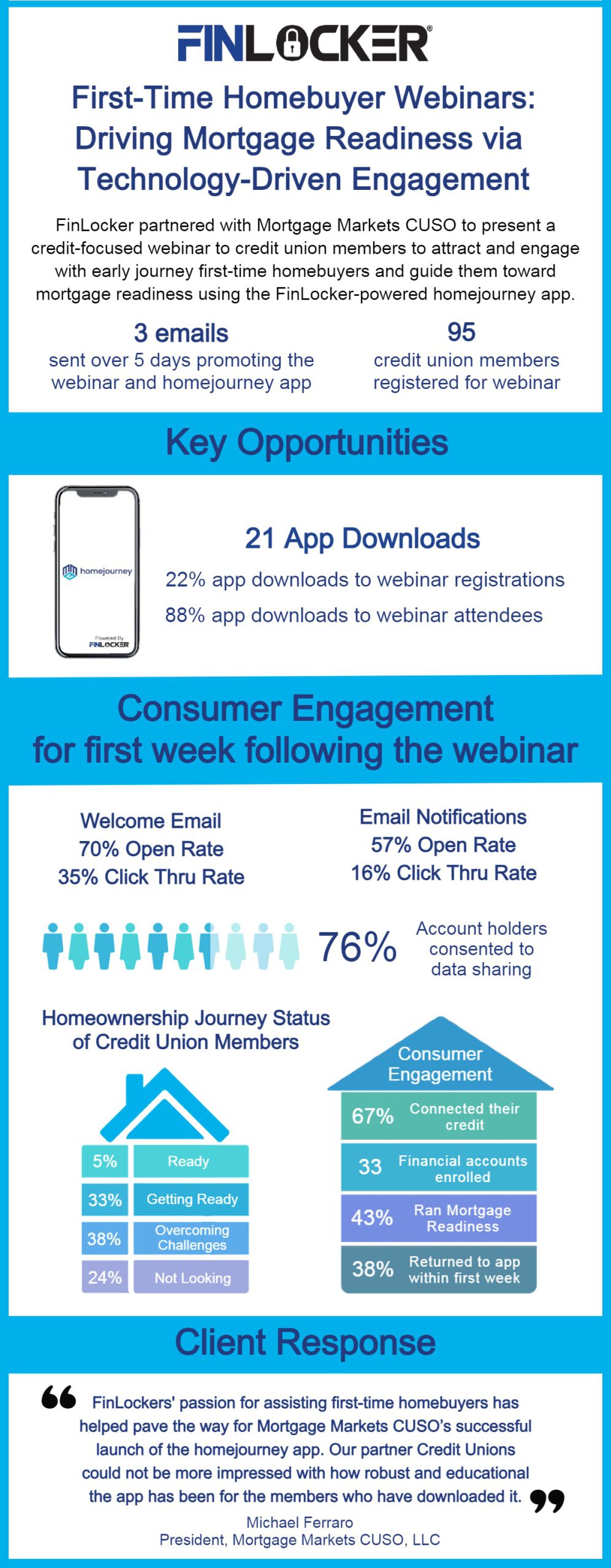

In December 2023, Mortgage Markets CUSO partnered with FinLocker to present a credit-focused webinar hosted by credit expert Sue Buswell, founder of SueKnowsTheScore, to identify credit union members who are prospective homebuyers and advise them on how to build and monitor their credit health in preparation for a mortgage.

The webinar not only informed prospective homebuyers with invaluable insights, it also served as an opportunity to distribute Mortgage Markets CUSO’s homejourney app, powered by FinLocker, to provide prospective homebuyers with a technology-driven engagement tool to achieve mortgage readiness.

