The mortgage industry continues to face challenges as more Gen Z and Millennials enter the home buying market. Despite record high home prices, elevated mortgage rates and limited inventory making homeownership difficult to attain for first-time buyers, 53.85% of mortgage offers went to millennials across the nation’s 50 largest metros in 20231.

These tech-savvy generations carry significant student loan debt burdens, limited credit histories, and lack financial education – presenting new challenges that mortgage lenders and loan officers must overcome. Financial education has become critical for loan officers to attract, educate and nurture these future homebuyers through their homeownership journey.

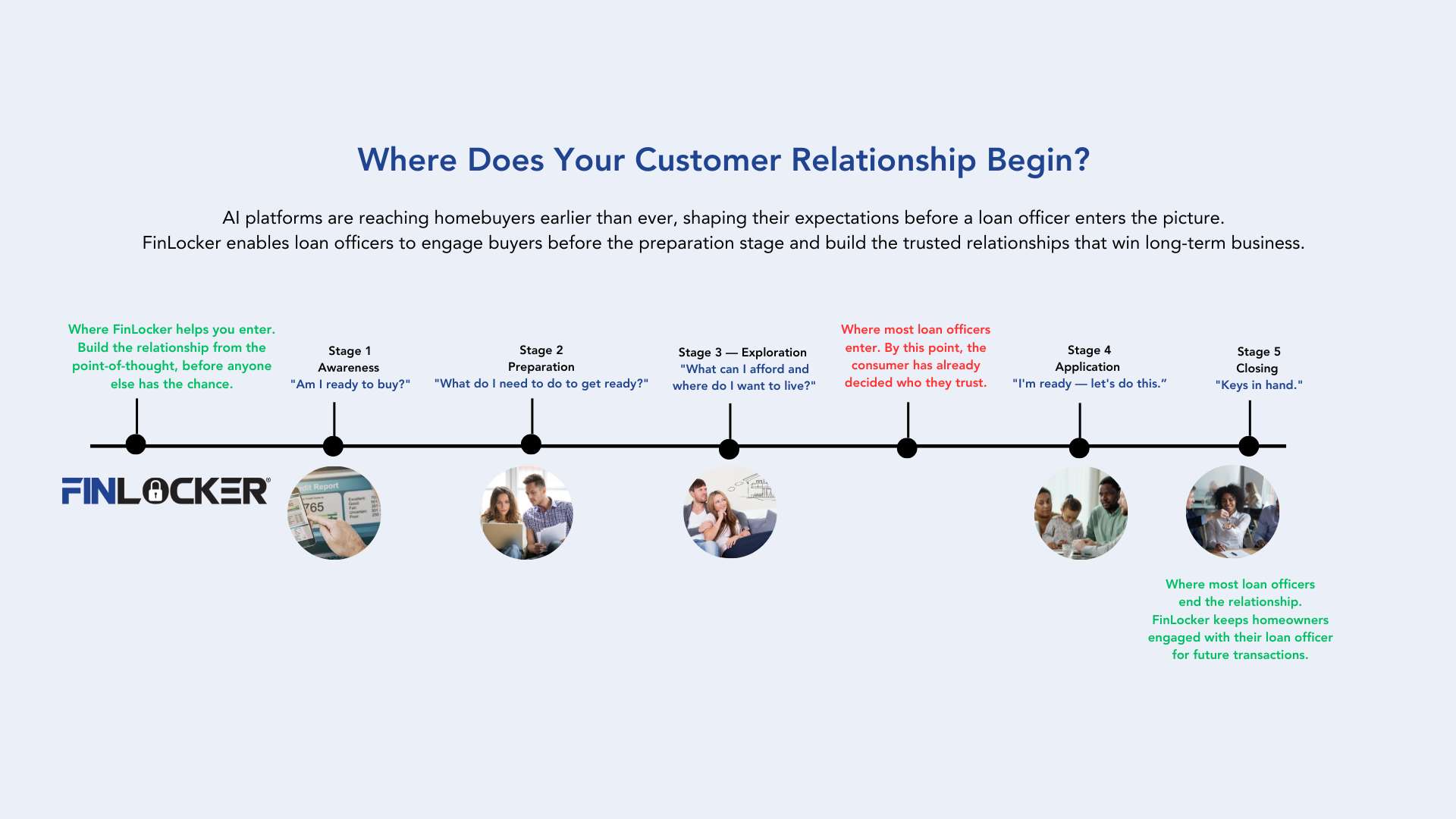

Mortgage originators who attract and engage with future homebuyers before they consciously begin their homeownership journey have a competitive advantage. The problem facing many originators is helping financially challenged consumers prepare earlier for homeownership while finding ways to keep discouraged homebuyers motivated.

In this guide, we explore the types of financial education future homebuyers seek and specific engagement strategies and tools that can help mortgage professionals build a robust customer database, enhance their reputation as trusted advisors and nurture their customer database for future business opportunities, including:

- Personal finance topics that Gen Z is researching and that you can use to attract these future homebuyers to your business

- The factors that Gen Z use to determine when they’ll start their homeownership journey and the financial education topics that can attract early journey first-time homebuyers to your business

- How to address the financial barriers to homebuying and reduce mortgage denials by nurturing with financial education throughout the consumer journey to mortgage readiness

- How to connect with first-time homebuyers on social media, online and in-person

- Technology that empowers homebuyers with tools and a guided path to achieve and sustain homeownership