As the COVID-19 pandemic wears on, putting jobs at risk if the economy slows, approximately 1.86 million homeowners remain in forbearance, with 65% of active plans set to expire by the end of 2021. With 750,000 of these active forbearance plans due to expire by the end of October, loan servicers will need to process up to 18,000 plans per business day over those two months, according to Black Knight’s Mortgage Monitor Report.

Recently, the CFPB published a report detailing 16 large mortgage servicers’ COVID-19 pandemic response. One of the major concerns to the CFPB was borrowers exiting forbearance and becoming delinquent without any loss mitigation process in place. Another concern is that some delinquent borrowers have not applied for any hardship assistance from their mortgage servicer either through lack of education about the process or out of concern that entering into a forbearance plan will put them at risk of losing their home rather than provide protection.

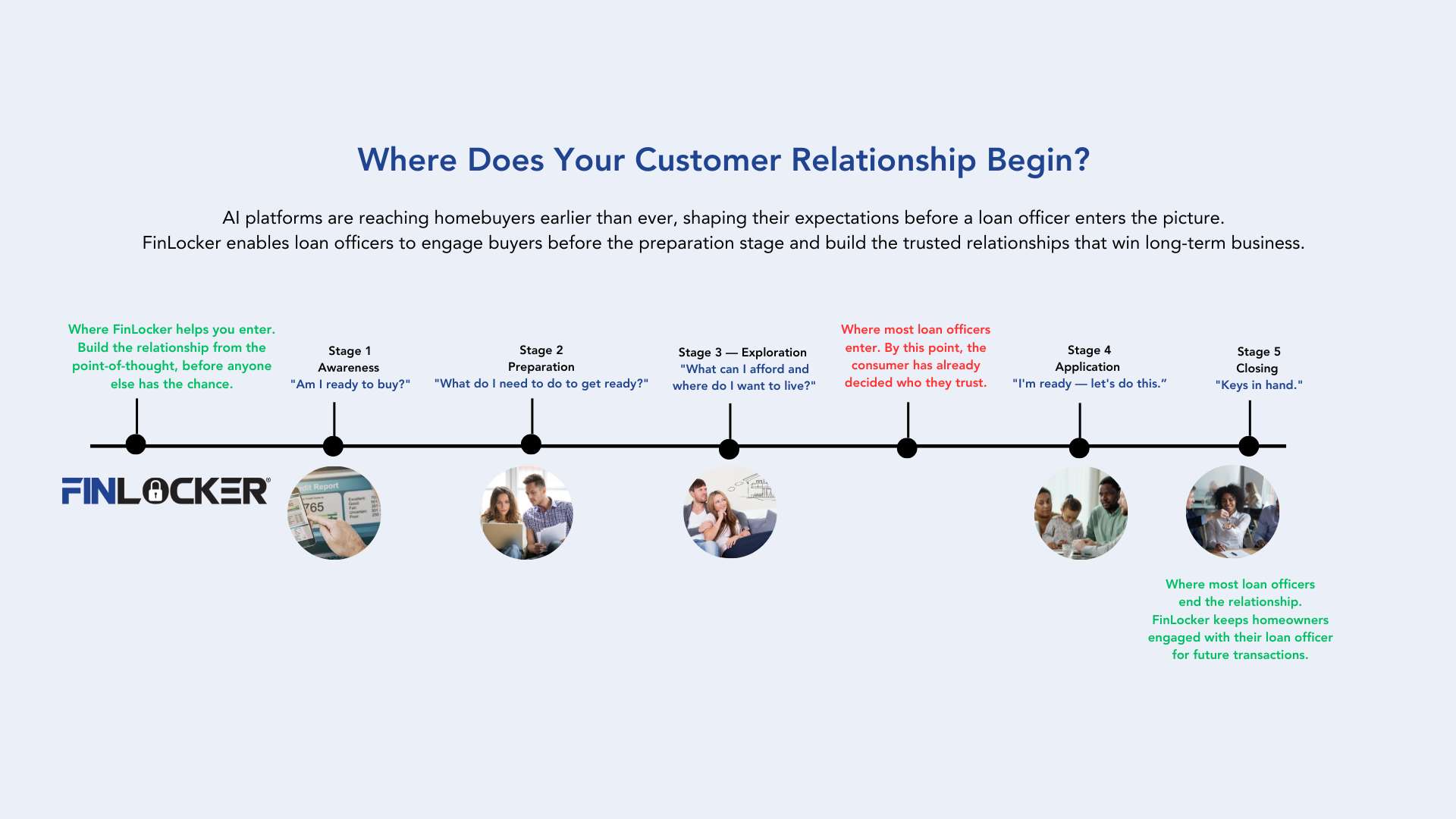

Whether or not your company services loans, if you are an originator who stays connected with your borrowers beyond the closing table, there is assistance you can provide to homeowners suffering financial hardship to educate them on the types of resources and assistance programs available.

- The CFPB maintains a useful mortgage and housing assistance page for homeowners consolidating the latest information from several housing-related government agencies. Homeowners to learn about forbearance options and resources for additional assistance.

- Borrowers with Fannie Mae loans can learn about forbearance plans and other kinds of mortgage assistance.

- The VA and USDA both have resource guides, with the latter providing resources beyond homeownership in English and Spanish.

FinLocker can benefit provide both mortgage servicers and homeowners experiencing financial hardship. Homeowners have access to educational resources and tools to plan scenarios for their forbearance exit strategy so they can approach their servicer with confidence. Homeowners can use the other FinLocker tools to receive real-time visibility of all their financial accounts, learn to budget, and save to get back on track with their mortgage payments. Homeowners can also monitor their credit score, credit report, and payment history. Under the CARES Act, lenders are required to report accounts in forbearance as current in certain situations. Using FinLocker, your borrowers will be notified when their credit score increases or decreases, or an alert is added to their credit report.

See how FinLocker can help you borrowers while reducing your loss mitigation here, then schedule a demo.