Advice for Managing Loans and Debt

Throughout August, FinTalk contributors are providing advice to share with first-time homebuyers to better manage their loans and debt, so they’ll be credit healthy when they are ready to buy a home.

Sue Buswell, Credit and Score Consultant #sueknowsthescore

Dustin Owen, Founder and Host of The Loan Officer Podcast

Scott Schang, CEO of Find My Way Home

Brian Vieaux, President & COO of FinLocker

Ally Carty, National Account Executive with ActiveComply #get2knowgenz

Catalina Kaiyoorawongs, CEO & Co-Founder of LoanSense

Rob Chrane, CEO & Founder of Down Payment Resource

Dan Smokoska, Founder of Loangendary Marketing

Jeremy Potter, Strategist and Advisor

Mike Faraci, CEO & Founder, Red Button Media

Sue Buswell, Credit and Score Consultant #sueknowsthescore

Scott Schang, CEO of Find My Way Home

FinTalk Content

Advice for Building Credit History with a Credit Card

Sue Buswell, Credit and Score Consultant #sueknowsthescore

Buyers today want to understand not just how to qualify for this loan, but for the refinance, sale and purchase of their next home. You are their guide into the home buying process, and that includes helping them understand how to maximize and manage their credit.

Most know the importance of paying bills on time, and keeping your balance to limit low on revolving debt.

But there are other equally important parts to the FICO score, and those can often be overlooked.

15% of our current mortgage score is length of credit history, and unlike adjusting a balance on a credit card via rescore, you cannot easily add history to a borrower.

Time after time I’ve had conversations with borrowers and lenders who are trying to find a way to increase a score. There are no late payments. There are no balance to limit issues. Oftentimes the borrower either has a thin file, or they had accounts with history, and stopped using them.

That is why early financial education for home buyers is so important. You cannot create a length of credit history as easily as paying down a credit card, and it can often be the difference in a good vs great score.

This happened several years ago, but the story and the solution holds true today.

A borrower was in the process of a construction loan and opened a new credit card. New debt during a mortgage transaction is bad enough, but he then transferred 3 other balances to that card. It was a zero percent interest offer for 2 years. Would help with his budgeting he explained. Unfortunately, it also dropped his score.

How?

When his lender repulled credit in anticipation of the loan closing, the new lower score reflected a factor of ‘length of time accounts have been established.’ Factors or reason codes are the explanation of a score issue. In this case, he did not have recently reported established pay history on his credit report, which is a higher risk factor.

His thousands in upgrades, his new home and his future were in jeopardy.

The 3 cards he transferred to the new account held his history. They were over 5 years old, with the oldest having 10 years of history. He had not utilized these cards in over 4 months, and his closing was 60 days away.

When you stop using your cards, they ‘age’ and unlike wine, not in a good way.

The solution? I advised his Lender to have him fill his gas tank with 1 card, take his wife to dinner on card 2 and buy her flowers on card 3.

These changes are not permitted via rescore so the Lender had to wait until the items were reporting the updated activity, and 45 days later, just 15 days prior to closing they were able to pull a new credit report with a now qualifying score.

Paying our bills on time and managing our debt to limit ratio is important, but when we overlook the other factors that make up our scores, it can be the difference in approval vs denial.

Good Credit Is Easy…Once You Understand It

Dustin Owen, Founder and Host of The Loan Officer Podcast

They don’t teach credit education in most schools, although they should. Whether or not a person has a good credit rating or a poor rating has a major impact as it pertains to getting ahead in life financially. On the lighter side, a person with good credit would expect a discount on auto insurance, a lower rate on their mortgage or even the ability to have utilities turn on at their new place without the requirement of a security deposit. On the harsher side, a person with poor credit may miss out on a career opportunity, won’t qualify for the business loan they desperately desire or could be denied financing for the greatest wealth building purchase, a house.

Here are five easy steps to making sure you have the best credit rating possible:

1 – Have credit. Having three active and open credit tradelines (think credit card, auto loan and student loan) with 12+ months of payment history reporting is key. The more years one has established credit the better the chances are they will have good credit.

2 – Pay your bills on-time. All the time. Without fail. Although this sounds basic, many fail in this department. Look to set up automatic payments if you are the type to be absent minded.

3 – Never, ever charge more than 50% of the max limit on a credit card. For example, if your Target card has a max limit of $500, do not charge more than $249. This applies even if you plan to pay the debt off when the bill comes due. Having a high balance to limit ratio will prevent achieving the highest credit rating even if you have never missed a payment.

4 – Be vigilant with checking your mail and actually reading what is sent to your home. Many times, we as consumers end up owing the cable company money for a box we did not return or have an outstanding bill due to our doctor for the amount not covered by our health insurance provider. When this happens, these unpaid charges end up as collections which are huge minuses when it comes to having good credit. Funds owed to cell phone providers and previous landlords are also common culprits to collection charges.

5 – Forward your mail. Each time you move, be sure to update your mailing address. The collections mentioned above are largely avoidable if only the person who owes the money actually received the notice. (Similar advice applies to email addresses. Make sure you are checking old email accounts, have your old accounts forwarded to your new account and/or you update all of your consumer accounts to reflect your best email address.)

