Goal

What’s A Mortgage sought to create a mobile financial well-being app that would cater to consumers at various stages of their homeownership journey. The app had to appeal to renters who could be a few years from buying a home and help prospective homebuyers get mortgage ready while also being useful to homeowners.

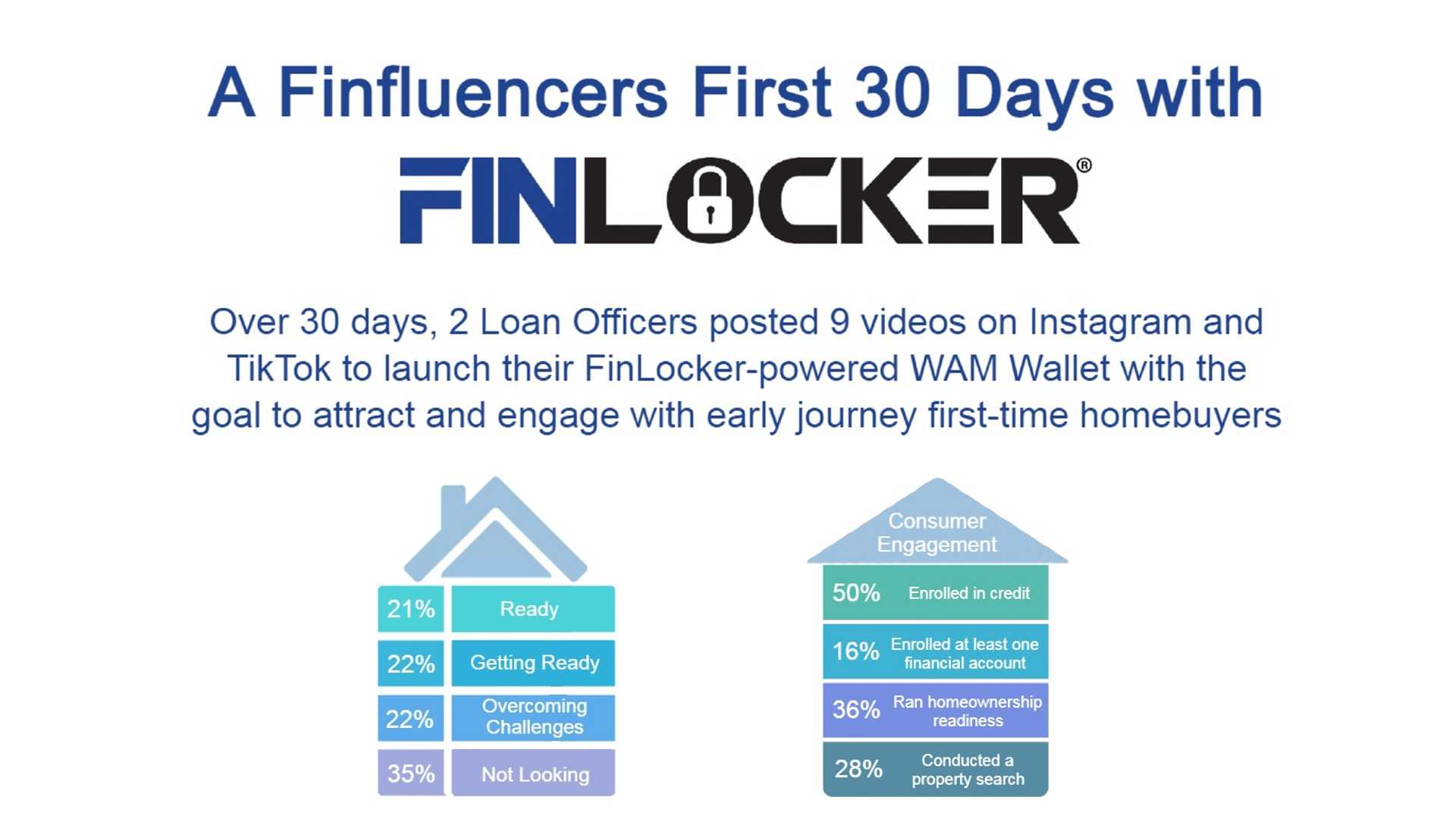

Having an outgoing brand image with tech and social media-savvy mortgage originators and marketing team, What’s A Mortgage decided to private-label their FinLocker financial fitness and homeownership app as the WAM Wallet. The goal was to attract early-journey first-time homebuyers who rely on social media platforms like Instagram and TikTok to learn about personal finance and home buying.

