For decades in mortgage lending, the focus has often centered on immediate results and quick turnarounds. However, an overlooked but highly valuable market segment is the “early journey” first-time homebuyer. These prospective buyers are 6 to 36 months away from being ready to purchase their first home.

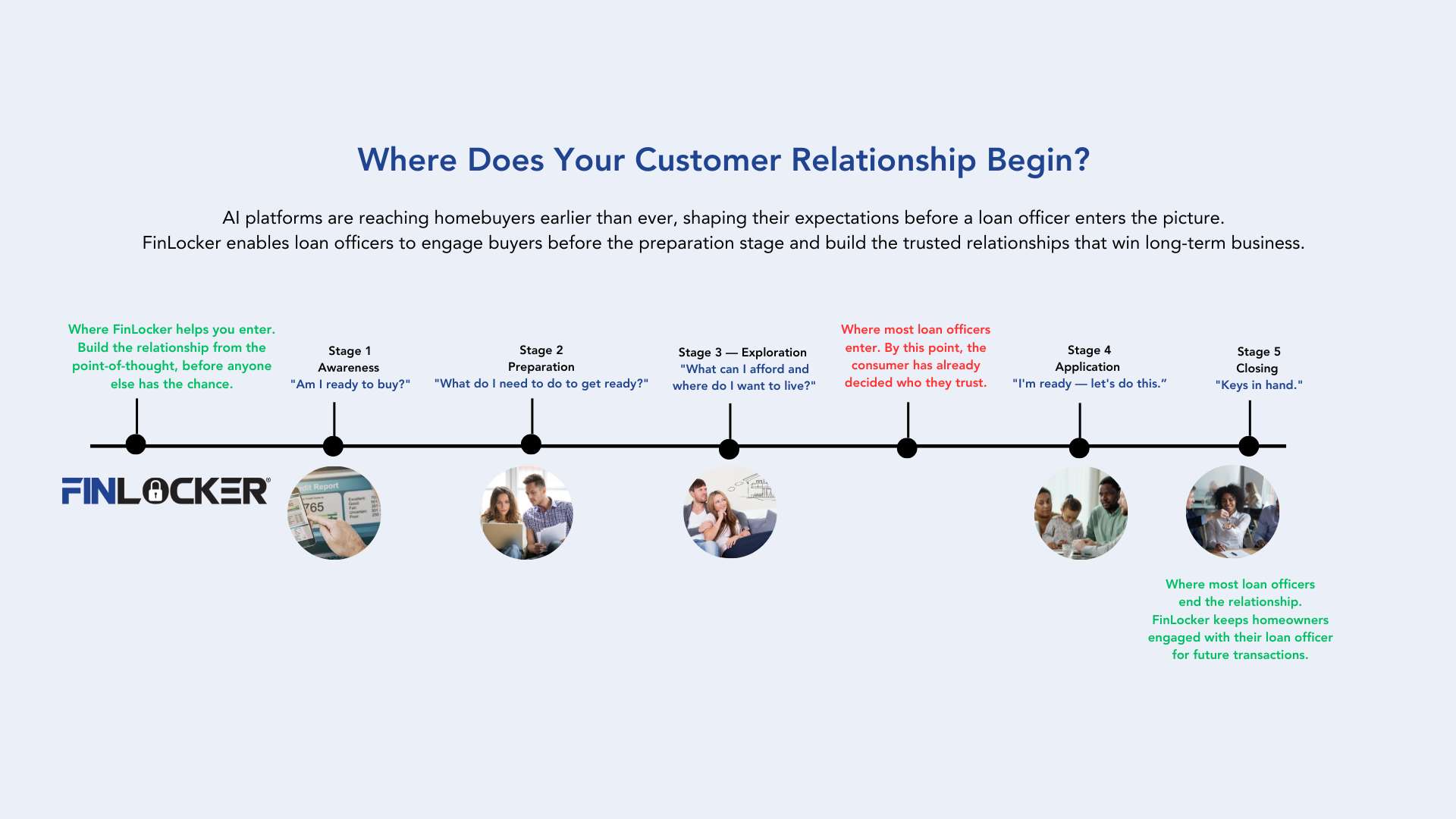

Loan officers can make a significant impact by engaging with these individuals at the “Point of Thought”—when they first start to think about becoming homeowners—rather than the “Point of Sale,” where most loan officers connect after a real estate agent refers a homebuyer. By starting the engagement early, loan officers can guide and educate buyers, building a foundation of trust and positioning themselves as invaluable resources throughout the homebuying journey. this paper aims to provide a comprehensive framework for loan officers to effectively work with early journey homebuyers.

Download The Argument for Playing the Long Game to obtain a comprehensive framework for loan officers to effectively work with early journey homebuyers, including:

• Insights to understand the early journey homebuyer

• Communication preferences of first-time homebuyers

• Why the local loan originator is the best source of financial education for early journey first time home

• Tactics to build and nurture a long-term pipeline

• Lead acquisition strategies

• Tactics to nurture through regular communication

• Tools and resources to connect with homebuyers

• The business case for investing time and resources into early journey homebuyers

Additional Resources with more insights and practical tactics to attract first-time homebuyers:

How to Attract, Engage and Nurture First-time Homebuyers with Financial Education