That’s it. Do not over complicate things. Have credit; just not too much. Use it; just not too much. Make your payment on time, all the time. And forever be on the lookout for money you may owe a third party that either you forgot about or just were not aware had to be paid by yourself.

Help Your Past Clients Make Sense of Confusing Student Loan Headlines

Scott Schang, CEO of Find My Way Home

The reality of the restart of student loan payments in October still hasn’t hit the mortgage world, but it has hit the online news cycle.

There are many moving parts around the restart of student loan payments, and the news headlines are not doing consumers any favors. Clickbait abounds, and consumers are being peppered with news about forgiveness, reporting pauses, and consolidation options.

Here are the top 5 things you need to know to combat misinformation online.

1. SAVE Plan Good News – The good news is that this makes income-based payment options more accessible and lower for most consumers.

2. SAVE Plan Bad News – The bad news is that there is a 12-month “moratorium” on credit reporting if consumers do not make their payments. Just because it’s not being reported as delinquent doesn’t mean it isn’t delinquent. A simple payment verification request will stop your loan in its tracks.

3. Student Loan Forgiveness – The past couple of weeks have been dominated by headlines about 800,000 student loans being forgiven. Eligible borrowers were notified in late July. The problem is that this number represents 1.6% of all outstanding student loans. To be eligible, you must have made 20 years of payments and have less than $10,000 left as a balance. This is a drop in the ocean. Most do not and will not qualify for forgiveness under this move.

4. Private Loan Consolidation – It seems like every person in America is currently getting spam emails touting the benefits of private student loan consolidation. Even NerdWallet is advertising private student loan consolidation! Here’s the problem. Once you do a private consolidation, you are no longer eligible for income-based repayment options or loan forgiveness. You cannot return to a federal student loan program once you consolidate into a private loan.

5. Private Loan Nightmare – True Story: Borrower worked as a psychologist for the County. Has a $300,000 student loan balance. Chose private consolidation and now has a $4,000 monthly payment. An income-based payment would have been $1,800, AND they were eligible for PSLF forgiveness in 3 years.

Cash Out Refinance Opportunities

In my next article, I will arm you with everything you need to get in front of this story and convert this confusion into conversations about getting student loan payments and, quite frankly, all of your past client’s monthly expenses under control.

Yes, a cash-out refinance will make sense for some of your past clients, homeowners, and buyers. I’ll show you how to show them the math and how to present it in a way that makes sense to them.

Remember, our job isn’t to tell our clients what to do. We’re here to do the math and help them make educated and informed decisions about what makes the most sense for their family situation.

Understanding How to Use Credit Debt to Build a Strong Financial Future

Brian Vieaux, President and COO of FinLocker

It’s essential to start understanding the importance of credit early in your financial life. Your credit score can make or break your future money moves, so it’s never too early to learn how taking on debt – or not taking on debt – will impact your credit history.

Your actions today – as a late teenager, college student, or 20-something worker – can affect your ability to get a car or home loan later. Casually opening a credit card that you’ve signed up at a football tailgate or retail store, going on a shopping spree, and then being unable to repay the debt could come back to haunt you when you try to get a loan down the road. So, it’s super smart to learn about the factors that make up your credit score before you get too deep into debt.

Not only does your credit score number matter but also your credit history because credit card companies and other lenders report all your actions to the three credit bureaus. And what does that mean? It means they will report the balances you accrue on each credit card, the credit limit of each credit card, and all the payments you make or don’t make on those credit cards.

When you apply for a car loan or mortgage loan, a potential lender will want to see that you’ve been making payments on your credit cards (which is called revolving credit) on time and have not been maxing out the cards to your full credit limit. That’s called credit utilization, and it can impact 30% of your credit score! It is recommended to keep your revolving credit balances below 30%, so if you’ve got a $2000 credit card limit and your balance is $900, that’s already 45%!

Student loans, car loans, and buy-now-pay-later loans are considered installment loans that are repaid through regularly scheduled payments, with interest, over a certain time period. Lenders often use your debt-to-income ratio, in addition to your credit score and credit history, to make decisions on approving you for a new installment loan, especially a high-value, long-term loan like a mortgage.

It’s important to understand how credit works before you get too deep in debt so that you can set limits on your credit card usage and budget to have enough money to make at least the minimum monthly payment on time. So, take control early and make those money moves wisely, and you’ll be setting yourself up for financial success later.

Gen Z Needs Your Help to Responsibly Use Debt

Ally Carty, National Account Executive with ActiveComply and #get2knowgenz

What better way to express the importance of the topic this month than admitting that Debt Responsibility is something that I, myself, and a lot of my peers are not well educated on. Given my lack of expertise in the subject matter, I am going to use my contribution to highlight certain questions I have heard around the topic and hopefully help highlight the importance of educating on debt.

