Business Building Center

Advancing Black Homeownership: A Mortgage Readiness Playbook

Homeownership remains one of the most powerful drivers of long-term household stability and intergenerational wealth. Yet for many Black households, the path to sustainable homeownership is still shaped by systemic barriers—unequal access to credit, affordability...

Building Financial Futures: How Credit Unions Can Attract and Engage Younger Members Throughout Their Financial Lives

In today's rapidly evolving financial landscape, credit unions face a critical challenge: attracting and retaining younger members. While the traditional strengths of credit unions—community focus, member ownership, and favorable rates—remain relevant, they must...

3 Trends in Hispanic Homeownership Shaping the Mortgage Industry

The past decade has seen Hispanic households contribute significantly to homeownership growth in the United States. Data shows that Hispanics have been responsible for 25% of the overall increase in homeownership nationwide over the last 10 years. In 2023, the...

A Homebuyer’s Guide to Understanding the NAR Settlement

Navigating the real estate market as a first-time homebuyer can be challenging. Recent changes resulting from the National Association of Realtors® (NAR) settlement have added complexity to the process, even for experienced homebuyers. To help you prepare for the...

The Argument for Playing the Long Game

Download The Argument for Playing the Long Game to obtain a comprehensive framework for loan officers to effectively work with early journey homebuyers.

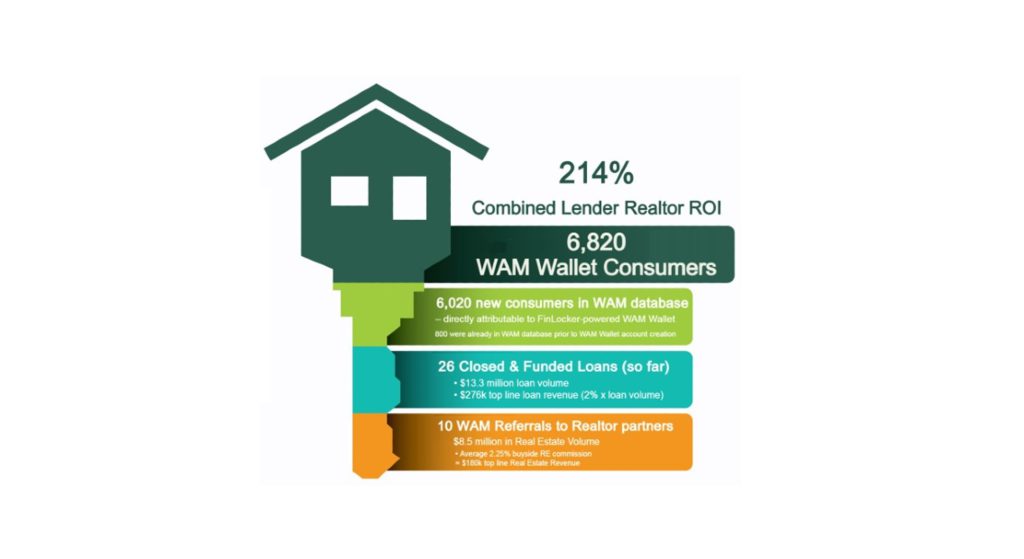

How a Mortgage Lender returned 90% ROI using FinLocker to Attract, Engage and Nurture Homebuyers

WAM Wallet Launch On May 4, 2023, What’s A Mortgage launched its FinLocker-powered WAM Wallet, capitalizing on a strategic social media campaign spearheaded by two influential mortgage originators, Minh Nguyen and Jide Buckley. Leveraging their substantial...

Empowering First-Time Homebuyers Through Financial Education: The Role of Loan Officers and FinLocker

In today's complex financial landscape, the journey to homeownership can be daunting for first-time buyers. The importance of loan officers extending their roles beyond mere facilitators of loans to becoming pivotal sources of financial education cannot be...

How Improving Your Financial Literacy Can Lead to Better Business Decisions

As a business owner, having a solid grasp of financial concepts and principles is crucial for making sound decisions that can make or break your company's success. Financial literacy encompasses understanding financial statements, cash flow management, budgeting,...

8 Ways Loan Officers Can Strengthen Relationships with Real Estate Agents

Most homebuyers start their homeownership journey by searching for homes online or connecting with a real estate agent before contacting a loan officer. After referrals from past clients, 8 in 10 loan officers say they receive referrals from real estate agents more...

Leveraging Technology to Boost Borrower Credit Scores and Pipeline Conversion

In today's competitive mortgage market, a borrower's credit profile is a critical factor in determining loan eligibility. However, credit remains a significant hurdle for many mortgage applicants, leading to application denials and pipeline fallouts, significantly...

How to Attract, Engage and Nurture First-time Homebuyers with Financial Education

The mortgage industry continues to face challenges as more Gen Z and Millennials enter the home buying market. Despite record high home prices, elevated mortgage rates and limited inventory making homeownership difficult to attain for first-time buyers, 53.85% of...

5 Financial Strategies to Empower Black Homeownership

Homeownership stands as a cornerstone of financial stability and wealth accumulation for most Americans. Yet, for Black Americans, it remains an enduring challenge. The Federal Reserve Bank of St Louis reported in Q4 2023 that the homeownership rate of Black...

Navigating the Mortgage Maze: Understanding the Different Levels of Mortgage Application Reviews

When it comes to financing the purchase of a home, the path to successfully obtaining a mortgage can seem like a maze. With terms like Full Mortgage Loan Approval, Pre-Approval, Pre-Qualification, Mortgage Ready Buyer, and even Qualified Borrower floating around,...