Business Building Center

Technology with a Heart: How AI and Consumer Data Are Scaling Hope and Homeownership

The housing market remains saddled with affordability pressures, rate uncertainty, and geo-political headwinds. It's far too easy to feel like the American Dream of homeownership is slipping further out of reach, especially for first-time buyers. But a quiet...

Leveraging Technology to Boost Borrower Credit Scores and Pipeline Conversion

In today's competitive mortgage market, a borrower's credit profile is a critical factor in determining loan eligibility. However, credit remains a significant hurdle for many mortgage applicants, leading to application denials and pipeline fallouts, significantly...

How to Attract, Engage and Nurture First-time Homebuyers with Financial Education

The mortgage industry continues to face challenges as more Gen Z and Millennials enter the home buying market. Despite record high home prices, elevated mortgage rates and limited inventory making homeownership difficult to attain for first-time buyers, 53.85% of...

5 Financial Strategies to Empower Black Homeownership

Homeownership stands as a cornerstone of financial stability and wealth accumulation for most Americans. Yet, for Black Americans, it remains an enduring challenge. The Federal Reserve Bank of St Louis reported in Q4 2023 that the homeownership rate of Black...

Navigating the Mortgage Maze: Understanding the Different Levels of Mortgage Application Reviews

When it comes to financing the purchase of a home, the path to successfully obtaining a mortgage can seem like a maze. With terms like Full Mortgage Loan Approval, Pre-Approval, Pre-Qualification, Mortgage Ready Buyer, and even Qualified Borrower floating around,...

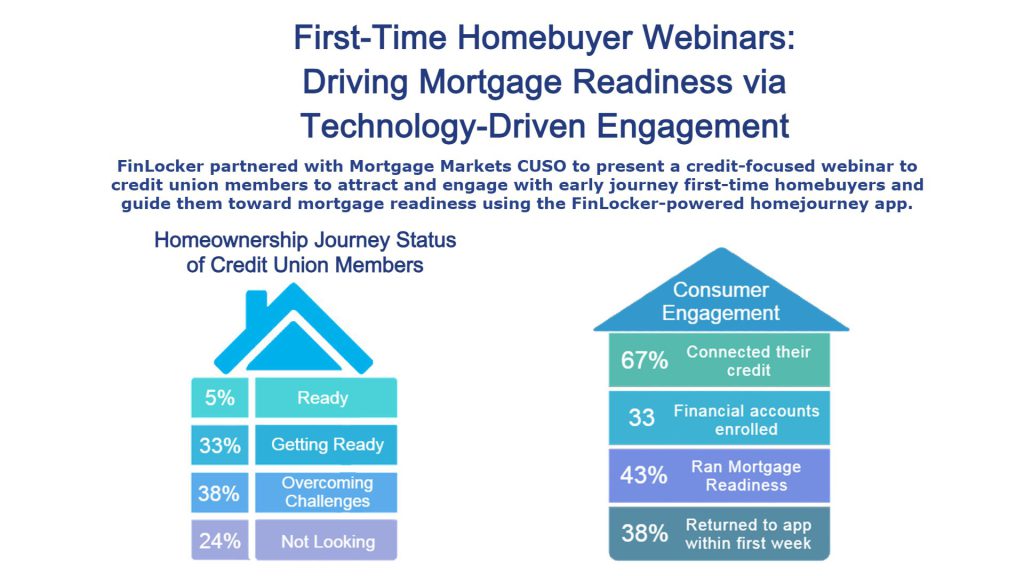

First-Time Homebuyer Webinars: Driving Mortgage Readiness via Technology-Driven Engagement

In December 2023, Mortgage Markets CUSO partnered with FinLocker to present a credit-focused webinar hosted by credit expert Sue Buswell, founder of SueKnowsTheScore, to identify credit union members who are prospective homebuyers and advise them on how to build...