Example 1 : DTI, what it means and how it will affect my ability to buy a home

• DTI = Debt to Income Ratio – what exactly does this mean and how do certain loan payments impact it

• In a recent conversation with a 25-year-old friend of mine who is a medical student, we were discussing homeownership. She asked me how much her student loan debt was going to affect her ability to buy a home in Nashville.

o I would bet a lot of students are curious about this question and even avoid the topic of homeownership all together because they do not want to seem “uneducated” on the topic when talking with professionals.

Example 2 : College Graduation = Finally Can Buy My Dream Car Mentality

• I recently interviewed a 27-year-old loan officer who had worked closely with some of my friends from college and helped them buy homes. I asked him what the biggest issue facing his Gen-Z borrowers was, and he said, “the lack of knowledge around the implications of buying that dream car post-grad.”

• A majority of my graduating class saw graduating college as a time to splurge for all of their hard work and take graduation present money to put towards a brand new Mercedes, BMW, or other fancy car. I can name at least five people off the top of my head who graduated college and added a car loan to go alongside their student loans. There is not enough conversation on how that car loan will impact their ability to buy a home for the next few years.

Example 3 : Using Credit Cards Responsibly

• “How often do you pay your credit card off? And how will it impact my credit score if I pay it in its entirety on time?”

• This is HUGE!! I realize it is more of a credit question, but when analyzing DTI, credit card payments come into play. Many Gen-Z individuals I connect with are all wondering the same thing about our credit cards,

1. What happens if we do not pay it in full?

2. How often should we pay credit cards off? (once a month, twice a month, etc.)

3. How a credit card balance plays into analyzing my debt-to-income ratio when discussing buying a home

• Something – personally – that I’d find beneficial, is a “best practices” tutorial on having a credit card and how to build a credit score.

How to Use Debt to Build Your Credit

Catalina Kaiyoorawongs, CEO and Co-Founder of LoanSense

Debt should be used to help your future and not trap yourself in a constant state of indebtedness. You need to know the right types of debt to incur and how to manage them properly.

Rule of thumb: Use debt to build wealth and only use it to invest in assets that will help you grow your net worth.

Educational Debt

The reason debt for your education may make sense is because it’s going to give you greater earning power. There is evidence that says getting a college degree at a school with good educational outcomes, such as good job prospects, a powerful alum network, and higher than 60% graduation rates.

If people are not graduating in four to six years, on average, at a higher than 60% rate, then that’s not a good place to invest and take out any type of student loan.

Secondly, what are you attending school for, and what’s your earning potential? Never take out more debt than your annual earnings. That’s another rule of thumb. So if you’re going to come out earning $70,000, I would use a rule of thumb of trying not to borrow more than 0.75% ratio of student debt to your earnings, which means that if I earn $100,000, I won’t take out more than $75,000.

Education generally is an excellent investment because if you don’t go to college and you earn $35,000 to $40.000, and you go to college, and now you can earn $70,000 out of college, that extra $30,000 in your first-year earnings. Your prospect of wage growth over your lifetime may make college make sense.

Debt and Mortgage

Another example of something worth investing in is, and I don’t say this just because we work in the niche of student loans and mortgages, but investing in a home. A home grows in equity and increases in value over time.

Car Loan Debt

Items that I would never incur debt to buy are things that depreciate or decrease in value over time. I would avoid taking out an auto loan because an automobile decreases in value over time. Getting a loan for a $50,000 car that will be worth $10,000 in the next six years is not considered an investment. That’s a lifestyle item.

I believe you should buy a car with savings you built over time. If I want to buy a new car or I need a new car in the next two years, I save for it over the next two years to minimize the amount I need to borrow for the car. Also, consider buying a car with better resale value because that means you’re losing less money over time.

An example of a way your car becomes an investment is Turo. If you put your car on Turo and now that car makes you money every month, then that might be worth an investment. But, if it’s just for your personal use to have a cool ride and doesn’t make you money, then it’s more of a lifestyle item.

Another example: if you’re driving for Lyft or Uber, that’s the basis for your job, then it might be worth taking out a loan because it’s making you money.

Using debt as a financial tool will increase productivity or quality of life

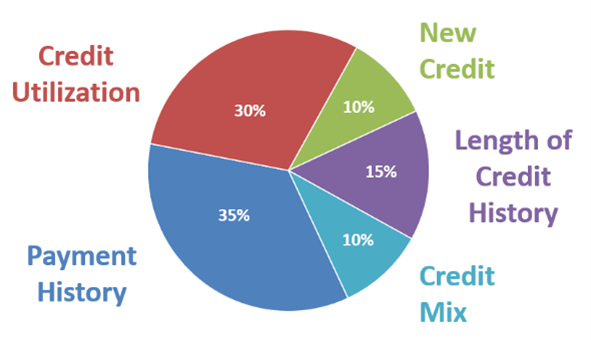

The most important factor for positive credit is having a positive payment history (35%). The credit mix is only 10%, whereas the positive payment history is 35%. Paying your debt on time is more important than an exact mix of credit. You could boost your credit to 800 without having an auto loan. You could raise your credit to a very high level with a positive payment history and longer average account length.

Using debt responsibly is using debt on items that grow in value, not buying things that decrease in value. Also, paying on time is critical, so it’s essential to budget to have enough income to make on-time payments.