Approach

Launch Strategy:

On May 4, 2023, the WAM Wallet was introduced through a series of short videos posted on Instagram and TikTok by two influential mortgage originators, Minh Nguyen and Jide Buckley. Leveraging their substantial following on both platforms, they showcased mortgage-related topics and explained how the WAM Wallet could assist first-time homebuyers in preparing for a mortgage and managing their loans effectively.

Feature Overview:

In the initial phase, each mortgage originator created an introductory video that highlighted the key features of the WAM Wallet. They emphasized how the app could benefit early journey homebuyers, offering a comprehensive overview of the app’s functionalities and how it can help them to achieve their financial goals, including homeownership.

whatsmortgage – Instagram

whatsamortgage – TikTok

themortgagekitchen – Instagram

Budgeting and Debt Management:

To help potential homebuyers prepare for a mortgage, the mortgage originators created content focused on budgeting and paying down debt. They specifically showcased the credit simulator feature within the WAM Wallet, illustrating how it could assist users in improving their credit scores and managing their debt more effectively. The videos demonstrated how the app’s tools and resources could support users in achieving financial stability and becoming eligible for favorable mortgage terms.

whatsamortgage – Instagram

whatamortgage – TikTok

mortgagekitchen – TikTok

Two weeks after their initial launch, analytics in their FinLocker Admin portal showed a significant number of account holders identified as being mortgage ready or homeowners. What’s A Mortgage decided to demonstrate the use of the WAM Wallet for these personas.

Home Valuation Assistance:

Minh Nguyen demonstrated how to check the value of a home using the WAM Wallet. He showcased the app’s functionality, enabling users to easily access property valuations and make informed decisions during the homebuying process. By providing valuable insights and tools, the WAM Wallet positioned itself as an indispensable resource for prospective homebuyers. Homeowners could see that the app provided them with the tools to easily monitor their property value and equity.

whatsamortgage – Instagram

whatsamortgage – TikTok

PMI Removal Guidance:

Additionally, Jide Buckley addressed the topic of removing Private Mortgage Insurance (PMI) through an informative video. He utilized the WAM Wallet to demonstrate the step-by-step process and benefits of eliminating PMI from a loan, emphasizing how the app simplifies the journey for users by providing relevant information and resources.

themortgagekitchen – Instagram

Results

Through their strategic use of social media platforms and the engaging content Minh Nguyen and Jide Buckley created, What’s A Mortgage successfully launched the WAM Wallet. The videos gained significant traction, generating interest and creating a buzz within the target audiences. They also attracted the attention of many admiring real estate agents and loan officers, building their referral network and opportunities for recruitment.

By showcasing the app’s features and highlighting its value in helping users prepare for homeownership, manage their finances, and make informed decisions, the WAM Wallet established itself as a trusted tool for the mortgage industry.

Utilizing the FinLocker Admin portal, What’s A Mortgage identified that 21% of the account holders are mortgage-ready, 22% are getting ready for a mortgage, and 22% are overcoming challenges. As 86% of account holders agreed to share their data with What’s A Mortgage, the loan officers and admins can see customers whose credit qualifies them for a mortgage, enabling them to recommend low down payment products to customers who would like to buy a home sooner.

Those not looking can use their WAM Wallet to manage their finances and monitor their credit, keeping What’s A Mortgage top of mind when they are ready for home financing. FinLocker placed each account holder on personalized journies to guide each customer towards mortgage readiness. Customers can also monitor their progress by running the homeownership readiness snapshot in their WAM Wallet and be provided with an action plan with additional guidance.

Moving forward, What’s A Mortgage is committed to empowering more consumers on their homeownership journey using the WAM Wallet and utilizing the personalized journeys provided by FinLocker to manage the larger pipeline that does the heavy lifting of nurturing their homebuyers with valuable financial tools and resources.

If you’re ready to build your business, please contact the FinLocker Customer Success team to discover how you can leverage your own private-labeled FinLocker-powered financial fitness app to expand your customer database, manage a larger pipeline and provide an exceptional homebuying experience to your customers.