Drive Growth in Hispanic Homeownership with a Financial Education Strategy

Hispanic homeownership is growing at a record pace despite affordability and inventory challenges across the United States. Fueled by rapidly forming households, a key precursor to homeownership, and younger homebuyers (the median age of Hispanic first-time...

Thriving in a Competitive Purchase Market: Empowering Homebuyers with a Roadmap to Mortgage Readiness

Navigating the mortgage transaction process can be an emotionally charged journey, not only for first-time homebuyers but also for seasoned homeowners. Mortgage originators often encounter challenges when working with first-time homebuyers, as the level of mortgage...

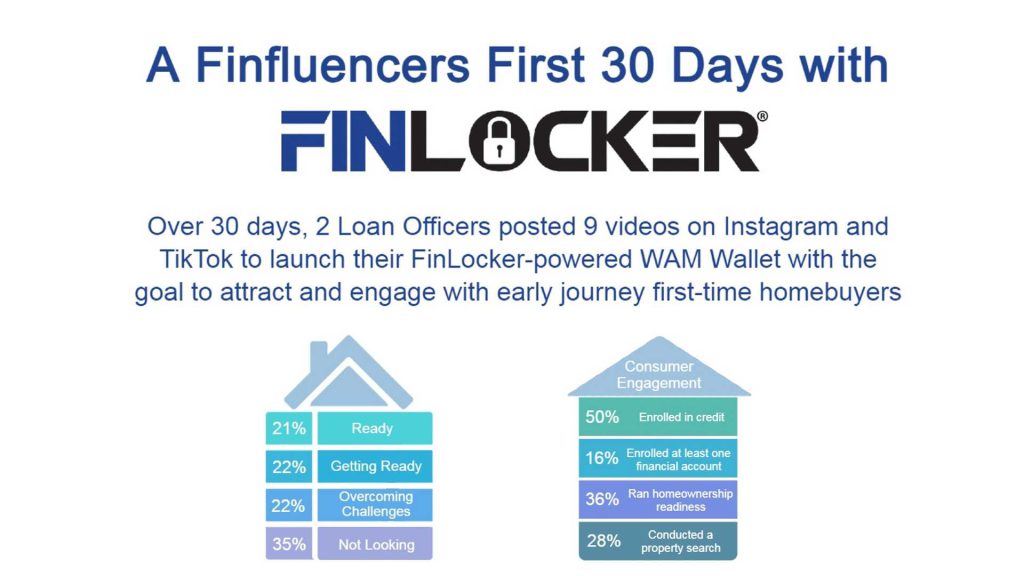

How What’s A Mortgage used social media to launch the FinLocker powered WAM Wallet to attract first-time homebuyers

Goal What's A Mortgage sought to create a mobile financial well-being app that would cater to consumers at various stages of their homeownership journey. The app had to appeal to renters who could be a few years from buying a home and help prospective homebuyers...

Understanding the Financial Habits of Future Homebuyers

The economic and housing conditions have significantly shifted home buying patterns in the past year, raising questions about the attitudes of future homebuyers towards homeownership. The National Association of REALTORS® (NAR) reported an 8% decrease in...

How to Build and Expand a Strong Referral Network

86% of originators receive referrals from past clients, according to the MGIC Loan Originators Survey Report. To expand your sales pipeline and increase business opportunities it's essential to widen your network and build strong relationships with professionals in...

Investing in Digital: How Credit Unions Can Attract Younger Members and Empower Homeownership with Digital Financial Tools

To meet consumer expections, it is crucial for credit unions to adapt and embrace digital financial tools to attract new members and better serve current members. In 2023, the average age of credit union members in the United States was 47 and only 7% of all credit...

Closing the Black Homeownership Gap with Financial Fitness Tools and Education

Homeownership is a critical component of financial stability and wealth building, but for Black Americans, achieving and sustaining homeownership has been a long-standing challenge. According to the U.S Census Bureau, the homeownership rate of White households was...