Give Homebuyers the Credit Education They Need To Sustain Homeownership

Rob Chrane, CEO & Founder, Down Payment Resource>/strong>

First, it’s important we make clear to all aspiring homebuyers that having car loans, student loans or open credit lines isn’t irresponsible. Many consumers look at debt as a bad thing, when in truth, having active credit with good payment history works for homebuyers, not against them.

In fact, Fannie Mae states in their Selling Guide, “Research has shown that borrowers with no active installment accounts represent a higher risk than borrowers who have active installment accounts.” The guide also notes that “…borrowers with student loan debt have been shown to represent less risk than those with only revolving debt.”

At Down Payment Resource, we know firsthand that many consumers question their ability to balance saving for a down payment on a home with their outstanding debt, and oftentimes will postpone their homebuying dreams due to misunderstandings or a lack of information. I may be a bit biased, but down payment assistance (DPA) programs come with multiple benefits, in addition to helping with down payment and closing costs. One key benefit being the homebuyer education requirement. These courses help consumers better understand what it takes to be a homeowner, including how to manage important credit decisions.

Whether a homebuyer is receiving DPA or not, loan officers and real estate agents can still recommend homebuyer education courses and even attend with their clients, regardless of where they are in the homebuying process. DPA providers typically have education and counseling services they recommend, and you can also visit HUD’s website to find a HUD approved counseling agency in your area.

One last benefit to consider, some DPA programs may allow alternative credit data to determine creditworthiness, such as monthly rent, utility payments, income and employment information. If this is the case for your state and/or local DPA providers, make sure your clients are taking advantage of this opportunity.

Give Your Audience Some Credit (Tips)

Dan Smokoska, Founder, Loangendary Marketing

You know how much debt and credit impact a potential borrower’s approval prospects.

One of the most impactful ways you can assist your clients is by helping them understand the importance of responsible debt management. From car loans to student loans to credit card debt, each financial decision can significantly impact their ability to secure a mortgage down the road.

You know all this. But do your prospects and target audiences?

That’s where you come in!

You might be wondering how you can effectively engage your audiences and potential borrowers to emphasize the significance of handling debt responsibly.

Well, your marketing is the key.

By employing various marketing strategies, you can initiate the credit conversation, build trust, and foster lasting relationships with your clients.

Why does marketing matter? Because it’s not just about selling services — it’s about educating and empowering borrowers to make informed financial choices. When you demonstrate your expertise and genuine concern for their financial well-being, people will be more inclined to turn to you for guidance.

Let’s dive into some marketing ideas that will ignite the credit conversation:

- Get in the Green: Good and excellent credit scores fall into the “green” categories on the credit score chart. Use social media, emails or blogs to highlight the numerous ways people can help move their credit scores into the green (or stay in the green). Tips like on-time payments, limiting debt, etc. Just remember to use a visual of the credit score chart so people connect with the theme.Always Keep Score: In kids’ games, you know the saying, “it doesn’t matter if you win or lose, it’s about having fun.” But, your borrowers aren’t kids and it definitely matters if you win the credit game – if they want the best mortgage at least. With football season coming up, create a campaign about always keeping score, and use football lingo to guide your messaging.

- Can’t Erase the History: Unlike the history on our browsers, we can’t just erase our history. Inform your audiences how any big purchases that impact their credit will show up in their history and play a role in their score going forward (and what it takes to keep their score improving).

- Get in the Mix: Educate your audiences on how having a mix of credit can help them build their scores. Highlight the purchases that show up on a credit report and have the biggest effect on scores. A lot of people may not understand that credit mix matters – and you’re the person to fix that.

I hope some of these marketing campaign ideas can help you start the conversation on credit and debt. If you decide to use any, please take all the “credit.”

Credit Scores are an Exercise (literally) in Hard Work

Jeremy Potter, Strategist and Advisor

Loan Officer: “Ok, at this point, we need to know your credit score. Do I have your permission to pull your credit?”

First-time Homebuyer: “Sure, let’s do it.” (I wonder what it’s gonna be?)

Vaguely (perhaps) consumers know this moment is actually the culmination of years of decisions, products, payments, and activities. But few consumers, including many of us working in the industry, appreciate the complexity of how a traditional FICO credit score is calculated. There’s a good reason. Years of complex modeling that went into FICO 4.0 and FICO 5.0 have not been updated to more modern data inputs. The result is that the FICO scores ordered by mortgage lenders for a conventional loan application may not continue to be the best way to measure a first-time home buyer’s willingness to repay.

Data sources, data models, and the experts that use them

Consumer advocates have raised some significant questions about whether traditional FICO scores contain inherently discriminatory elements. The idea is that the weighting of debts and the inclusion or exclusion of specific debts favors mostly white people and represents increasingly outdated notions of the willingness to repay. At the same time, the credit bureaus launched their own joint venture – VantageScore – to compete with FICO and FICO responded with new models like FICO 10 and UltraFICO aimed at factoring in new data sources to provide a more modern approach. Fannie & Freddie have now changed their guidelines to allow lenders to evaluate VantageScore as part of a mortgage application.

