Many first-time homebuyers aren’t waiting around for the homebuyer grants. They’re jumping off the fence and landing with two feet to hit the ground running in their quest to buy a home. According to a recent report from the National Association of Home Builders, of the 16% of American adults considering a future home purchase in the first quarter of 2021, 63% have moved beyond planning and are actively trying to find a home to buy, up from the comparable 49% share a year earlier. This increase marks the fifth consecutive year-over-year gain in the share of prospective buyers who have become active buyers.

Nationwide, homebuyers are facing stiff competition to buy a home. Higher prices are reducing their purchasing power, despite low interest rates. First-time buyers seeking a starter home priced 25% or more below the local-area median saw prices jump 15.1% during the past year, compared with the overall 11.3% gain in the national CoreLogic index.

Millennials are the most likely generation to have moved on from just planning a home purchase to actively searching for a home to buy: 73% of this generation’s prospective buyers were already active buyers in Q1 2021, up from 54% a year earlier. Hot on their tails is Gen Z buyers, with 53% becoming active buyers in Q1 2021.

A high proportion of first-time homebuyers have student loan debt, which reduces their ability to save for a down payment and closing costs and often affects their debt-to-income ratio.

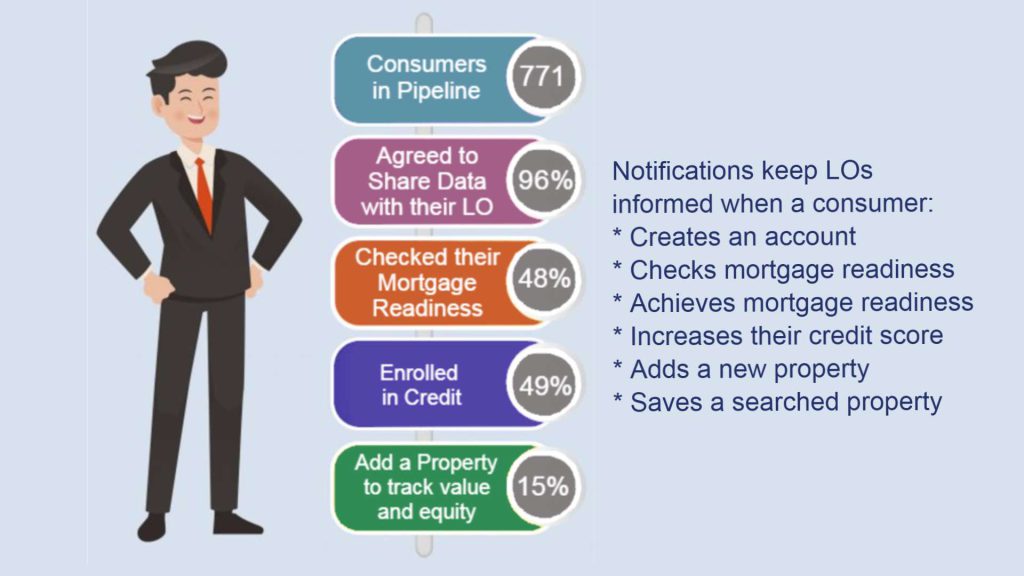

First-time homebuyers can improve their eligibility criteria for better mortgage terms with a higher credit score and down payment. FinLocker provides a full suite of tools to groom homebuyers for the mortgage process, save for their down payment and costs to close, pay down and manage their debt, and increase their credit score.

Homebuyers can save their financial documents and share them directly from their FinLocker app with their originator for a pre-qualification and mortgage loan application. As 64% of homebuyers actively engaged in the purchase process have spent three months or longer looking for a home, the FinLocker app also streamlines the process for originators to reissue pre-qualification or pre-approval letters if they have a lengthy house hunt.