Brian Vieaux has 30 years of experience in bank lending and mortgage, covering business strategy, business development, sales and marketing, compliance, quality control, and risk management. In building business channels within both large and medium-sized companies, Brian has gained significant experience in all areas of management, including sales production management, human resources, administration, operations, risk management, and training and development. Prior to joining FinLocker in 2019 as the company’s President and Chief Operating Officer, Brian was SVP Third Party Originations, Wholesale & Correspondent Lending at Flagstar Bank, SVP at Aurora Bank, SVP at Indymac Bank, and National Sales Director at CitiMortgage. Brian began his mortgage banking career in 1991 with Source One Mortgage Services Corporation. An alumnus of Michigan State University, Brian is a former Mortgage Bankers Association’s Residential Board of Governors member and was co-chair of the MBA’s Wholesale Executive Forum. In 2005, he attained the Mortgage Bankers Association industry designation of Certified Mortgage Banker (CMB).

What are some of the perks of a financial fitness platform? How does FinLocker guide clients with their mortgages?

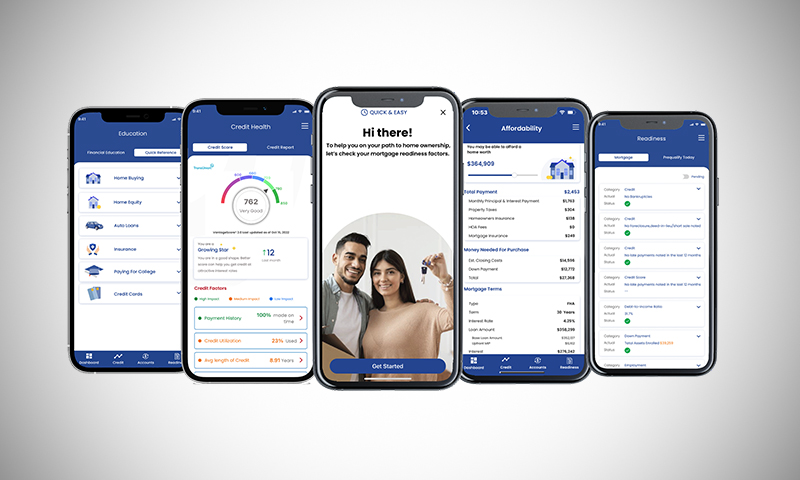

Similar to other financial fitness platforms available to consumers, FinLocker provides credit-building, budgeting, goal-setting, and money-management tools to help them achieve their financial goals. FinLocker is unique because it offers additional tools and resources to help homebuyers overcome the common barriers of mortgage eligibility – low credit score, poor credit history, high debt-to-income ratio, and insufficient savings for their down payment and closing costs. The tools are driven by proprietary digital technology that perpetually analyzes their consumer-permissioned financial data in the platform to show them what they need to do to become eligible for a mortgage. The platform then guides homebuyers with personalized journeys to achieve mortgage readiness.

FinLocker enables mortgage lenders, banks, and credit unions to spread financial fitness to prospective homebuyers much earlier in their homeownership journey. Our clients can private-label their FinLocker and give their branded app to their consumers to enable the platform to nurture their consumers toward mortgage readiness, freeing mortgage originators to focus on providing personalized service to mortgage-ready consumers. The app has additional tools that provide homeowners with their home equity and value. Homeowners can continue to use their lender’s branded app to monitor their credit and manage their finances to sustain homeownership.

How do you spread financial awareness among people?

Financial education is often not taught in schools and colleges in the United States. Students are graduating with student loan debt without the skills to budget their paychecks to pay bills and living expenses while saving money to achieve future financial milestones, such as buying a car or obtaining a mortgage.

FinLocker provides educational resources that supplement the financial tools to address this imbalance. Additionally, the mortgage process is often intimidating to many first-time homebuyers. FinLocker removes the mystique by explaining the mortgage process and introducing the terms and jargon they’ll be hearing along the way.

Many people worldwide continue to have easily transitioned into using online banking, Google Pay, and the like. As a veteran in the field of FinTech, do you think that soon paper currency will be obsolete?

We don’t believe that paper currency will become obsolete. There are still low-to-moderate income, underbanked and unbanked segments in society who rely on paper currency.

According to a recent report from the Board of Governors of the Federal Reserve System, 81% of adult Americans are fully banked, 13% are underbanked, and 6% are unbanked. Despite the prevalence of online banking and payment apps, the percentage of unbanked Americans has only dropped by 1.75% in 6 years. However, whenever you drill down into these surveys, adults with less than a high school degree, Black Americans, and Hispanics are disproportionally unbanked and underbanked.

Until financial education is taught at all grade levels in U.S. schools, these consumers won’t learn the benefits of banking and responsibly using credit, so they will continue to live in a cash-based society, unable to access core banking services and the opportunities to build credit to qualify for a car loan or mortgage.

Do you like working in the FinTech industry? if yes, how did you realise your love for FinTech?