What happens next – whether FICO 10 or VantageScore or some other way of underwriting credit history – will depend on all kinds of political and competitive pressure. This leaves you and your customers in a weird spot. (Scientific term, weird.) We need to continue to educate first-time home buyers on all the ways their choices and behavior will influence a traditional FICO score while at the same time preparing for a future where FICO 4.0 is obsolete. Until then, however, many consumers will be caught between what they experience in today’s evolving economy and the tried & true steps our industry recommends for improving credit score.

The status quo

It is no small thing that an entire industry exists surrounding credit improvement, credit repair and challenging credit history, generally. What is a bit more surprising, perhaps, is that FICO score has only been around since 1989. While it might be younger and you or I, it is about the same age as your clients, the average first-time homebuyer. It was not until 1995 that Freddie Mac made it required and it became part of the Fannie Mae & Freddie Mac infrastructure. In a relatively short time, FICO came to dominate the way lenders and, therefore, consumers engaged the credit history portion of the underwrite. Since FICO has evolved to be a primary threshold for access to a mortgage AND the dominate data point in pricing a mortgage, it is critical for applicants and loan officers to understand. Like everything in our industry (any risk-based industry), it is only as good as the data reported or available to the model.

Today, the version of FICO or credit score used is important because each has a different source and combination of data inputs. FICO 4 uses 2 credit reporting bureaus. FICO 5 uses one – Experian. FICO 8 uses all 3 credit bureaus and is more “forgiving” of the one-time late payment. (Who among us has forgotten to set up autopay on the utilities after moving or changing credit cards?). Being well-versed in what version a lender is using for evaluating mortgage applications is an increasingly important part of preparing a first-time home buyer for product & pricing. Especially if you are lucky enough to have a first-time home buyer come in for a pre-approval before shopping for a home. Knowing which debts, payments, outstanding balances or open credit lines can be addressed for the best outcomes depends on which system or model will be used for decision-making.

Every mortgage loan officer has been well-trained to advise their customers to avoid large purchases, new credit cards or new car loans during the mortgage application process. Easy enough (though we all know customers do not always listen) during the 30, 60, 90 days surrounding home shopping and home buying. What about 3 years beforehand? 6 years?

Few mortgage loan officers are identifying and incubating leads for 3 years. This makes sense given the economics of time and lead source (and the likelihood for competition as you get closer to the transaction), but often some of the most meaningful decisions regarding credit score – amounts, types (i.e., mix), and length of time the credit is available – are happening years prior. One of the best practices for modern-day loan officers is to become the established expert to your entire network for strategies to obtain home loan credit. (The boring advice is often the valuable advice for a reason, right?) Whether it’s realtors, the kids of past customers, social media followers or an existing contact list, navigating FICO and the evolving real-time data landscape will become inseparable from the path to homeownership (if it hasn’t already!).

Tomorrow is an evolution from status quo to financial wellness

Going forward, knowing what data is being used for what decision by which platform or lender is likely to get more and more complicated. Consumers will be able to sign up for monitoring tools, for robo-advising tools, and for incentivized data-sharing products. This will get messier (a little) before it gets better. That’s good news for you. Experts empowered with technology are the future of consumer-facing industries.

Consider the fitness and wellness industry for a moment. There are as many ways to get in shape and stay in shape as there are humans on the planet. Each is personal to that person’s likes & dislikes, habits, body style, brain chemistry, and genes (we could go on and on). Similarly, each mortgage applicant’s situation has its own personal circumstances and level of knowledge associated with it. In the fitness industry, however, it’s pretty clear that step one is to take action. There are two ways – lace up your sneakers and get out your front door (hiking, walking, running, etc.) or subscribe to a service provider (Peloton, local gym, yoga classes, Spartan races) – and consumers are pretty clear on the fundamentals of diet & exercise. Our industry has done a poor job of simplifying step one and creating varied opportunities for people to get the subscription or service provider they need. Sure, we can argue that people are more confused and scared by money & finances than getting in shape, but getting (and staying) in shape sucks. It’s hard. So let’s not get too defensive – financial wellness is (still) coming.When evaluating credit scores for your clients, especially first-time home buyers, let’s take two things from the “other” wellness industry. First, wearables like Apple watch, whoop, and oura ring track and report data for real-time analysis and better decision-making. Our clients are walking around with their entire banking and transaction records on their phone (and their phone goes everywhere with them!). Real-time data will transform your conversations around credit. Second, coaches and experts are more popular than ever. Consumers are looking to spend time, significant time, with an on-screen or in-person expert that leads them through the steps and pushes them to be better. We have long told ourselves we don’t have time for this or consumers won’t actually show up. Are we sure that’s still true?

Final takeaway(s)

Becoming an expert on today’s FICO landscape and different versions is your step 1. Getting your expertise into more places that will benefit your referral network and, ultimately, first-time home buyers is an immediate step 2. Your training regime (if you wanna look at it like that) is to get comfortable tracking the new tools and products being offered to consumers months or even years before they are shopping for a home loan. That’s the best way to bridge today’s FICO-industrial-complex to a more dynamic, more active (but more competitive) credit reporting market of the future.

