Business Building Center

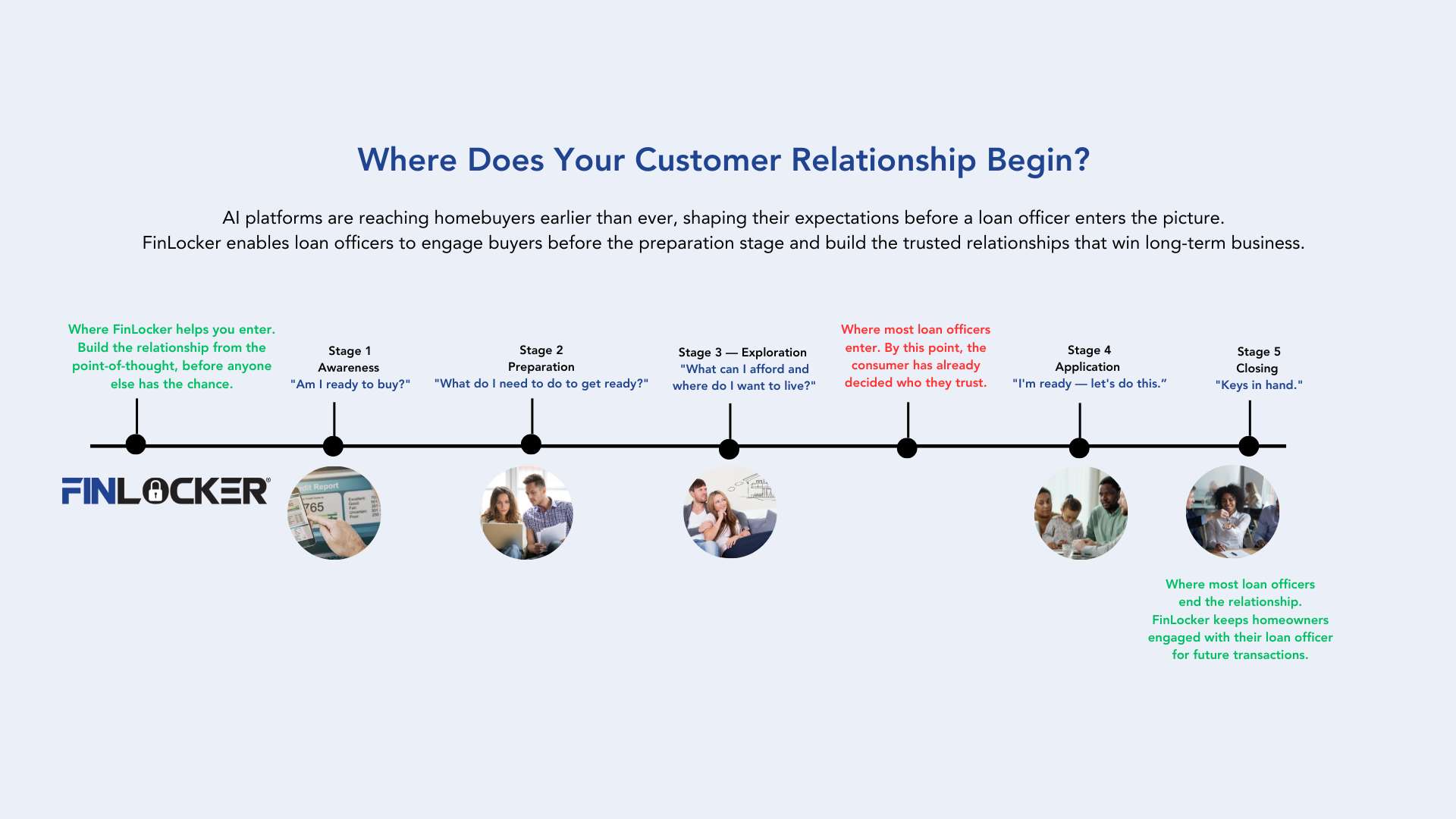

Why Loan Officers Are Losing the Homebuyer Conversation Before It Starts

There's a shift happening in how consumers prepare to buy a home, and it's moving faster than most of the mortgage industry has noticed. Buyers are no longer starting their homeownership journey with a Google search that leads to a blog post, a Zillow listing, or a...

How Dwell Mortgage Is Redefining Lifetime Client Engagement with KeySteps for Mortgage Brokers

Building lifetime mortgage client engagement by putting value first When Dwell Mortgage launched Dwell 365, the goal wasn’t just to create another mortgage client portal. Founder Shane Kidwell, a mortgage broker since 2015 and loan originator since 2008, set out to...

Mortgage Relationship Marketing: How Dennis Wells Uses “Manifest With Us” to Build High-Intent Homebuyer Pipelines

Playing the Long Game to Nurture Leads Into Loyal Borrowers Overview of Dennis Wells' homebuyer pipeline 4 months live on the Manifest With Us platform 50 consumers actively engaged in the app Leveraging BuyerVision to reduce credit pull costs Early engagement...