I love it! FinTech is a fast-paced and ever-evolving industry. I observed various FinTechcompanies and products during my 28 years in mortgage origination. What attracted me to move to FinLocker was to be part of a solution to spread financial fitness among all consumers within an industry with whom I still have many contacts.

When it comes to home buying, what advice would you give a first-time buyer?

A first-time buyer can begin to self-determine if they can qualify for a mortgage by first reviewing their credit score and credit report. If they have been paying bills on time, have not maxed out their credit cards, and have a good credit score, they should qualify based on their credit health. Next, they should research the cost of homes in their preferred neighborhoods so they can input an average sales price into an online mortgage calculator. The calculator will help them to determine the amount they will need for their down payment and closing costs and if they can afford the monthly mortgage payment. Before they begin touring homes, they should meet with a mortgage loan officer to learn about eligibility requirements for mortgage and down payment programs. When they get pre-qualified, the loan officer will inform them of the current interest rate that they can qualify to receive. Of course, if a first-time buyer connects with a mortgage lender who provides FinLocker, this process will be much easier.

Undeniably, we live in a capitalistic world today. What is something you swear by when it comes to making money? Or, what’s the best way to save and invest?

I’m not a gambler or an active investor, so I’ve found success in my life by aligning my work, which is where I make my money, with things I’m passionate about. Many successful start-ups have a passionate founder or leader. I recommend aligning your passion with your work so it won’t feel like work, and the passion will drive your energy to your job, which should equate to your ability to earn more.

Please share one of the highlights of your FinTech professional career.

I’m still relatively early in my fintech career. Among the highlights is learning and understanding how fintech can help improve people’s lives, like financial literacy, financial fitness, and preparing for a home purchase.

Being the COO of FinLocker, what strategies do you use to keep employees motivated?

Our strategy is around transparency, trying to remove siloed thinking and be more communicative and collaborative. However, it starts with the recruiting process; be mindful of hiring new team members who align and share your passion for the company’s mission.

How is FinLocker different from other financial institutions/companies? What would you say is your company’s USP?

FinLocker offers the next generation in customer relationship-based performance marketing to empower mortgage originators, lenders, servicers, banks, and credit unions, to provide personalized financial solutions and experiences for their customers.

FinLocker has partnered with Fannie Mae, TransUnion, Microsoft, and consumer housing advocacy groups to help all first-time homebuyers on their journey to achieve homeownership. FinLocker is Day 1 Certainty approved by Fannie Mae for direct source asset verification and has partnered with Argyle for employment and income verification.

Financial institutions can private-label their instance of FinLocker with their brand, so their consumers can stay within the platform for their entire homeownership journey. The consumer really doesn’t need to use another app on the market. FinLocker provides all the essential tools to build and monitor their credit health, manage their financial accounts, budget and save for their down payment and pay down debt. It has a home affordability calculator, online property search, and a secure way to transfer their financial data and documents to their mortgage loan officer when they are ready to apply for a mortgage.

FinLocker provides a unique USP for each business category. For example, the platform enables mortgage lenders and originators to connect with homebuyers at the top of the sales funnel and provides a high-tech, high-touch solution to manage a larger pipeline of homebuyers and recover homebuyers initially turned down for a mortgage. The tools in the FinLocker platform prepare homebuyers for a mortgage and homeownership and enable them to initiate a mortgage application directly from the app with their lender once they have achieved mortgage readiness. This service contributes to an increased lead to loan rate for mortgage lenders and originators.

Once homebuyers become homeowners, they continue to use their sponsoring mortgage lender’s or mortgage servicer’s private-labeled FinLocker to monitor their credit, manage their finances, and monitor their home equity and net worth. FinLocker provides a valuable engagement platform that enables financial institutions to create customers for life and cross-sell additional financial products via the app.

How do you plan to drive growth within your company? What’s next for FinLocker?

FinLocker is a B2B2C platform, so scaling happens in two ways. The first way to scale is to increase the number of users of the FinLocker platform by adding more businesses that will distribute the FinLocker platform to their consumers. We have a robust pipeline within the mortgage vertical, specifically large mortgage lenders who are in the implementation stage with our product and will begin distributing their private-labeled FinLocker to their customers and prospects over the next 90 days. Onboarding these businesses will significantly ramp up our user base in terms of consumers using the FinLocker platform.

Secondly, we look at the FinLocker app as a holistic consumer financial experience, so we’re continually reviewing how to add tools and features into the app to solve consumer problems, which also adds value to a lender providing the app to their consumers. So while we focus today on mortgages, we’re looking at other areas to help solve problems. As I mentioned in response to an earlier question, millions of consumers who are either unbanked or underbanked need help to create a credit profile or expand their credit profile to improve their credit score. That’s not just a mortgage use case. That broadly applies to consumers to benefit them for related financial services like buying auto and home insurance that are somewhat priced based on a consumer’s credit score. We want to empower borrowers to use their own financial data to achieve financial fitness and readiness so they can present themselves to their lender with their identity, credit, assets, employment, and income verified inside their app.

This interview first appeared in Digital First magazine on November 2, 2022.