Filling in the High School Knowledge Gaps to Empower Homebuyers

Mike Faraci, CEO & Founder, Red Button Media

As a mortgage loan originator, your success hinges on your ability to connect with potential homebuyers and sellers. One approach to achieve this is by incorporating relatable content into your marketing strategy and empowering them with knowledge to guide them through their homebuying journey.

When creating your content, try asking yourself the question, “What do I wish I learned in High School that would’ve prepared me better?” This will lead to a bevy of ideas, and many of them will most likely involve being more responsible with debt.

Let’s explore three essential topics that resonate with homebuyers and sellers and will help to establish you as a trusted resource in their pursuit of homeownership.

1. Understanding Credit Scores and Factors Impacting Them

- Many people wish they had learned about credit scores earlier in life.

- Explain what a credit score is and its significance in the mortgage application process.

- Discuss factors that impact credit scores, such as payment history, credit utilization, and credit mix.

- Offer tips for improving and maintaining a healthy credit score, which can lead to better mortgage terms and lower interest rates.

2. The Significance of Debt-to-Income Ratios

- Debt-to-Income ratio is a critical aspect of a mortgage application that often goes overlooked inexperienced borrowers.

- Educate your audience about DTI and break it down into simplistic terms.

- Emphasize why a favorable DTI ratio is essential for loan approval.

- Provide guidance on managing debts and strategies to improve DTI ratios before applying for a mortgage.

3. Real Estate: A Powerful Wealth-Building Tool

- Few people realize the potential of real estate as a wealth-building tool in the United States.

- Explain the long-term benefits of homeownership, such as building equity and long-term appreciation of property value.

- Discuss potential tax advantages and the power of real estate investments to diversify financial portfolios.

- Showcase success stories of individuals who have built substantial wealth through real estate.

Trust is the backbone of any successful mortgage loan originator’s business. By generously sharing valuable educational content and insights based on your own experience, you establish yourself as an expert. As clients appreciate your authentic approach and relatable stories, they are more likely to trust your guidance during their home buying or selling journey.

As a mortgage loan originator, incorporating relatable content into your marketing approach is a game-changer. By using a few ideas like the ones above, you can connect with a diverse audience of homebuyers, sellers, and referral sources. Embrace the power of relatability to educate, entertain, and engage, and watch your relationships and business grow through trust and authenticity.

Benefits of Credit Diversity

Sue Buswell, Credit and Score Consultant #sueknowsthescore

Creditors matter to your credit score. Not just their accurate reporting of your data to the Credit Bureaus, but the creditors you build your history with influences your score.

Your credit mix while just 10% of your score can be a tie breaker when it comes to a good vs great score.

A good mix includes both revolving and installment – but are those creditors Tier 1 or Tier 2?

A department store card is often where many new to credit borrowers start. Easier to qualify for, and often with lower credit limits, this type of credit is important for mix but having just department store cards can suppress your score.

Installment loans are also an important part of your credit profile, but who you choose as your creditor Bank or Credit Union vs Finance Company can influence your score as well.

Creditors within the scoring system are classified by their risk profile. Finance company and department store credit is more widely available, easier to qualify for, and therefore carries a higher level of risk. This type of credit is Tier 2.

Tier 1 credit is from Bank, Credit Unions and major credit cards like Mastercard, Visa, etc. They have stricter lending guidelines and these cards and loans are more difficult to obtain.

Tier 3 credit is generally from creditors that often are not reported – telecom, rental history, pay as you go and more.

Analyzing two credit reports with equal pay history, balance to limit on revolving accounts, and length of credit history, the borrower with Tier 1 credit will have a higher score than the one with primarily Tier 2 creditors.

To maximize your score, you need both revolving credit and installment loans, but you also need to be mindful of the creditor tiers to achieve your best score.

Student Loan Payment Crisis Creates Cash-Out Refinance Opportunities

Scott Schang, CEO, Find My Way Home

As I mentioned in my previous article, educating and empowering your clients, prospects, and referral partners around the topic of the restart of student loan payments is a road that ultimately leads to new business opportunities.

For homebuyers, this is a conversation about financial preparedness, financial management, and financial literacy. Student loan payments represent purchasing power. It could be the difference between buying your dream home, settling for a home in a neighborhood that isn’t your first choice, and for some, the ability to buy a home at all.

For homeowners, this is a conversation with your past clients and your referral partners’ clients about preserving your standard of living and managing household expenses for your past clients and your referral partners’ clients.

Cash Out Refinance Opportunity

Educate your past clients with emails or phone calls. Give them accurate information about what their options are. This is an opportunity to help your clients explore income-based payment options using Fintalk contributor, LoanSense, and review their household budget for opportunities to provide cashflow relief and set them up to take advantage of lower mortgage interest rates in the future.

“I Want to Keep My 3% Mortgage”

This will be the most common thing you’ll hear when looking for opportunities to provide cashflow relief for struggling families facing cuts in other areas of their lives to afford student loan payments that have popped back up in their budget.

Here are a few things to remember.

