Homeownership stands as a cornerstone of financial stability and wealth accumulation for most Americans. Yet, for Black Americans, it remains an enduring challenge. The Federal Reserve Bank of St Louis reported in Q4 2023 that the homeownership rate of Black households was 45.9%, a rate that has been consistent since 2010, significantly trailing behind the 73.8% rate for white households. These figures underscore persistent disparities in access to credit, wealth, and economic opportunities.

Despite these challenges, Black renters have a strong desire for homeownership, with 86% expressing the intention to own a home, according to the Fannie Mae Q3 2022 National Housing Survey. To bridge this gap and foster financial stability, mortgage lenders, banks, and credit unions should focus on financial education strategies tailored to the unique challenges faced by Black Americans in their homeownership journey.

Key areas for action to increase black homeownership

1. Expand access to affordable credit

Current Situation: Black Americans often face challenges in building their credit profile, resulting in lower credit scores that limit access to affordable home financing. A Consumer Financial Protection Bureau report revealed that the median credit score for Black homebuyers was 691, compared to 750 for White homebuyers, 764 for Asian homebuyers, and 716 for Hispanic homebuyers in 2022.

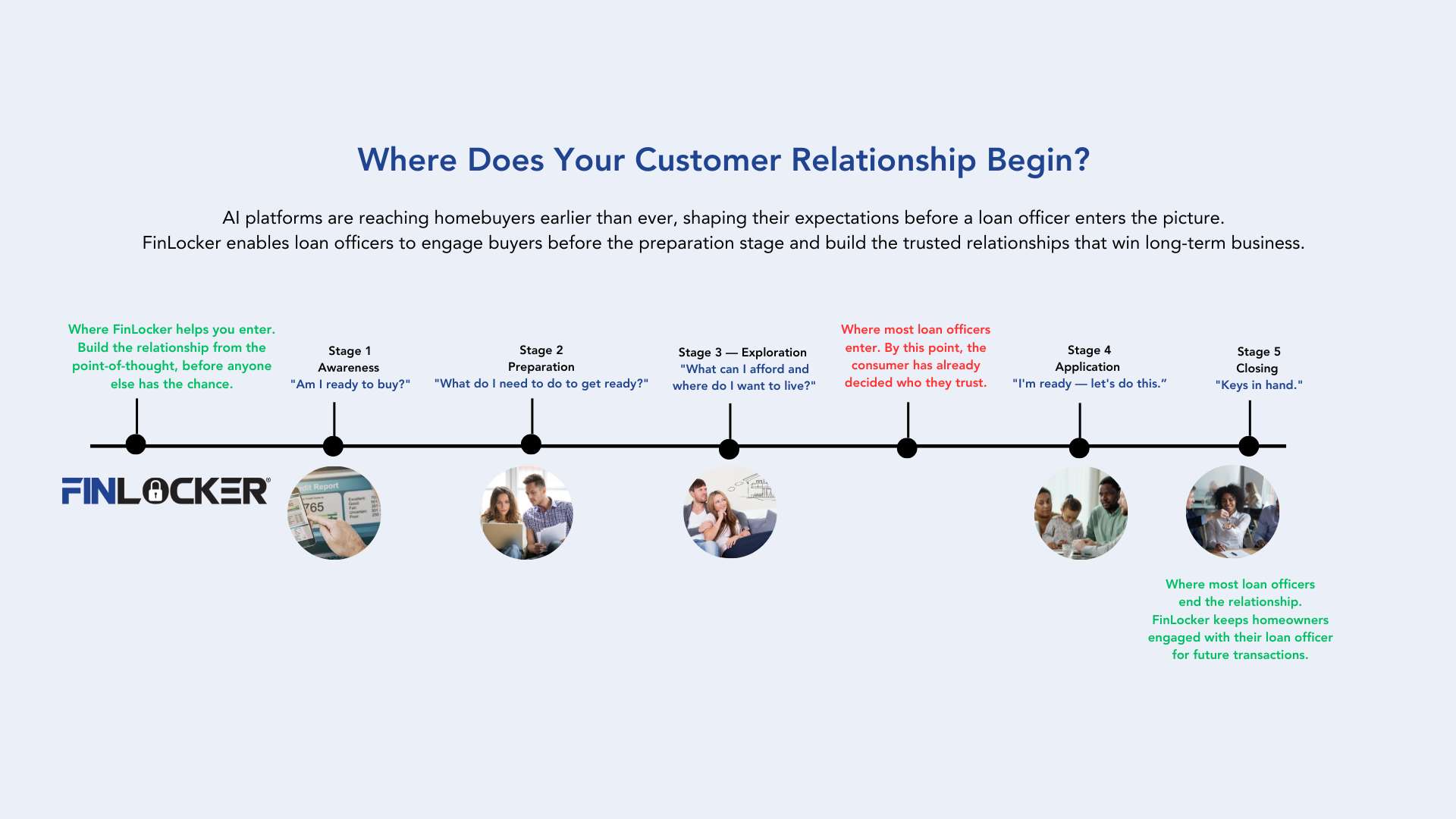

Action Strategy: Introduce financial fitness tools early in the homeownership journey. Platforms like FinLocker empower homebuyers to obtain their credit scores, monitor their credit reports, access educational resources, and improve credit health. Partner with services like eCredable to enable renters to report their on-time payments to their utility accounts to their TransUnion credit report, facilitating credit score improvement without accumulating additional debt.

Further Insight: A CitiGroup report determined that “improving access to housing credit might add an additional 770,000 Black homeowners, adding up to $218 billion in sales and expenditures.”

2. Reduce high levels of student loan debt

Current Situation: Student loan debt remains a significant barrier to homeownership. Student loans delayed saving for a down payment or home purchase for 25% of all homebuyers in 2023, according to the National Association of Realtors®, and this was when student loan repayments were paused!

Yet, student loan debt disproportionally affects Black borrowers, with 46% of Black student borrowers being the most likely to put off buying a home because of student loan debt. The lower incomes many Black Americans earn also make it difficult to pay back their student loans and start saving to achieve other lifestyle milestones.

Action Strategy: Advocating for student loan debt forgiveness could immediately increase the wealth of Black Americans by up to 40%, enabling them to pursue homeownership.

Partner with services like LoanSense to understand how different mortgage loan programs calculate student loan payments for credit underwriting purposes. They can also identify federal loan programs and government subsidies to reduce student loan payments and increase homebuyers’ purchasing power. For every $450 per month in student loan payments, home purchasing power is reduced by $50,000. To see how reducing student loan payments can increase a consumer’s home budget, use the free LoanSense Purchasing Power Tool.

