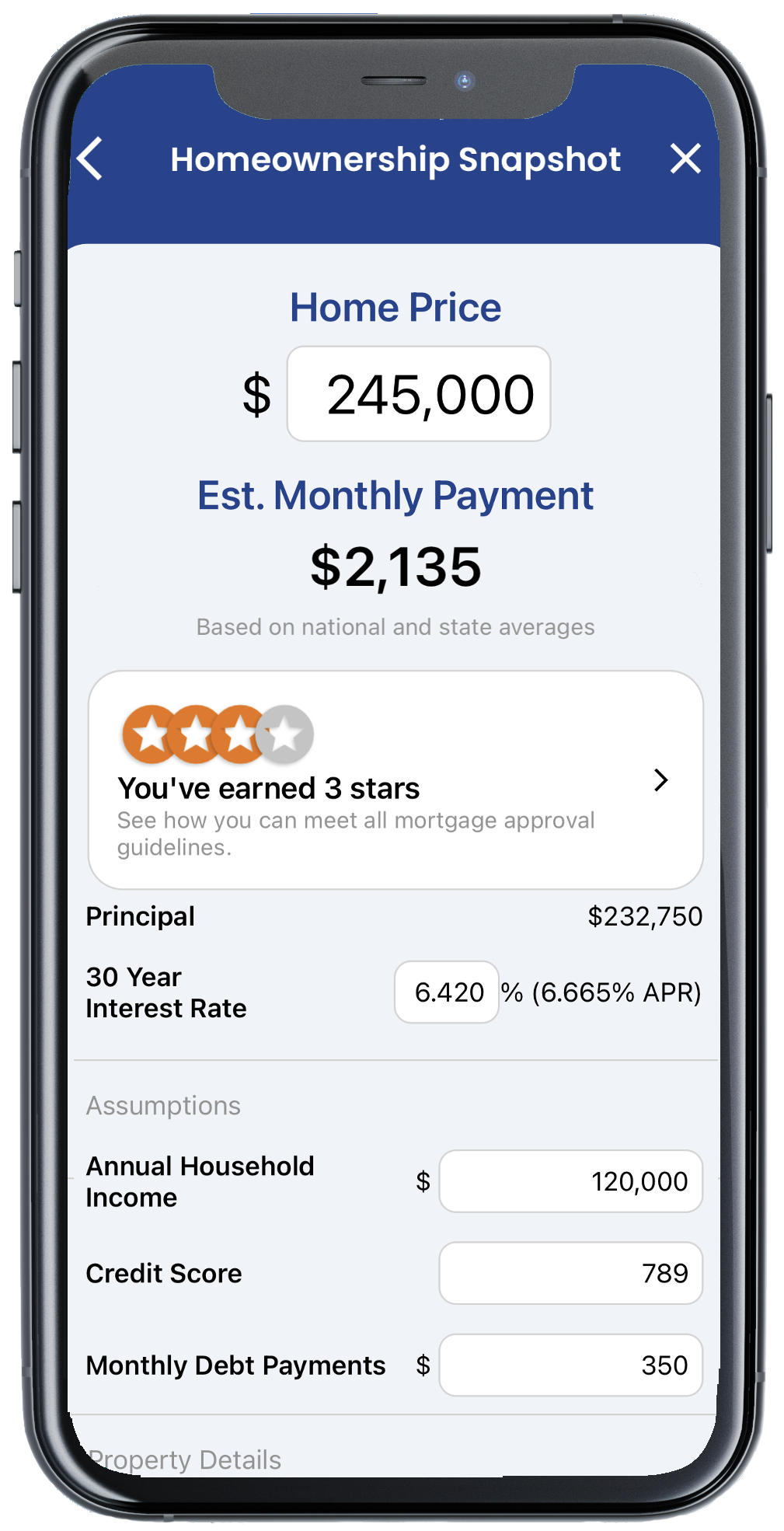

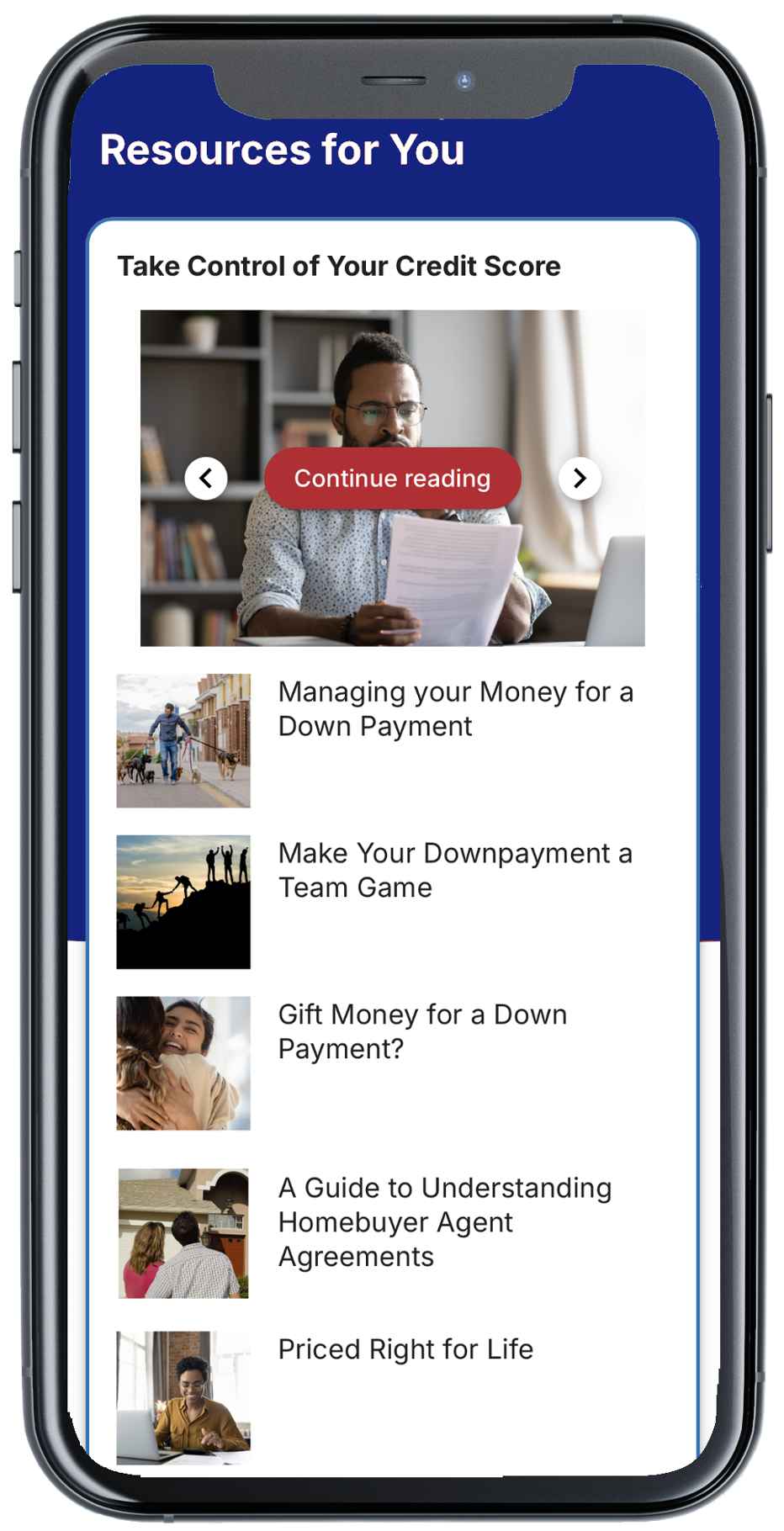

Whether your customers want to purchase a home in the next few months or are years away from purchasing, FinLocker can help improve their financial fitness and understanding of the homebuying process. FinLocker provides tools and resources to help all users build and maintain their credit, manage their finances, budget, and save to achieve their financial goals. Homebuyers and homeowners can access additional tools and receive personalized action plan to qualify for a mortgage and sustain homeownership.

A personal path to achieve homeownership

FinLocker Partners

Companies That Trust FinLocker

FinLocker is Recognized by

FinLocker Creates Customers for Life

Create deeply engaging customer relationships that reflect your company’s brand and value proposition with your private-labeled FinLocker.

Questions? Check out our FAQs or Contact Us.