• That HELOC they took out to avoid refinancing the low rate on their first mortgage is now approaching, if not already, into the double-digit interest rate range. And that HELOC payment that has been increasing with every bump of the fed rate is only an interest payment. This HELOC will recast into a fully amortized, adjustable-rate mortgage after ten years. “Are you ready for this new payment?”.

• Credit card balances are all double digits, some as high as 20+%. Increased credit card balances are lowering their credit scores. Lower scores mean higher interest rates. It’s a vicious cycle that’s hard to reset.

• The LLPA hit for cash-out refinance will wipe out any benefit they would have received by taking advantage of lower mortgage rates.

Having a Blended Rate Analysis Conversation

MBS Highway, TrustEngine (formerly MortgageCoach), or even an old-fashioned Excel spreadsheet are tools that can show your clients what they are actually spending on interest payments across their monthly payments.

Our job isn’t to convince them to refinance, but our responsibility as their “lender for life” is to give them the information they need to make educated and informed decisions.

A debt consolidation today will put them in a position for a rate and term refinance, with a higher credit score (presumably after paying off revolving debt), and put them in a position to take advantage of a rate reduction of as little as 0.50%.

Strapped with high revolving debt, lower credit scores, and cash-out LLPAs, they’re looking at needing at least a 1.5% to 2% drop in rates to see any relief at all.

Conversation Starter

As I mentioned before, our job isn’t to tell our clients what to do. We’re here to do the math and help them make educated and informed decisions about what makes the most sense for their family situation.

This topic is a conversation starter relevant to 49 million Americans, 29 million of whom are between the ages of 25 and 55. Start this conversation today. Even if you only educate someone about the ability to qualify for income-based payments, you’re helping to sort through the confusion and positioning yourself as an expert that cares about others.

Having these conversations is a trust-building exercise. You may get cash-out refinances or purchase business that results from these conversations. But most importantly, you are earning trust, becoming an expert educator and guide, and building a pipeline and network of people who know, like, and trust you and your advice or guidance.

Paying Down Credit Card Debt is a 3-for-1 Benefit

Steve Ely, CEO of eCredable

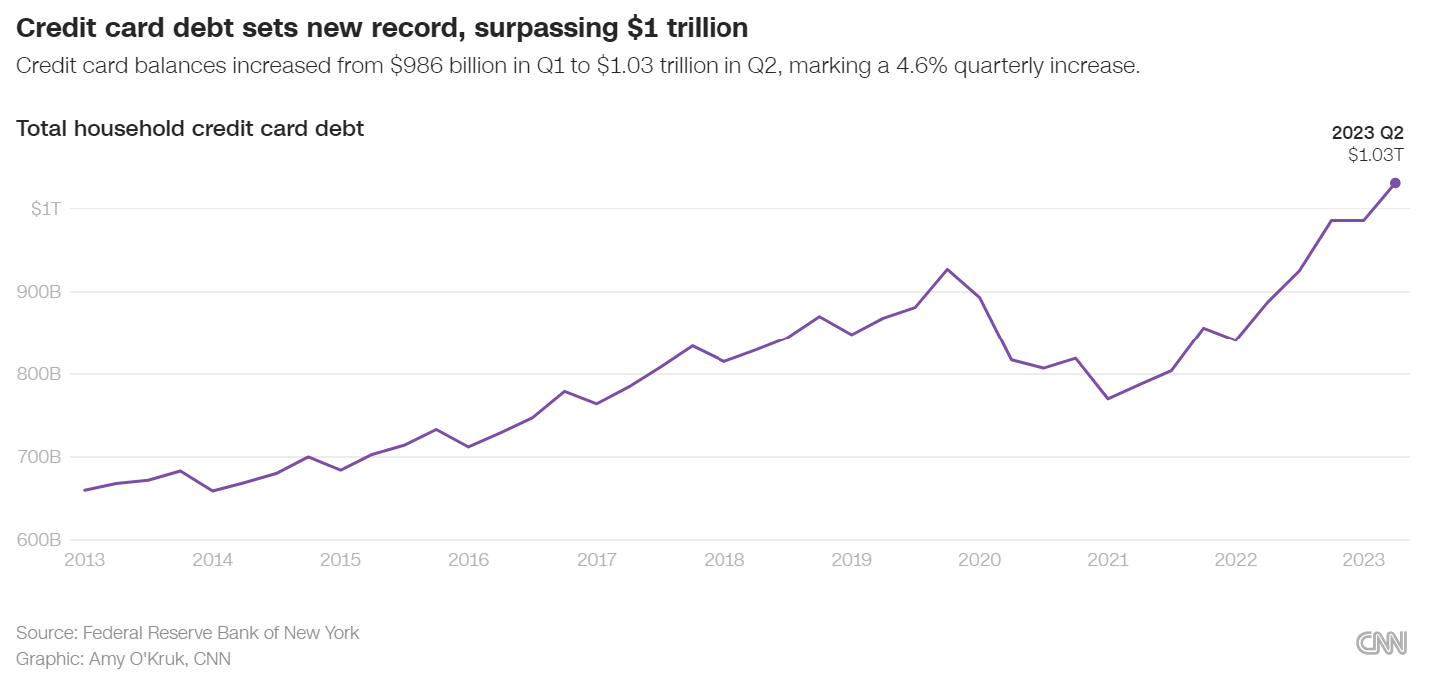

The total amount of credit card debt in the U.S. recently surpassed $1 trillion. That’s a staggering amount of money people owe to the issuing banks, which includes an equally staggering amount of interest consumers are paying on this debt. If you’re contemplating buying a house anytime soon, paying down credit card debt provides a 3-for-1 benefit:

1) Better Credit Score – Your credit score is made up of these 5 components. The good news is that 65% of your score you have significant control over. Make your payments on time and limit your “credit utilization” to less than 30% of your available revolving credit lines (like credit cards). Paying down credit card balances will yield a better credit score, which means better terms when you apply for a home loan.