Further Insight: Data from the National Center for Education Statistics highlights that Black college graduates carry an average student loan debt of $52,000, 25% more than their white counterparts. Four years after graduation, Black students owe an average of 188% more than white students borrowed. In the same period, 83% of white students owed 12% less than they borrowed.

3. Overcome income and wealth disparity by improving financial literacy

Current Situation: Disparities in median household income pose challenges for Black Americans in affording and sustaining homeownership. In 2022, the median household income for Black households ($52,860) was substantially lower than for Asians ($108,700), White ($77,250), and Hispanic ($62,800), according to the U.S. Census Bureau. This disparity makes it more difficult for Black Americans to afford to buy and maintain a home and accumulate generational wealth. Addressing the wage gap could unlock up to $2.7 trillion in income, according to CitiGroup.

Action Strategy: Promote financial education and tools to enhance credit, manage finances, and overcome financial challenges. Support first-generation Black homebuyers by providing information on first-time home buyer and down payment assistance programs.

Further Insight: Closing the racial wealth gap is a complex challenge, but strengthening financial literacy is crucial to improving financial health and achieving homeownership.

4. Build partnerships with community organizations

Current Situation: Collaboration with community organizations is essential to understanding and addressing the unique needs and challenges of Black Americans on their path to homeownership.

Action Strategy: Partner with state and regional housing counseling organizations, Black-owned business organizations, and organizations serving Black renters in your communities. These partnerships can facilitate tailored solutions and support community-specific initiatives. The United Way has at least one branch in every U.S. state, and the Mortgage Bankers Association has a Building Generational Wealth Through Homeownership policy initiative.

5. Identify future black homeowners

Current Situation: Identifying eligible consumers and providing targeted support can enhance the effectiveness of marketing and lending initiatives.

Action Strategy: Identify eligible consumers by utilizing solutions like TransUnion’s Low-to-Moderate Prescreen Solution. Provide digital tools like FinLocker to empower consumers with financial challenges to build their credit and make informed decisions on spending and saving their income, enabling them to qualify for mortgages.

By adopting these comprehensive strategies, mortgage lenders, banks, and credit unions can actively contribute to breaking down barriers to homeownership for Black Americans, fostering a more inclusive and equitable housing market. The resulting increase in homeownership will not only benefit individual families but also contribute to building stronger, more stable communities and fostering long-term economic growth for all. To explore how FinLocker can support your company in these initiatives, schedule a 1:1 consultation today.