How LeaderOne Financial Converted “Not Yet Ready” Leads Into 20 Closed Loans with Homeownership App

From “Not Yet Ready” to Closed Deals — How a Digital Mortgage Engagement Tool Turned Future Buyers Into Clients The Challenge: Too Many “Not Yet” Buyers Slipping Away The Roller Mortgage Team at LeaderOne Financial is a $100M+ annual production team built almost...

How Darren Kaplan Turned FinLocker Into a High-Closing Mortgage Marketing Lead Machine

From “Apply Now” to “Ready to Buy” — A 10-Month Transformation in Borrower Conversion When Darren Kaplan, Branch Manager at Total Mortgage in Chapin, South Carolina, first explored the FinLocker platform, he wasn’t looking for “just another mortgage tool.” He...

Homebuyer App Success Story: How Abdel Khawatmi Uses PathHome to Build Trust and Convert More Borrowers

From Pre-Approval to Post-Closing — How PathHome Became the Central Tool in His Client Retention System In a year when many Loan Officers have been waiting for the market to turn, Abdel Khawatmi, Branch Manager at PRMG, has been engineering his own results. While...

The Financial Fitness Flywheel: How Empowered Clients Drive Loan Officer Growth

In today’s mortgage market, where generating quality leads is harder and closing timelines are stretching, loan officers need more than quick wins. The most valuable clients are not just the ones who close, they are the ones who actively refer friends, family, and...

How Loan Officers Can Create a High-Converting Sales Funnel

After three decades navigating the ups and downs of the mortgage industry, I can say this with confidence: we’ve entered a new era. The loan officers who will succeed going forward are the ones who control the top of their sales funnel - not those who rent it or...

4 Proven Strategies to Build Fall Pipeline During Summer Downtime

It’s July. The temps are rising, but for many loan officers, the pipeline’s cooling down. Rates aren’t dropping fast enough to spark a refi boom, and homebuyers? Many are sidelined by affordability or fatigue from bidding wars. So, what now? After more than 35...

Technology with a Heart: How AI and Consumer Data Are Scaling Hope and Homeownership

The housing market remains saddled with affordability pressures, rate uncertainty, and geo-political headwinds. It's far too easy to feel like the American Dream of homeownership is slipping further out of reach, especially for first-time buyers. But a quiet...

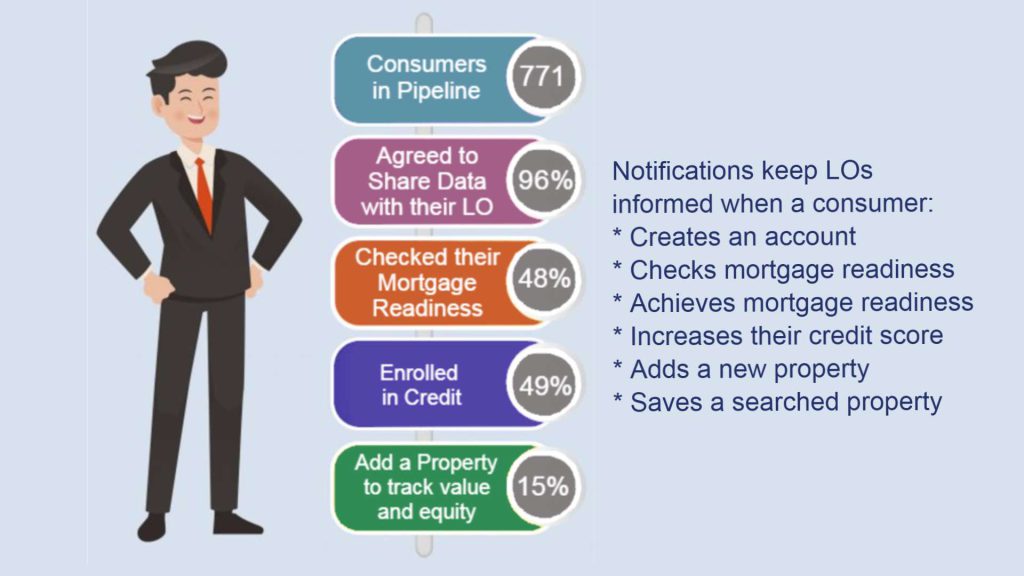

How Edge Home Finance Uses Real-Time Data Insights to Prepare and Identify Mortgage-Ready Homebuyers

By leveraging the data insights provided by Edge Loan Advisor, Edge Home Finance LOs can quickly identify mortgage-ready homebuyers and those who need additional guidance to achieve homeownership.

Path to Equity: 5 Strategies to Boost Black Homeownership

Homeownership remains a key driver of financial stability and wealth creation for American households, accounting for nearly two-thirds of their net worth. Yet, for Black Americans, it continues to be an uphill battle. The homeownership rate for Black households...

Growing Your Sales Pipeline: How Loan Originators Can Build a High-Value Network of Referral Partners

As a loan originator, building strong relationships with professionals in related industries is an effective way to expand your sales pipeline and increase business opportunities. Real estate agents, divorce attorneys, financial advisors, and other professionals in...