2) More Money for a Down Payment – No matter which type of loan you are applying for, the more money you have for a down payment the lower your monthly mortgage payment. Paying down credit card debt allows you to reallocate these funds to your down payment.

3) A Lower DTI – Your debt-to-income-ratio is a key factor in getting approved for a loan. If you have a borderline ratio, paying off your credit card debt will lower your DTI.

How To Improve Your Credit Scores

Jeffrey Walker, CEO and Co-Founder of CredEvolv

You can improve your credit scores by first fixing errors in your credit history (if errors exist) and then following these guidelines to maintain a consistent and good credit history. Repairing bad credit or building credit for the first time takes patience and discipline. There is no quick way to fix a credit score. In fact, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you’ll need to repair your credit history before you see your credit score improve. Here are three steps I often share with borrowers to improve their credit score:

1. Check your credit report for errors.

Carefully review your credit report from all three credit reporting agencies for any incorrect information. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Checking your own credit report or FICO Score has no impact on your credit score.

2. Pay bills on time.

Making payments on time to your lenders and creditors is one of the biggest contributing factors to your credit scores—making up 35% of a FICO Score calculation. Past problems like missed or late payments are not easily fixed.

- Pay your bills on time.

- If you have missed payments, get current and stay current.

- Be aware that paying off a collection account will not remove it from your credit report.

- If you are having trouble making ends meet, contact your creditors or see a legitimate credit counselor.

3. Reduce the amount of debt you owe.

Your credit utilization, or the balance of your debt to available credit, contributes 30% to a FICO Score’s calculation. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below.

- Keep balances low on credit cards and other revolving credit.

- Pay off debt rather than moving it around.

- Don’t close unused credit cards as a short-term strategy to raise your scores.

- Don’t open several new credit cards if you don’t need to increase your available credit.

Focus on Relationships, Not Transactions, For Stronger Customer Relationships

Doug Wilber, CEO of Denim Social

It’s time for some real talk…

Most, if not all, mortgage brands are highly undifferentiated.

Most lenders’ products are highly commoditized.

In a market like this, what makes the difference? The relationships that loan officers can build with their clients and the community they serve. Case closed. Except…

The problem?

Most LOs have been trained to think about the world through the lens of transactions, not relationships. And it makes sense…during the refi boom we recently experienced, the LO who got to the borrower first won.

But now things are different. LOs must quickly pivot away from thinking about customers as “deals” and start thinking about them as real people. Real people with real hopes, dreams, and aspirations that are much harder to achieve in the current rate and inventory market.

Every loan officer needs to differentiate themselves as a resource…a guide…a partner for borrowers to help them navigate these turbulent waters.

And, in today’s digital landscape, being a resource means meeting people where they are. And where they are is on social media. Activating mortgage loan officers in a social selling strategy is a key way to expand reach, drive engagement, and humanize the brand: those who engage in social selling achieve 45% more sales opportunities and are 51% more likely to hit their sales quotas.

However, it all comes back to the strength of relationships fostered over time. Good selling starts with genuinely listening to customers and being authentic, no matter what. Loan officers must genuinely care about customers’ needs to find the right solutions and demonstrate that level of care to earn the necessary trust. And, when it comes to social, this authenticity needs to shine through.

Here’s how loan officers can use social media to make their customer relationships stronger:

View social media as an opportunity to provide value. We already know that authenticity is important to customer acquisition. That same authenticity should show up in social media activity.

Lean into the power of real-life experience. There’s a good chance that loan officers live and work in the communities they serve. Showing on social media what’s happening in their communities will help foster a sense of belonging and drive interest among followers.

Embrace storytelling. Too often, social media marketing for loan officers consists only of market statistics or data points. While this type of content can absolutely be useful and helpful, it’s not enough on its own.

Be themselves. If loan officers are only professional and stuffy, audiences won’t connect. They shouldn’t be afraid to let a little personality shine through on social media. Thought leadership can create credibility and demonstrate expertise, and it’s always better received when served up by a real-life person.

Building authenticity through social media is similar in principle to building authenticity in real life; it’s just using a different medium to do so. When loan officers share personal stories and helpful content with clients in a way that reflects their true personalities, they’ll build lasting relationships both online and offline that will serve as the foundation of sales for years to come. Prioritize people: the sales will follow.

See how Dart Bank used social media to strengthen customer relationships in this case study.