Business Building Center

The 2026 Big Game Playbook: Turn Game-Day Scrolls into First-Time Buyer Leads

The Big Game isn’t just football anymore—it’s the biggest “second-screen” night of the year. People watch ads, react in real time, vote in polls, and share takes during every break. That’s your opening: while national brands buy awareness, you can turn game-day...

Drive Growth in Hispanic Homeownership with a Financial Education Strategy

Hispanic homeownership is growing at a record pace despite affordability and inventory challenges across the United States. Fueled by rapidly forming households, a key precursor to homeownership, and younger homebuyers (the median age of Hispanic first-time...

Thriving in a Competitive Purchase Market: Empowering Homebuyers with a Roadmap to Mortgage Readiness

Navigating the mortgage transaction process can be an emotionally charged journey, not only for first-time homebuyers but also for seasoned homeowners. Mortgage originators often encounter challenges when working with first-time homebuyers, as the level of mortgage...

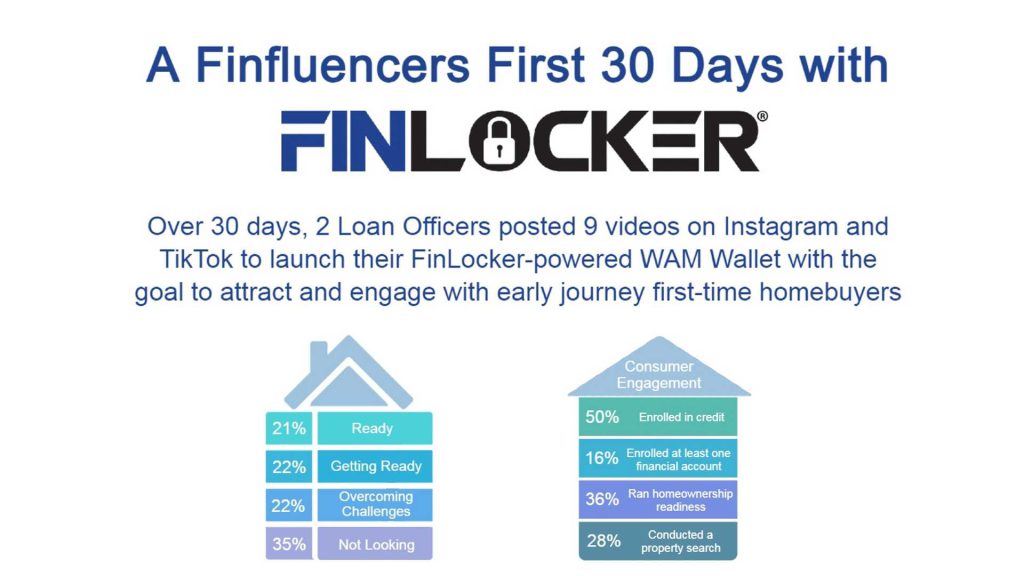

How What’s A Mortgage used social media to launch the FinLocker powered WAM Wallet to attract first-time homebuyers

Goal What's A Mortgage sought to create a mobile financial well-being app that would cater to consumers at various stages of their homeownership journey. The app had to appeal to renters who could be a few years from buying a home and help prospective homebuyers...

Understanding the Financial Habits of Future Homebuyers

The economic and housing conditions have significantly shifted home buying patterns in the past year, raising questions about the attitudes of future homebuyers towards homeownership. The National Association of REALTORS® (NAR) reported an 8% decrease in...

How to Build and Expand a Strong Referral Network

86% of originators receive referrals from past clients, according to the MGIC Loan Originators Survey Report. To expand your sales pipeline and increase business opportunities it's essential to widen your network and build strong relationships with professionals in...

Investing in Digital: How Credit Unions Can Attract Younger Members and Empower Homeownership with Digital Financial Tools

To meet consumer expections, it is crucial for credit unions to adapt and embrace digital financial tools to attract new members and better serve current members. The average age of credit union members in the United States is 53. Baby boomers dominate credit union...

Closing the Black Homeownership Gap with Financial Fitness Tools and Education

Homeownership is a critical component of financial stability and wealth building, but for Black Americans, achieving and sustaining homeownership has been a long-standing challenge. According to the U.S Census Bureau, the homeownership rate of White households was...

Recession Proof Ways To Expand Your Mortgage Sales Database

First-time homebuyers were the focus of 85% of originators in 2022, yet they only made 26% of home purchases. When your marketing efforts are focused on a subset of consumers who have already begun their homeownership journey, you face intense competition from...

Strategies to Boost User Adoption of New Technology

Overcome employee resistance to change and accelerate user adoption of new technology solutions with a three-phase adoption plan 70% of digital transformation programs fail due to a lack of employee engagement, inadequate management support, poor or nonexistent...

Keep Customers for Life with Your Closing Gift

It's a monumental achievement to buy your first home. It's no less of an accomplishment for homeowners to refinance successfully. Whether you are a loan officer with a mortgage lender, bank, or credit union, you've played an integral part in the transaction's...

Building a Digital Strategy to Drive Growth in Hispanic Homeownership

Across the United States, Hispanic homeownership is growing at a record pace. Fueled by young first-time homebuyers, the rate has continuously increased since 2014, reaching 48.4% in 2021. Looking at data from the 2021 State of Hispanic Homeownership Report...

Manage Your Mortgage Tech Stack to Align With Your Changing Business Needs

Drive future success by aligning your tech stack with the market's product and consumer segment Are you a mortgage lender who is worried about the rising cost of orginations and the shrinking margins? Are you concerned about not being able to provide the best...