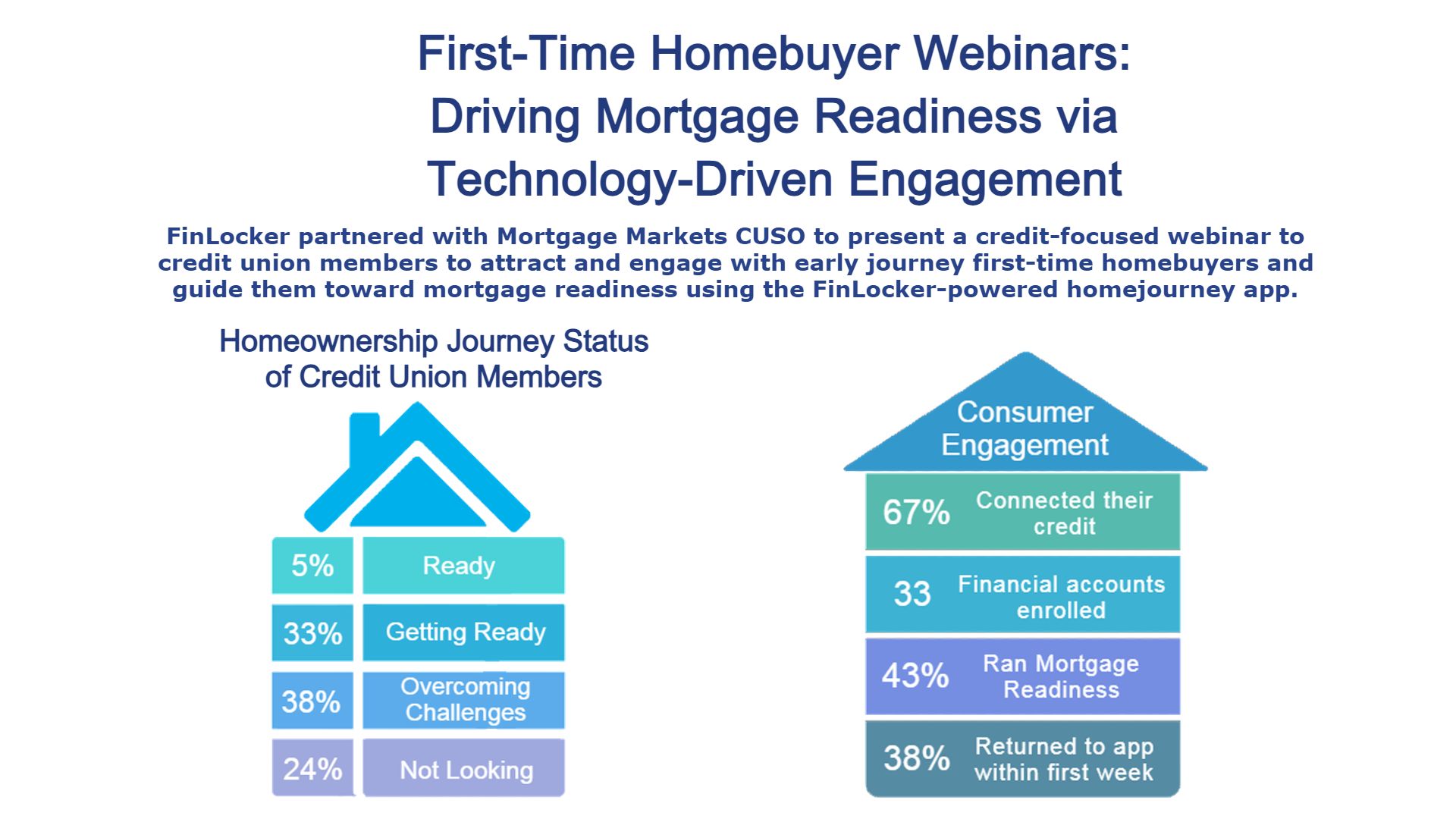

However, the partnership didn’t just end with the webinar. As credit union members actively engaged with their homejourney app to monitor and improve their credit, efficiently manage their financial accounts, and save for their down payment, their homeownership-focused financial fitness tool provided each member with a personalized action plan to overcome financial challenges, steering each customer through their unique homeownership journey.

Loan officers found themselves in an advantageous position, as the homejourney app kept the prospective homebuyers engaged with the credit union while providing the loan officers with analytics informing them of the homeownership journey status of their customers and notifications when customers’ credit scores improved and went over the mortgage eligibility threshold. They could also see when customers were actively engaged by re-running their mortgage readiness and improving their eligibility factors.

This collaboration between FinLocker, Mortgage Markets CUSO, and Sue Buswell didn’t just enhance engagement; it redefined how prospective homebuyers get mortgage-ready. By seamlessly integrating technology-driven solutions with expert-led webinars, they empowered individuals, providing them with the necessary tools, knowledge, and support to achieve their dream of homeownership.